Please use a PC Browser to access Register-Tadawul

Moderna (NasdaqGS:MRNA) Joins Russell Midcap Indices In Late June 2025

Moderna MRNA | 49.70 49.18 | +6.65% -1.05% Pre |

In late June 2025, Moderna (NasdaqGS:MRNA) underwent significant index changes, adding to the Russell Midcap indices while exiting the Russell Top 200 indices. This reclassification might have signaled a shift in investor perception, aligning with the company's 18% share price increase over the last quarter. Despite the broader market experiencing a rally with indexes like the S&P 500 and Nasdaq reaching record highs, Moderna's earnings report, strategic alliances, and product-related updates added weight to its price movement. These developments occurred against a backdrop of economic optimism, with strong job growth boosting market sentiment.

The recent index reclassification of Moderna into the Russell Midcap indices and removal from the Russell Top 200 indicates a shift in investor perception, possibly affecting long-term investor strategies. Despite a recent 18% share price increase over the past quarter coinciding with broader market highs, Moderna's five-year total return was a 50.83% decline. This underperformance relative to industry peers indicates the challenges Moderna faces, including decreased revenues and high costs impacting profitability.

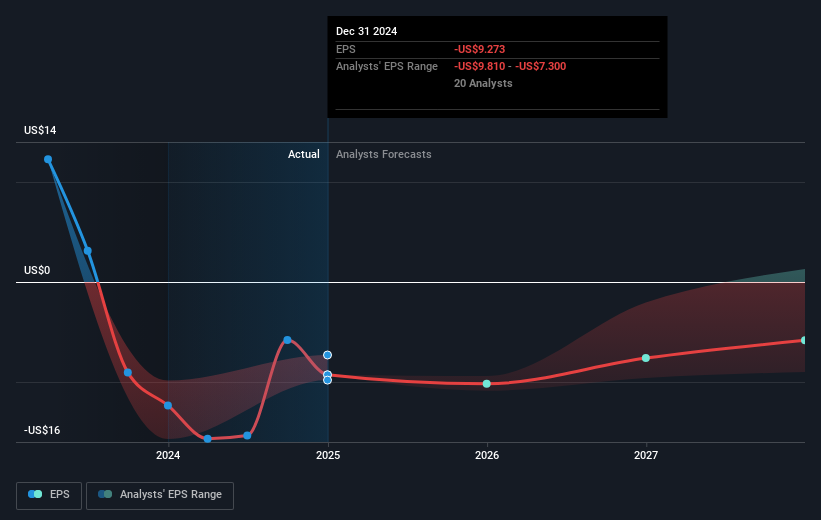

The news and developments around Moderna's strategic alliances and product updates could potentially bolster future revenue through international market expansion and oncology advancements. Analysts expect revenue growth driven by new product approvals, yet the company's earnings are still forecast to remain negative in the near term. Current share price movements reflect some investor optimism, trading below the consensus price target of US$47.59, suggesting room for growth, provided the company meets these expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.