Please use a PC Browser to access Register-Tadawul

Minerals Technologies (MTX): Losses Deepen 19.9% Annually, Investor Focus Shifts to Profitability Path

Minerals Technologies Inc. MTX | 61.94 61.94 | +0.65% 0.00% Pre |

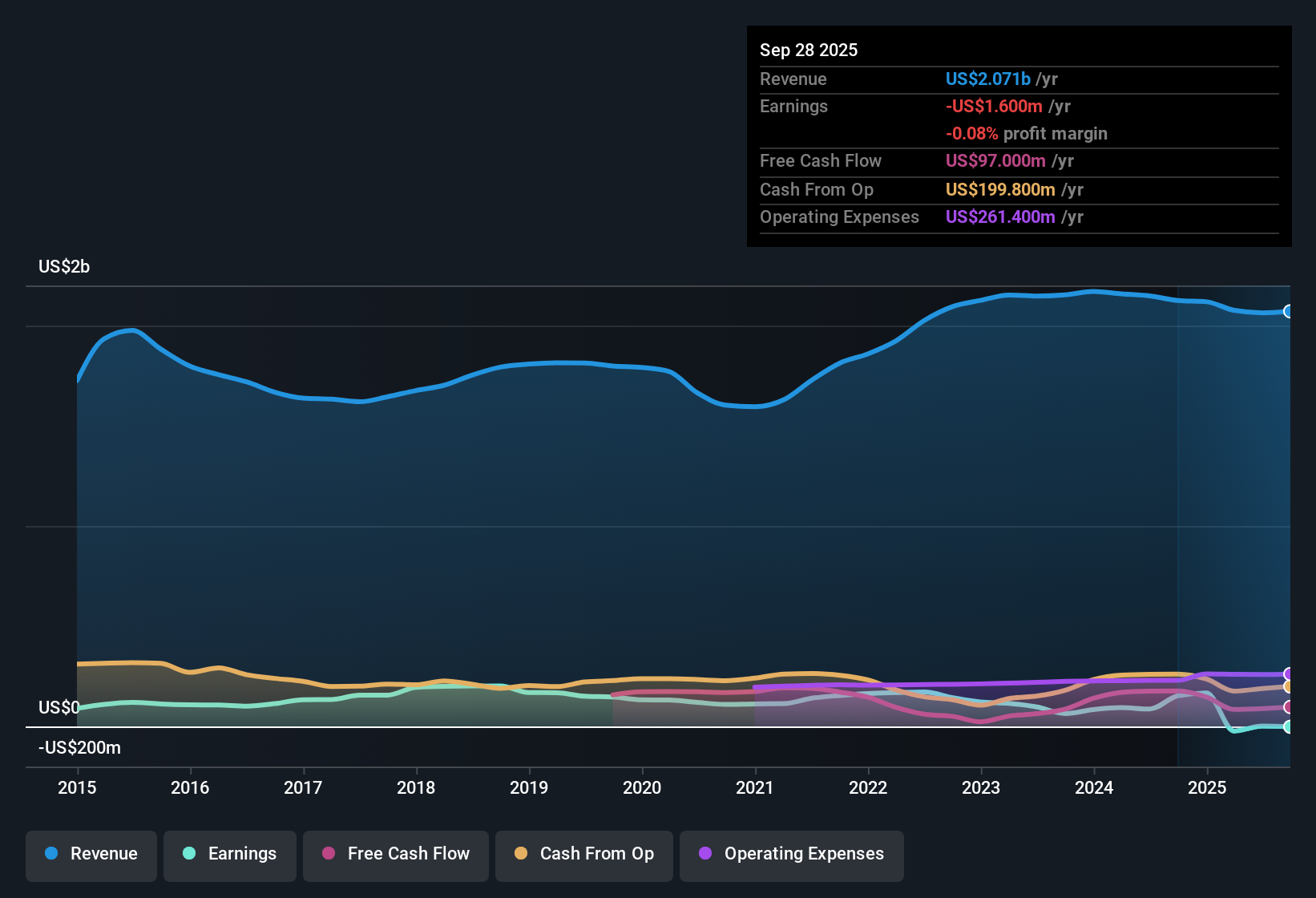

Minerals Technologies (MTX) is currently unprofitable, with losses deepening at an annual rate of 19.9% over the past five years. Looking forward, revenue is forecast to grow 3.4% each year and the company is expected to transition to profitability within three years. Earnings are projected to surge 246.7% annually. With these growth forecasts and a share price of $59.71, which sits below the consensus analyst target, investors are watching closely as MTX aims to return to the black and capitalize on its value-oriented positioning.

See our full analysis for Minerals Technologies.Now, let’s see how these latest earnings line up against the key narratives that have shaped community and market expectations for MTX.

Margins Forecast to Jump from 0.1% to 36%

- Analysts project a steep lift in profit margins, expecting them to rise from a razor-thin 0.1% now to 36% within three years as new products and increased capacity take hold.

- According to the analysts' consensus view, surging profit margins will be driven by several factors:

- Efforts to shift MTX's business mix toward higher-margin sustainable products, such as natural oil purification and eco-packaging, are anticipated to deliver much stronger net margins compared to legacy operations.

- Consensus also highlights that MTX’s heavy investment in expanding production for specialty applications could capture secular tailwinds from sustainability trends, increasing margin accretion as legacy segments play a smaller role.

- Consensus expects margin expansion to unlock lasting earnings durability, even as revenues grow modestly. 📊 Read the full Minerals Technologies Consensus Narrative.

DCF Fair Value Sits Above Current Price

- MTX trades at a Price-to-Sales ratio of 0.9x, a discount compared to both the US Chemicals industry (1.2x) and its peer group (1.3x), with its current share price of $59.71 sitting well below the DCF fair value estimate of $71.21 and the analyst price target of $84.00.

- From the analysts' consensus view, the case for relative undervaluation rests on two factors:

- The valuation discount is seen as a cushion for investors as the company transitions to profitability, especially since long-term growth drivers are in play and shares are already trading beneath forecasted fair value.

- Consensus notes that achieving the expected $818.2 million in earnings by 2028 would justify a much lower future PE ratio (3.8x) than today, implying upside potential if those profit targets are met.

Structural Risks: Paper Decline and Legal Overhang

- MTX faces lingering risks from declining North American and European paper demand and unresolved talc litigation, cited explicitly by analysts as factors that could erode growth and earnings stability.

- Within the consensus narrative, these risks play out in two main ways:

- Subdued volumes in the core Specialty Additives business, which services the paper market, create ongoing pressure on revenue and margin improvement even as other parts of the portfolio gain ground.

- Legal uncertainties over talc exposure present the chance of unexpected settlement costs, making it harder to forecast longer-term cash flows and potentially unsettling broader investor confidence in the transition story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Minerals Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your perspective and craft your own narrative in just a few minutes with ease: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Minerals Technologies.

See What Else Is Out There

Despite ambitious profit margin targets and upside potential, MTX’s exposure to declining paper demand and legal uncertainties introduces questions about its ability to deliver dependable growth.

If you want to sidestep these industry-specific risks, use stable growth stocks screener (2098 results) to focus on companies proving consistent gains and resilient earnings across market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.