Please use a PC Browser to access Register-Tadawul

Modine Manufacturing (MOD): Evaluating Valuation After Strategic Transformation and Climate Solutions Expansion

Modine Manufacturing Company MOD | 139.88 | -15.32% |

Modine Manufacturing (NYSE:MOD) has been generating investor attention lately after a series of moves designed to sharpen its operational focus and bolster its position in the growing HVAC and air quality markets.

With consistent earnings beats, successful integration of acquisitions, and a focus on streamlining operations, Modine's momentum has snowballed, as reflected in its 58% share price return over the past 90 days and a remarkable 951% three-year total shareholder return. That kind of long-term outperformance has kept investors' attention, even as near-term returns have moderated.

If Modine's rapid transformation has you watching the sector for emerging leaders, now could be the right moment to discover fast growing stocks with high insider ownership

With shares up nearly 60% in the last quarter and Modine trading just shy of analysts' price targets, the question now is whether there is still unrecognized upside or if the market already reflects the company’s bright future.

Most Popular Narrative: 9.2% Undervalued

Modine Manufacturing’s current market price remains below the most popular narrative fair value estimate, providing a notable margin at recent levels. The narrative builds its views by projecting meaningful acceleration in the company’s future growth, creating a stark contrast with where shares are trading today.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products. Management is forecasting the potential to double data center revenues from approximately $1 billion in fiscal '26 to $2 billion by fiscal '28. This structural demand from digital infrastructure is expected to materially boost revenue growth and deliver significant operating leverage over time.

How bold are the assumptions behind this price target? Analysts are betting on a scenario with sky-high revenue growth, surging operational leverage, and a jump in future profits. Want to see which numbers give Modine’s valuation its muscle? Dig in to uncover the precise financial projections fueling this powerful narrative.

Result: Fair Value of $160.00 (UNDERVALUED)

However, execution risks from aggressive expansion and potential delays in data center orders could quickly shift the outlook for Modine’s ambitious growth narrative.

Another View: Multiples Raise Caution

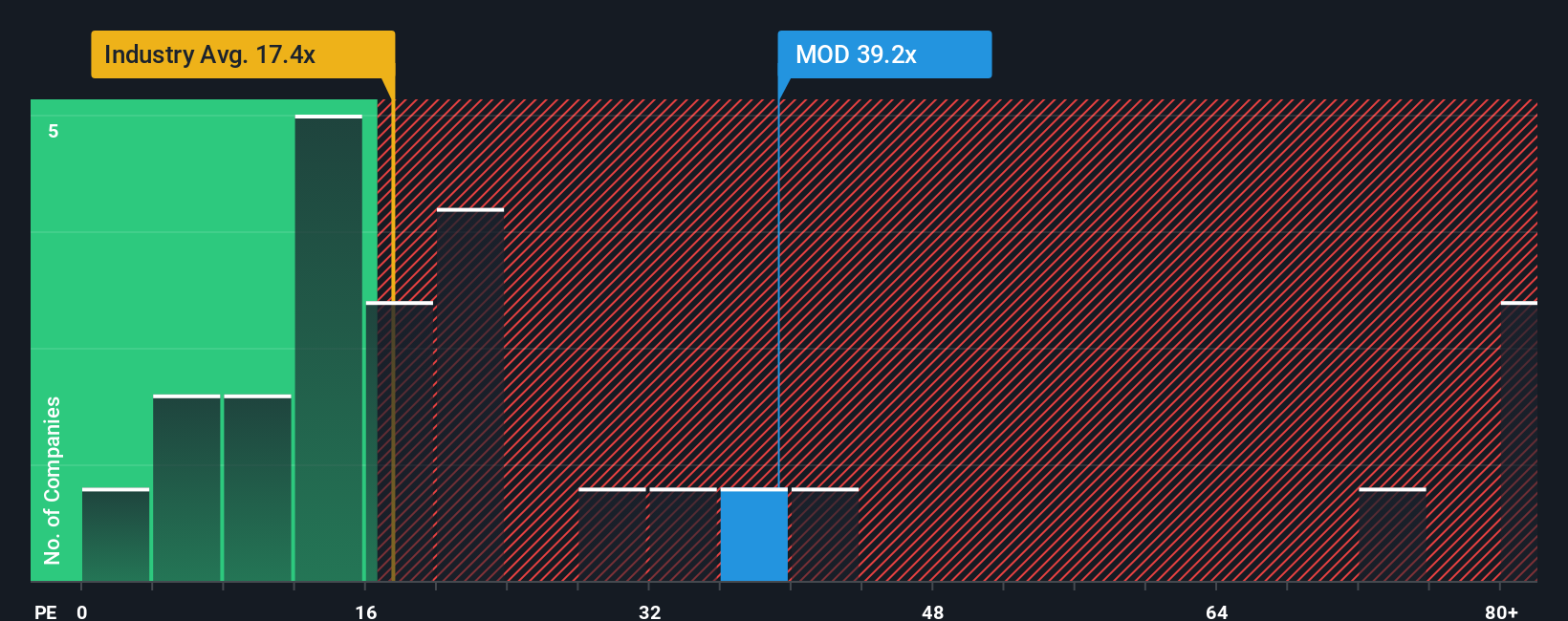

While the narrative points to Modine as undervalued, traditional valuation ratios paint a different story. The company is trading at a price-to-earnings ratio of 40.6 times, which is much higher than its industry peers averaging 17.3 times and above the fair ratio of 31.8 times. This gap signals a premium price and raises questions about whether the market is already factoring in most of Modine’s future growth.

Build Your Own Modine Manufacturing Narrative

If the numbers or assumptions here do not quite match your view, take a few minutes to explore Modine’s data and craft your own investment case. You can Do it your way.

A great starting point for your Modine Manufacturing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that broadening their strategy with fresh opportunities can make all the difference. Don’t miss out on these exciting markets and trends now gaining momentum:

- Tap into the latest breakthroughs in medicine and AI by exploring these 33 healthcare AI stocks, which are poised to transform healthcare innovations and patient outcomes.

- Uncover reliable income by reviewing these 19 dividend stocks with yields > 3%, offering robust yields and consistent performance, ideal for building your dividend portfolio.

- Get ahead of the curve in digital assets by checking out these 79 cryptocurrency and blockchain stocks, powering advancements in blockchain, payments, and financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.