Please use a PC Browser to access Register-Tadawul

Middle East Undiscovered Gems Featuring 3 Promising Stocks

DERAYAH 4084.SA | 28.28 | -1.05% |

Amidst a dynamic landscape, the Middle East market has shown resilience with Dubai's stock index marking consecutive gains and Abu Dhabi snapping its losing streak, buoyed by strong performances in the financial sector. In this environment of cautious optimism and mixed sector performance, identifying promising stocks requires a keen eye for those with robust fundamentals and potential to thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 0.66% | 87.23% | 32.52% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

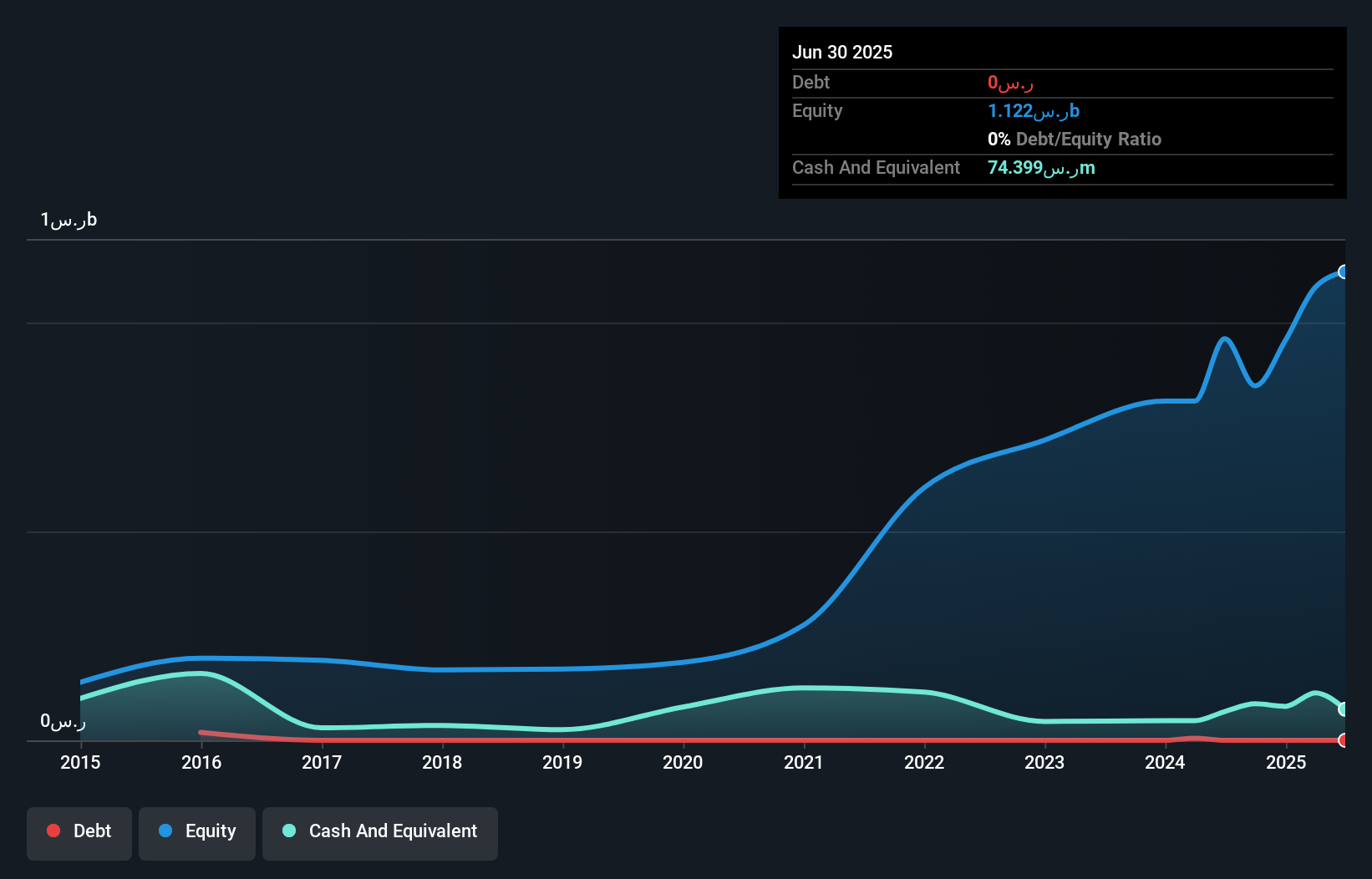

Derayah Financial (SASE:4084)

Simply Wall St Value Rating: ★★★★★★

Overview: Derayah Financial Company offers brokerage, advisory, and custody services both in the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR 6.36 billion.

Operations: Derayah Financial generates revenue primarily from brokerage services, contributing SAR 695.74 million, followed by asset management at SAR 135.27 million and investment services at SAR 31.69 million. The company's net profit margin is an area of interest for investors analyzing its financial performance over time.

