Please use a PC Browser to access Register-Tadawul

Mobile Infrastructure Corporation (NASDAQ:BEEP) Investors Are Less Pessimistic Than Expected

Mobile Infrastructure Corporation Common Stock BEEP | 3.15 3.15 | -3.67% 0.00% Post |

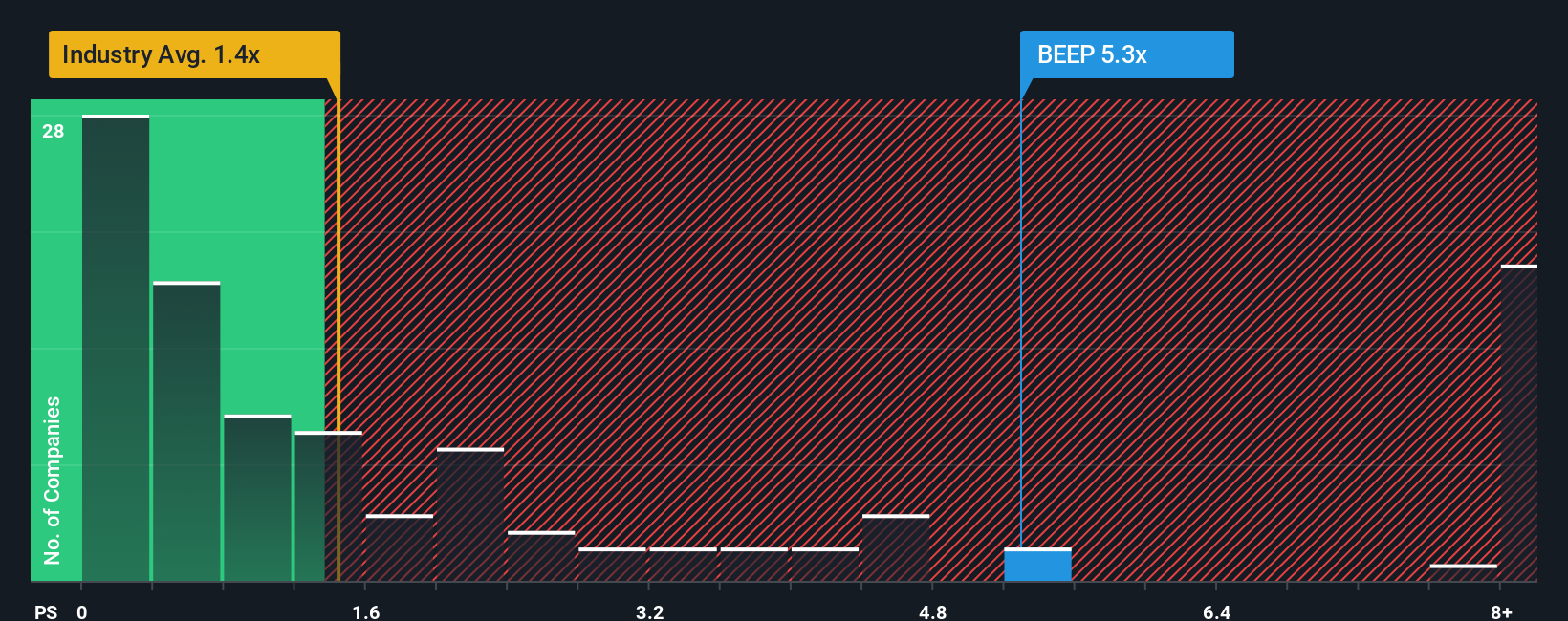

When you see that almost half of the companies in the Commercial Services industry in the United States have price-to-sales ratios (or "P/S") below 1.4x, Mobile Infrastructure Corporation (NASDAQ:BEEP) looks to be giving off strong sell signals with its 5.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Mobile Infrastructure Performed Recently?

Mobile Infrastructure certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Mobile Infrastructure's future stacks up against the industry? In that case, our free report is a great place to start.How Is Mobile Infrastructure's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Mobile Infrastructure's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Pleasingly, revenue has also lifted 55% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.3% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.6%, which is not materially different.

With this information, we find it interesting that Mobile Infrastructure is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Mobile Infrastructure's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Mobile Infrastructure currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.