Please use a PC Browser to access Register-Tadawul

Mixed Earnings and Efficiency Drive Might Change the Case for Investing in Performance Food Group (PFGC)

Performance Food Group Company PFGC | 91.50 | -1.60% |

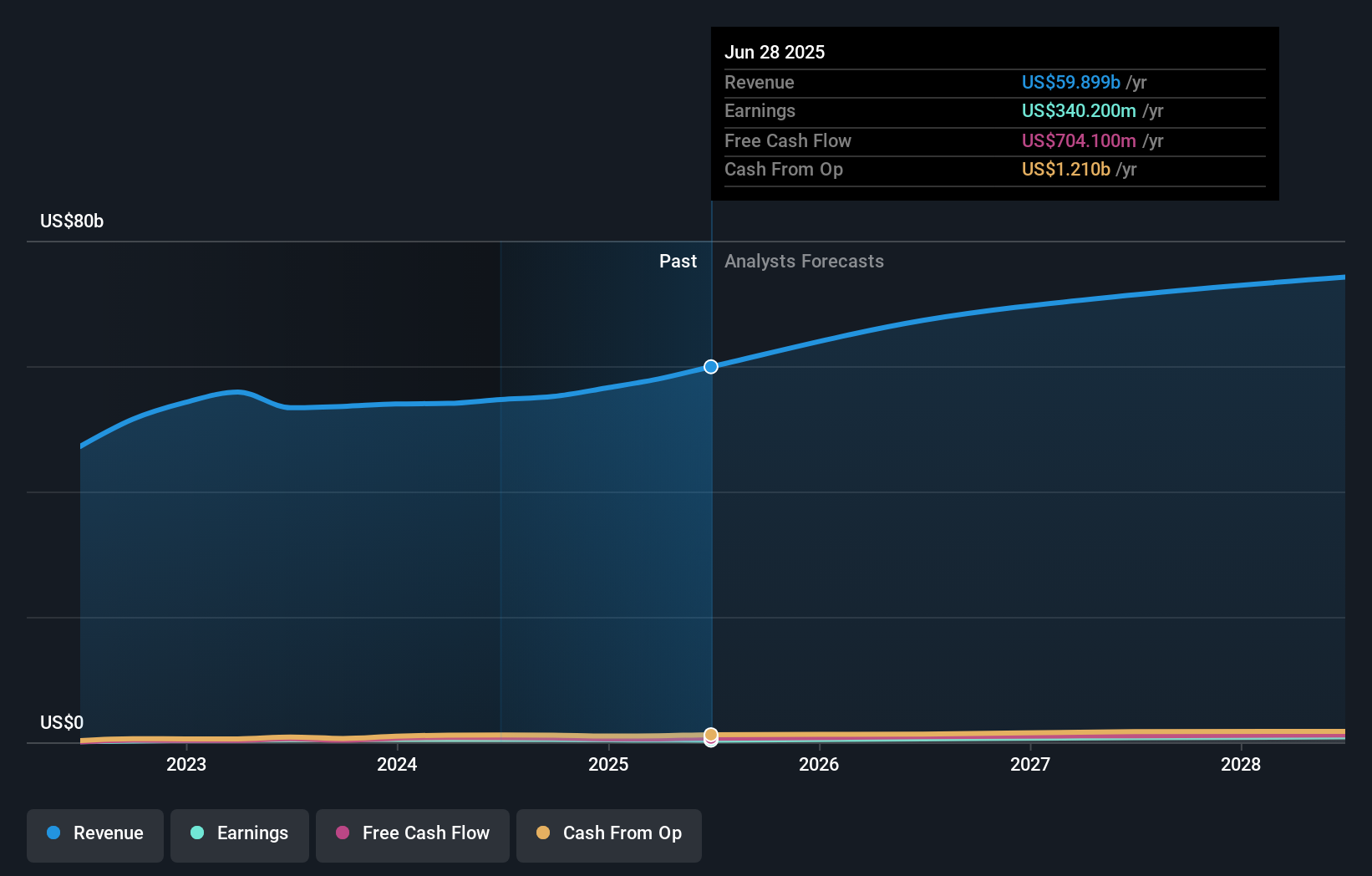

- Performance Food Group reported its fourth quarter and full-year 2025 results, delivering US$16.94 billion in quarterly sales and offering guidance for fiscal 2026 sales between US$67 billion and US$68 billion.

- Despite higher sales, the company posted a year-over-year decline in both quarterly and full-year net income, prompting management to highlight continued efficiency initiatives and disciplined capital allocation, including share buybacks and potential acquisitions.

- We'll explore how Performance Food Group's mixed earnings performance and focus on disciplined M&A activity could influence its future growth narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Performance Food Group Investment Narrative Recap

To be a shareholder of Performance Food Group, you need to believe in its ability to convert industry-leading sales growth into consistent profit expansion, despite pressures on margins from competition and integration risks tied to ongoing M&A activity. The latest quarterly results, while showing healthy revenue gains and reiteration of strong guidance for 2026, do not materially change the most important near-term catalyst, sustained margin improvement, or lessen concerns about rising costs and acquisition-related execution risks.

Among recent company announcements, the update on Performance Food Group’s disciplined share buyback program stands out. While buybacks can signal confidence in long-term value creation, the relatively small number of shares repurchased in the most recent tranche has limited immediate impact on earnings per share, keeping the focus on operational execution and margin management as primary catalysts.

However, investors should also weigh the risk that, even with robust sales, ongoing margin compression in segments like Specialty and increased M&A could ...

Performance Food Group's outlook points to $74.7 billion in revenue and $830.1 million in earnings by 2028. Achieving these figures would require 7.6% yearly revenue growth and a $489.9 million increase in earnings from the current $340.2 million.

Uncover how Performance Food Group's forecasts yield a $117.36 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Performance Food Group range from US$117.36 to US$172.52 across two viewpoints. With margin expansion and integration risks in focus, these differing perspectives highlight the value of exploring multiple opinions before making decisions.

Explore 2 other fair value estimates on Performance Food Group - why the stock might be worth as much as 71% more than the current price!

Build Your Own Performance Food Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Performance Food Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Performance Food Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Performance Food Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.