Please use a PC Browser to access Register-Tadawul

Middle Eastern Dividend Stocks Featuring Top Picks

Al RAJHI REIT 4340.SA | 8.07 | -0.12% |

The Middle Eastern stock markets have recently experienced a mix of declines and gains, with Saudi Arabia's bourse extending losses due to weak earnings while Dubai's index saw a slight increase driven by Emirates NBD. In this fluctuating environment, dividend stocks can offer investors a measure of stability through regular income, making them an attractive option for those looking to navigate the current market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Peninsula Group (TASE:PEN) | 6.69% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.19% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.00% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.07% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.24% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.71% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.65% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.10% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 3.54% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates and has a market cap of AED24.24 billion.

Operations: Commercial Bank of Dubai PSC generates its revenue from Personal Banking (AED2.05 billion), Institutional Banking (AED1.27 billion), and Corporate Banking (AED1.11 billion) within the United Arab Emirates.

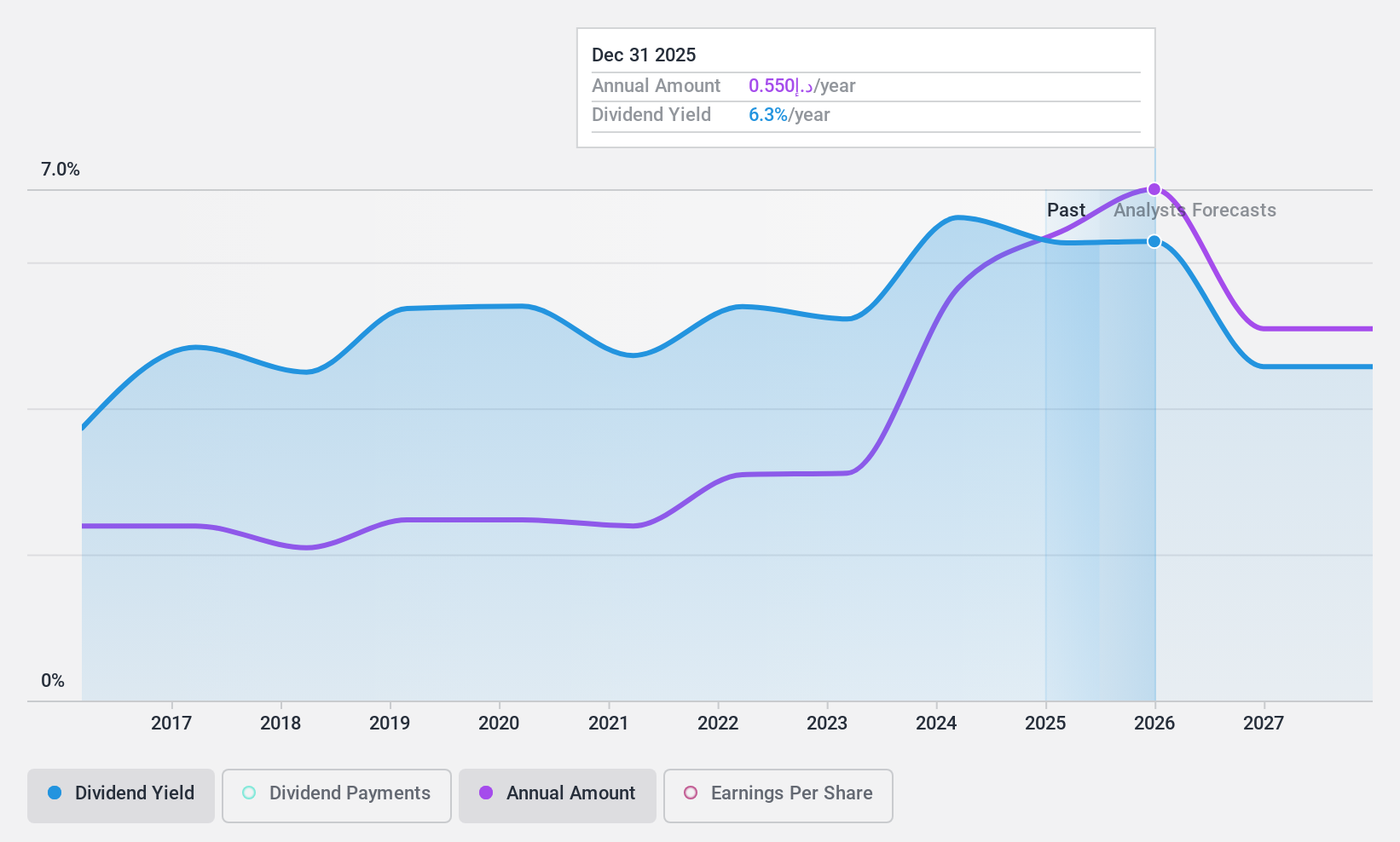

Dividend Yield: 6.2%

Commercial Bank of Dubai PSC offers a stable and reliable dividend, with payments growing over the past decade. The current dividend yield of 6.25% is slightly below the top quartile in the AE market but remains attractive given its consistent growth and coverage by earnings (52.3%). Despite a high level of bad loans (5.3%), recent earnings reports show strong financial performance, with net income rising to AED 3 billion for 2024, supporting future dividend sustainability.