Please use a PC Browser to access Register-Tadawul

Millicom Tightens Hold On Tigo Colombia As Valuation Discount Persists

Millicom International Cellular SA TIGO | 66.08 | +3.33% |

- Millicom International Cellular has secured full ownership of UNE EPM Telecomunicaciones S.A. (Tigo Colombia) by winning EPM's remaining shares in a public auction.

- The deal gives Millicom near complete consolidation of its Colombian operations, tightening control over one of its key markets.

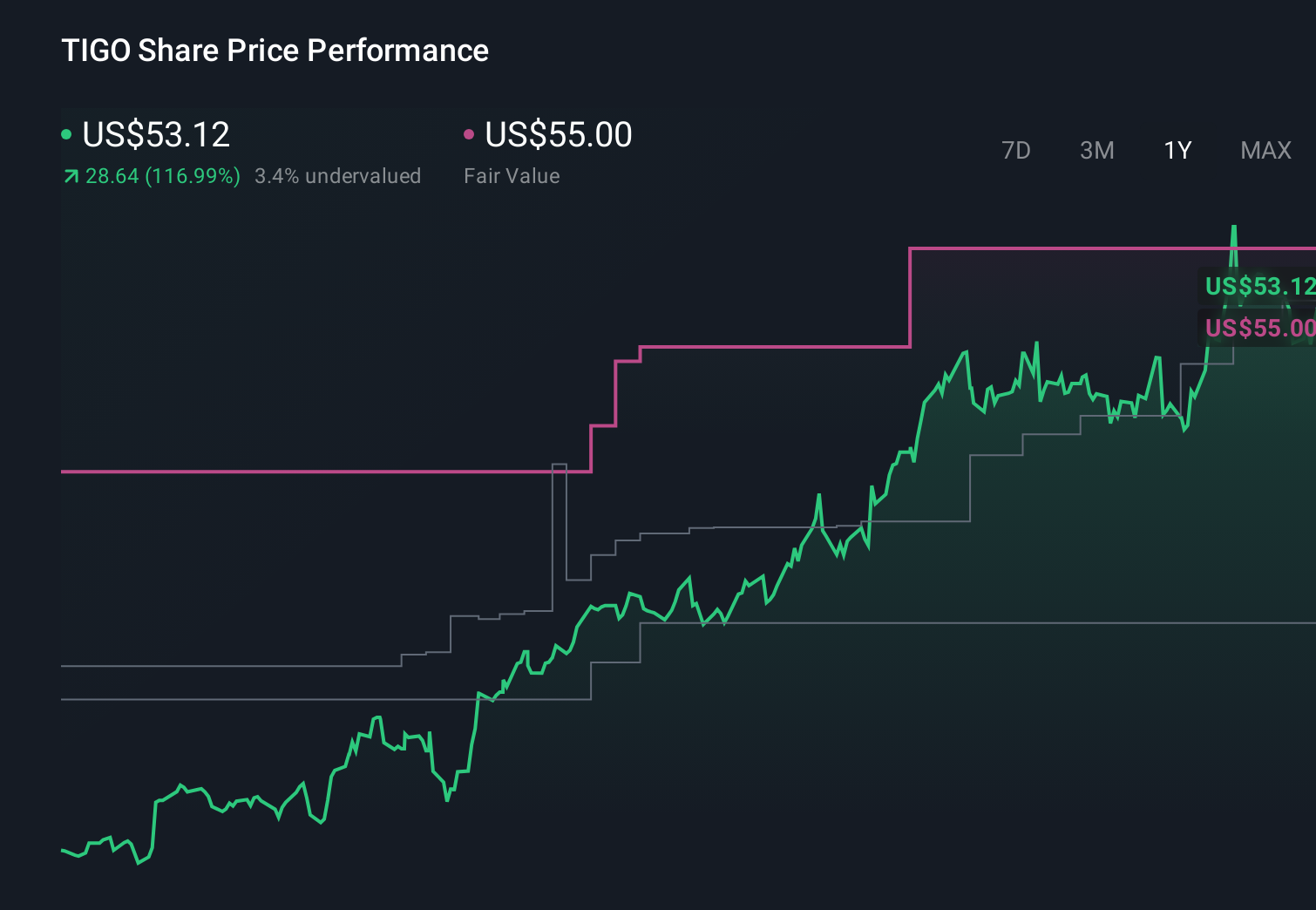

For investors following NasdaqGS:TIGO, this move comes with the shares trading at $60.83. The stock has posted a 2.0% return over the past week and 10.0% over the past month, with a 7.6% return year to date. Over the past year, the return is very large relative to many telecom names, and multi year returns also show strong gains.

Full ownership of Tigo Colombia gives Millicom more flexibility to align its Colombian unit with group wide priorities and to simplify decision making. As integration progresses, key areas to watch include the pace at which the company simplifies its structure, how it manages capital allocation in Colombia, and how it communicates its priorities for the enlarged operation to shareholders.

Stay updated on the most important news stories for Millicom International Cellular by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Millicom International Cellular.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$60.83, the share price is about 4.9% above the US$57.98 analyst target, within the 10% band that suggests it is close to consensus.

- ✅ Simply Wall St Valuation: Shares are described as trading at 68.1% below an estimated fair value, which is a large discount in that model.

- ✅ Recent Momentum: The 30 day return of roughly 10.0% points to positive short term momentum as the Colombia deal progresses.

Check out Simply Wall St's in depth valuation analysis for Millicom International Cellular.

Key Considerations

- 📊 Full ownership of Tigo Colombia could simplify operations and make it easier for you to assess group performance in a key market.

- 📊 Keep an eye on how management talks about integration costs, capital allocation in Colombia, and any updates to earnings guidance tied to the deal.

- ⚠️ One flagged risk is that interest payments are not well covered by earnings, so watch leverage and funding terms as the transaction is absorbed.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Millicom International Cellular analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.