Derayah Financial, a nimble player in the Middle East financial scene, showcases high-quality earnings with a price-to-earnings ratio of 15.3x, undercutting the SA market's 21.1x. Despite not outpacing industry growth last year with only 3.8% earnings growth against the Capital Markets industry's 13.6%, it remains debt-free and boasts an impressive five-year annual earnings growth of 17.6%. Recent reports indicate Q1 revenue at SAR 209 million and net income at SAR 106 million, reflecting a dip from last year's figures but still solid enough to support its dividend policy promising no less than SAR 1.30 per share for FY2025.

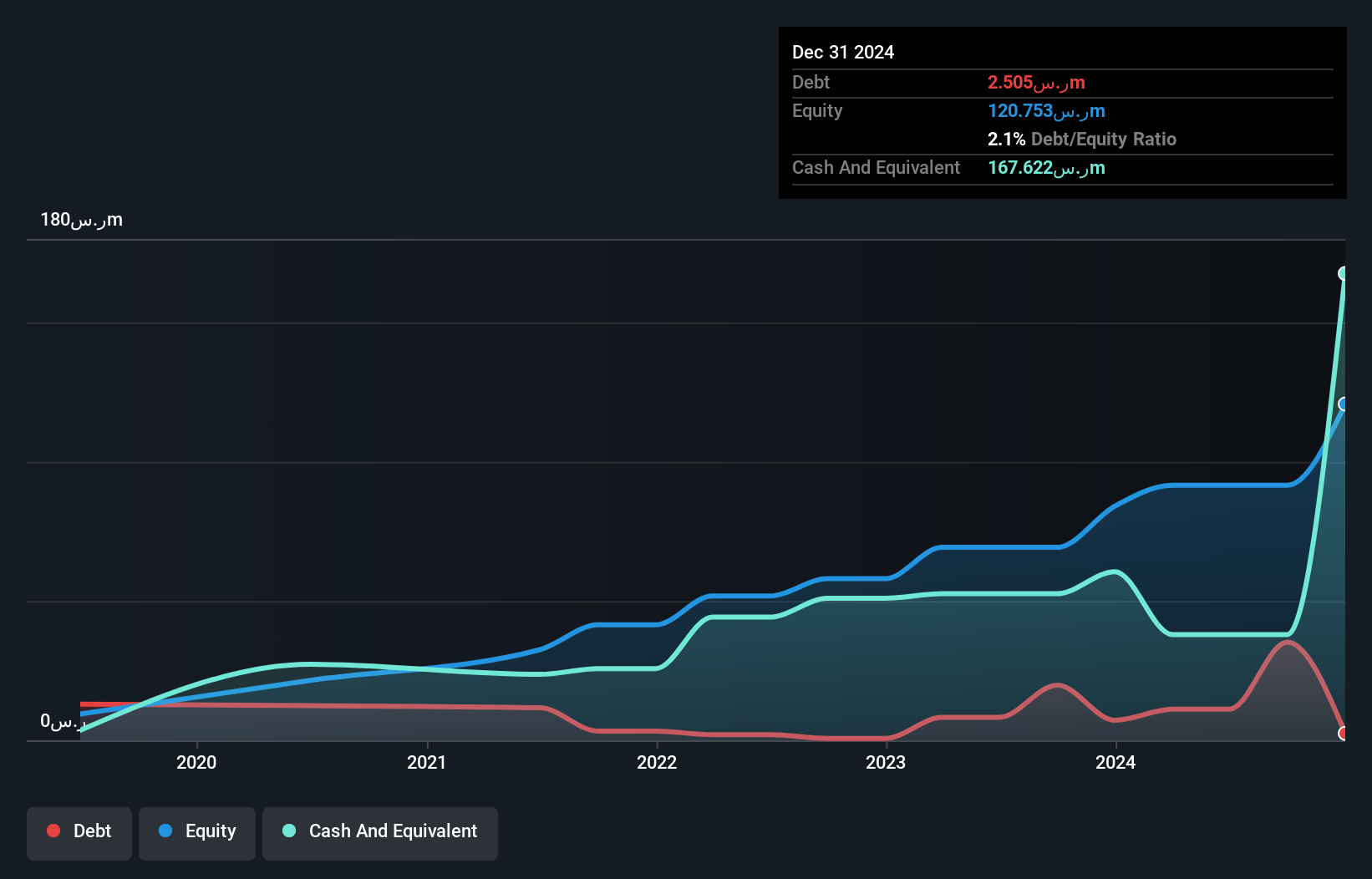

Saudi Azm for Communication and Information Technology (SASE:9534)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR 1.73 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: Azm generates revenue primarily from enterprise services (SAR 142.76 million), followed by proprietary technologies (SAR 48.32 million) and advisory services (SAR 31.56 million). The platforms for third parties contribute SAR 19.79 million to the total revenue stream.

Saudi Azm for Communication and Information Technology stands as an intriguing player in the Middle East's tech landscape. Over the past five years, its earnings have grown at a robust 21% annually, while recent strategic moves include a partnership with the National Housing Company to develop a digital platform. This collaboration aims to enhance financial and digital brokerage services, positioning Azm for future growth. Despite volatility in its share price recently, the company boasts high-quality earnings and has significantly reduced its debt-to-equity ratio from 84% to just 2%. With cash exceeding total debt, Azm seems well-prepared for upcoming ventures.

