Please use a PC Browser to access Register-Tadawul

Mint Incorporation Full Year 2025 Earnings: US$0.068 loss per share (vs US$0.037 profit in FY 2024)

Mint MIMI | 0.34 0.33 | -11.55% -0.62% Pre |

Mint Incorporation (NASDAQ:MIMI) Full Year 2025 Results

Key Financial Results

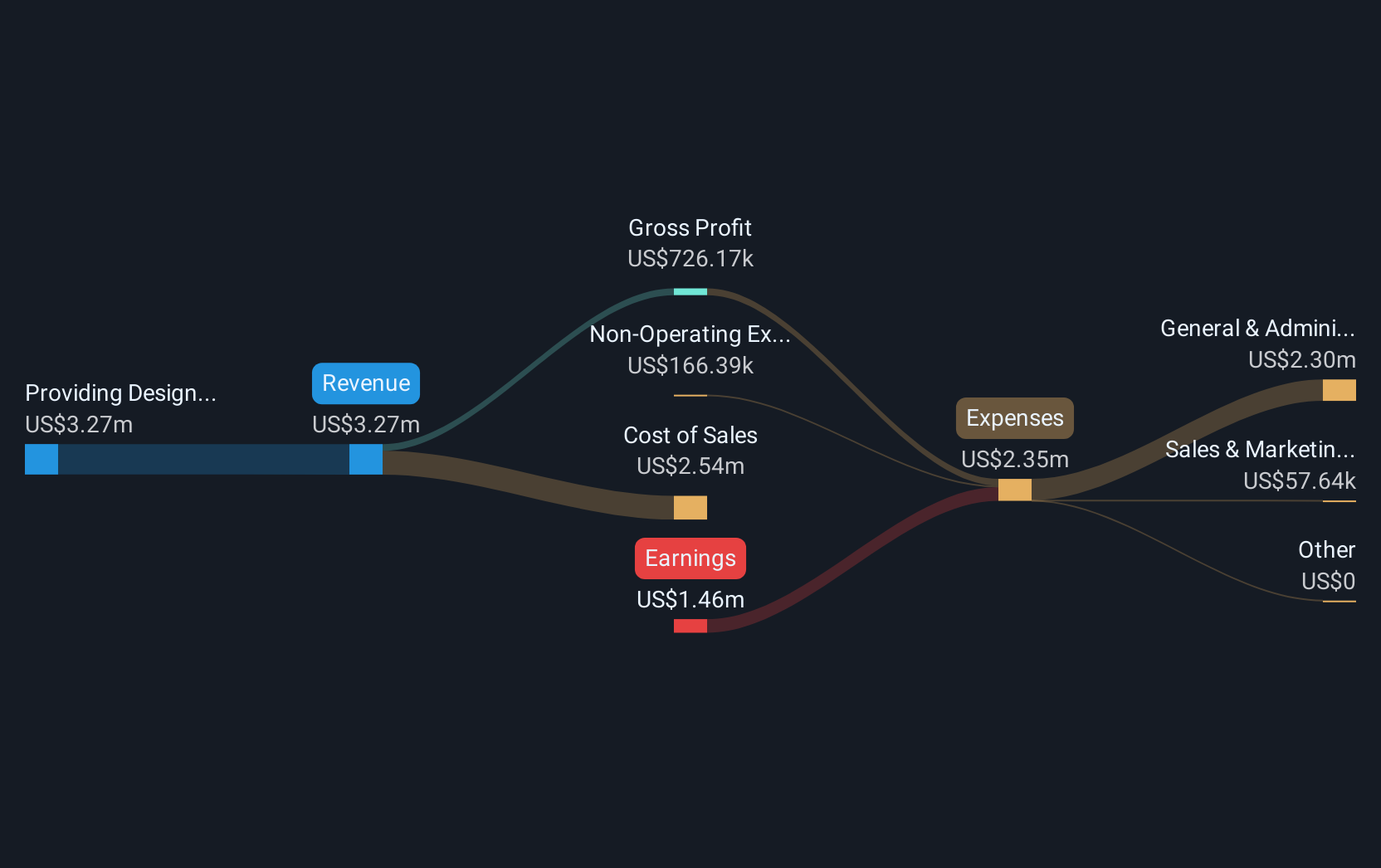

- Revenue: US$3.27m (down 26% from FY 2024).

- Net loss: US$1.46m (down by 287% from US$783.4k profit in FY 2024).

- US$0.068 loss per share (down from US$0.037 profit in FY 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

In the last 12 months, the only revenue segment was Providing Design, Fit out and Repair and Maintenance Services contributing US$3.27m. Notably, cost of sales worth US$2.54m amounted to 78% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to US$2.30m (98% of total expenses). Over the last 12 months, the company's earnings were enhanced by non-operating gains of US$166.4k. Explore how MIMI's revenue and expenses shape its earnings.

Mint Incorporation shares are up 4.7% from a week ago.

Risk Analysis

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.