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia-compliant investment fund listed on Tadawul, focused on generating periodic income through investments in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.29 billion.

Operations: The Al Rajhi REIT Fund generates revenue primarily from its commercial real estate assets, amounting to SAR236.02 million.

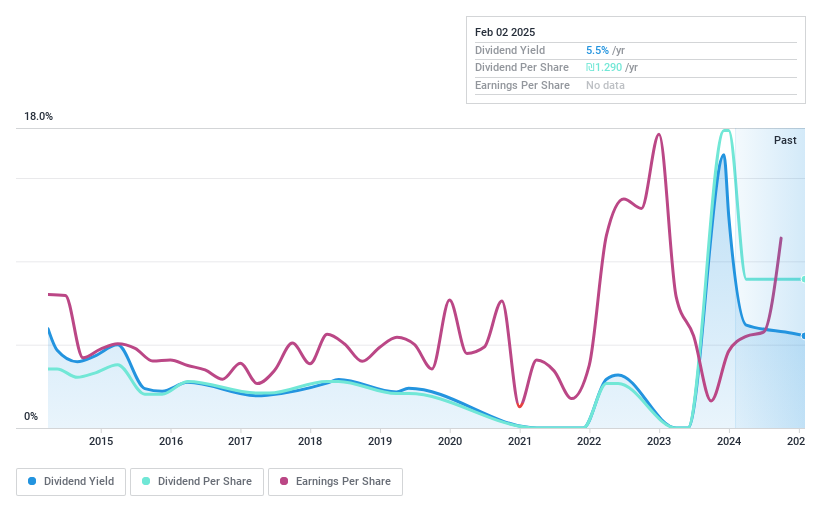

Dividend Yield: 6.6%

Al Rajhi REIT Fund's dividend yield of 6.56% ranks in the top 25% in the Saudi market, though its payment history is volatile and unreliable over six years. Recent earnings growth of 185.5% supports dividend coverage by both earnings (75%) and cash flows (87.5%). However, shareholder dilution and outdated financial data raise concerns about stability, despite a recent SAR 0.14 cash dividend announcement for February 2025 distribution.

Golden House (TASE:GOHO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Golden House Ltd operates and manages sheltered housing centers for the elderly population in Israel, with a market cap of ₪411.66 million.

Operations: Golden House Ltd's revenue is primarily derived from the operation and management of sheltered housing centers for the elderly in Israel.

Dividend Yield: 4.9%

Golden House's dividend yield of 4.86% is below the top 25% in the IL market, and its payments have been volatile over the past decade. Despite this, dividends are well-covered by earnings with a payout ratio of 39.1%, though cash flow coverage is higher at 77.3%. Recent earnings showed significant improvement with net income reaching ILS 109.02 million for Q3, reversing from a loss last year, supporting dividend sustainability despite historical volatility.

Make It Happen

- Discover the full array of 60 Top Middle Eastern Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.