Please use a PC Browser to access Register-Tadawul

Monarch Casino And Resort (MCRI) Margin Gains Reinforce Bullish Narratives Despite Modest Growth Forecasts

Monarch Casino & Resort, Inc. MCRI | 95.39 | -0.74% |

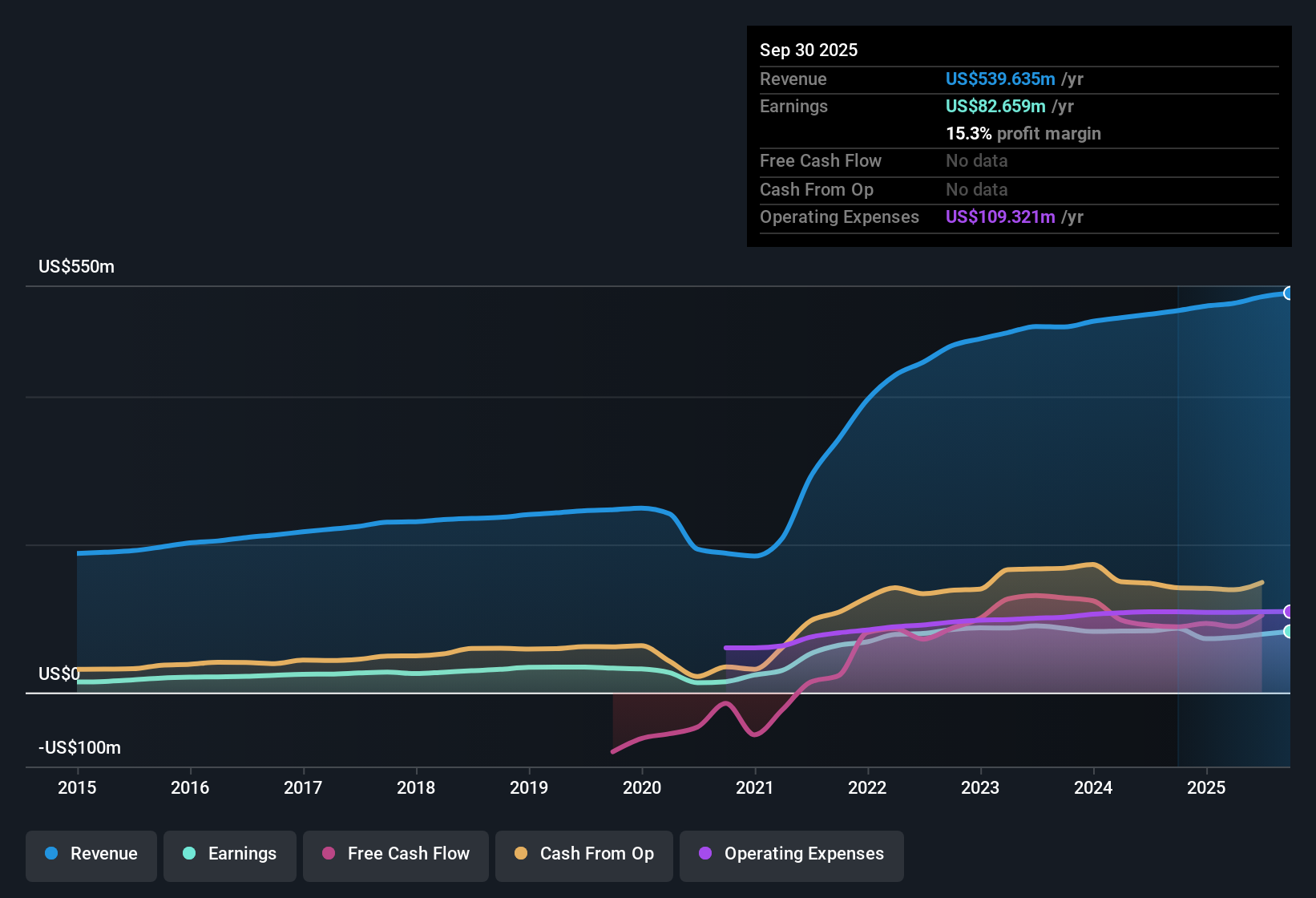

Monarch Casino & Resort (MCRI) has just wrapped up FY 2025 with fourth quarter revenue of US$140.0 million and basic EPS of US$1.27, while trailing twelve month figures show revenue of US$545.1 million and EPS of US$5.55, set against earnings growth of 39.3% over the past year. Over recent periods the company has seen revenue move from US$134.5 million in Q4 2024 to US$140.0 million in Q4 2025, with quarterly EPS shifting from US$0.23 to US$1.27 and trailing net profit margin sitting at 18.6% compared with 13.9% a year earlier. This sets up a results story that focuses on how investors weigh these margin levels and earnings growth against expectations for steadier growth ahead.

See our full analysis for Monarch Casino & Resort.With the headline numbers on the table, the next step is to see how these results line up with the prevailing narratives around Monarch Casino & Resort, and where the data may support or challenge what investors currently believe about the business.

39.3% earnings growth puts profitability in focus

- Over the last 12 months, earnings grew 39.3% with net income at US$101.4 million and trailing EPS at US$5.55, while the trailing net profit margin sits at 18.6% compared with 13.9% a year earlier.

- What supports a bullish angle is that this margin profile and earnings growth sit on top of relatively steady revenue of US$545.1 million, and:

- the five year compounded earnings growth rate of 11.1% per year shows the business has not relied only on a single strong year, and

- Q4 FY 2025 net income of US$22.9 million compares with US$4.2 million in Q4 FY 2024, which heavily supports the bullish case that recent profitability is materially higher than a year ago.

Investors who want to see how this earnings profile fits into different long term storylines can step back and review a balanced narrative of the business with 📊 Read the full Monarch Casino & Resort Consensus Narrative.

Revenue growth looks steady, not rapid

- On a trailing basis, total revenue of US$545.1 million is up from US$522.2 million a year earlier, while forecasts point to revenue growth of about 2.4% per year, which is below broad US market growth expectations.

- Critics who take a more bearish stance often focus on that modest 2.4% revenue growth forecast and about 4.1% expected annual earnings growth, arguing that:

- slower expected top line growth can limit how much the market is willing to expand valuation multiples relative to faster growing peers, even when margins are currently healthy, and

- recent quarterly revenue, such as US$140.0 million in Q4 FY 2025 versus US$142.8 million in Q3 FY 2025, shows that near term revenue movement can be fairly muted, which lines up with that cautious growth view.

P/E of 16.8x and large DCF gap

- At a share price of US$95.49, the trailing P/E of 16.8x sits below the US hospitality industry average of 20.9x and a peer average of 25.5x, while the current price is also below the DCF fair value of about US$184.15 per share and the allowed analyst price target reference of US$107.50.

- Supporters of a bullish view often point out that this 16.8x P/E and the large gap to the DCF fair value suggest the market price does not fully reflect the 39.3% trailing earnings growth, yet:

- the same data set also shows that forward earnings growth expectations of around 4.1% per year are modest, which gives bears a clear data point to argue that some of that discount may be tied to slower expected growth, and

- the combination of a lower P/E than peers and below market growth forecasts leaves room for both sides to interpret whether current pricing is cautious or simply aligned with those growth assumptions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Monarch Casino & Resort's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Monarch Casino & Resort pairs strong trailing earnings with relatively modest forecast revenue and earnings growth, which can limit how much the market is willing to re-rate the shares.

If that slower growth profile leaves you wanting more, take a look at 55 high quality undervalued stocks identified by our screener, so you can quickly zero in on companies where current pricing looks more compelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.