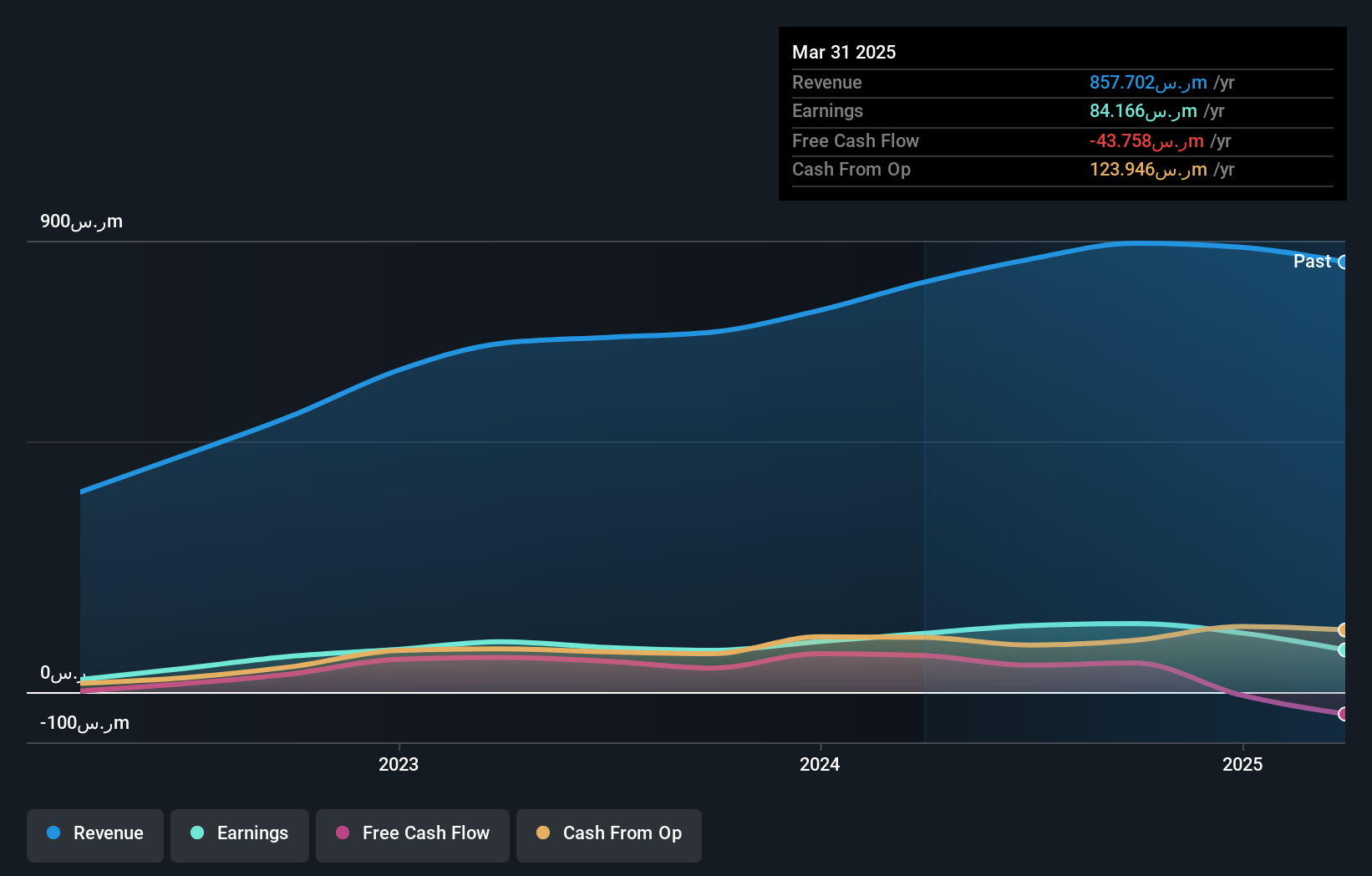

Balady Poultry (SASE:9559)

Simply Wall St Value Rating: ★★★★★☆

Overview: Balady Poultry Company operates in the Kingdom of Saudi Arabia, focusing on the production of poultry products, with a market capitalization of SAR1.24 billion.

Operations: The company generates revenue primarily from chilled and frozen poultry products, amounting to SAR887.12 million.

Balady Poultry is making waves with its recent financial performance. Despite a dip in Q1 2025 net income to SAR 6.66 million from SAR 40.6 million the previous year, annual sales for 2024 soared to SAR 887.12 million, up from SAR 760.97 million in the prior year, showcasing robust growth potential. The company boasts a high level of non-cash earnings and more cash than total debt, which suggests financial resilience. While share price volatility has been noted recently, Balady trades at an attractive valuation—28% below estimated fair value—making it a compelling consideration amidst industry peers despite some challenges ahead.

Next Steps

- Investigate our full lineup of 225 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.