Please use a PC Browser to access Register-Tadawul

MongoDB Expands AI Offerings As Shares Trade Near Estimated Fair Value

MongoDB, Inc. Class A MDB | 344.56 | -3.18% |

- MongoDB announced new AI product integrations, including Voyage AI models, aimed at extending its platform's AI capabilities.

- The company is positioning these tools to support modernization of legacy applications and broaden use cases across its cloud database offerings.

MongoDB, listed as NasdaqGM:MDB, sits at the center of the database and cloud services market, with a current share price of $344.35. The stock return over the past year is 23.9%, while the year to date return is a decline of 13.8%. This suggests investors have recently reassessed the shares after a strong 3 year return of 63.4%.

The latest AI integrations, including Voyage AI models, are aimed at making MongoDB more useful for organizations that want to bring AI closer to their data and modernize older systems. For long term focused investors, a key consideration is how these product moves affect MongoDB's role in database centric AI workloads over time.

Stay updated on the most important news stories for MongoDB by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on MongoDB.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$344.35, MongoDB trades about 23% below the US$448.74 analyst target, with a wide expected range between US$250 and US$525.

- ⚖️ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, so the valuation signal is balanced rather than clearly cheap or expensive.

- ❌ Recent Momentum: The 30 day return of roughly 15.6% decline shows recent negative momentum even as AI product news hits the market.

Check out Simply Wall St's in depth valuation analysis for MongoDB.

Key Considerations

- 📊 The AI integrations aim to deepen MongoDB's role in database centric AI workloads, so you may want to judge whether this aligns with your expectations for the business mix.

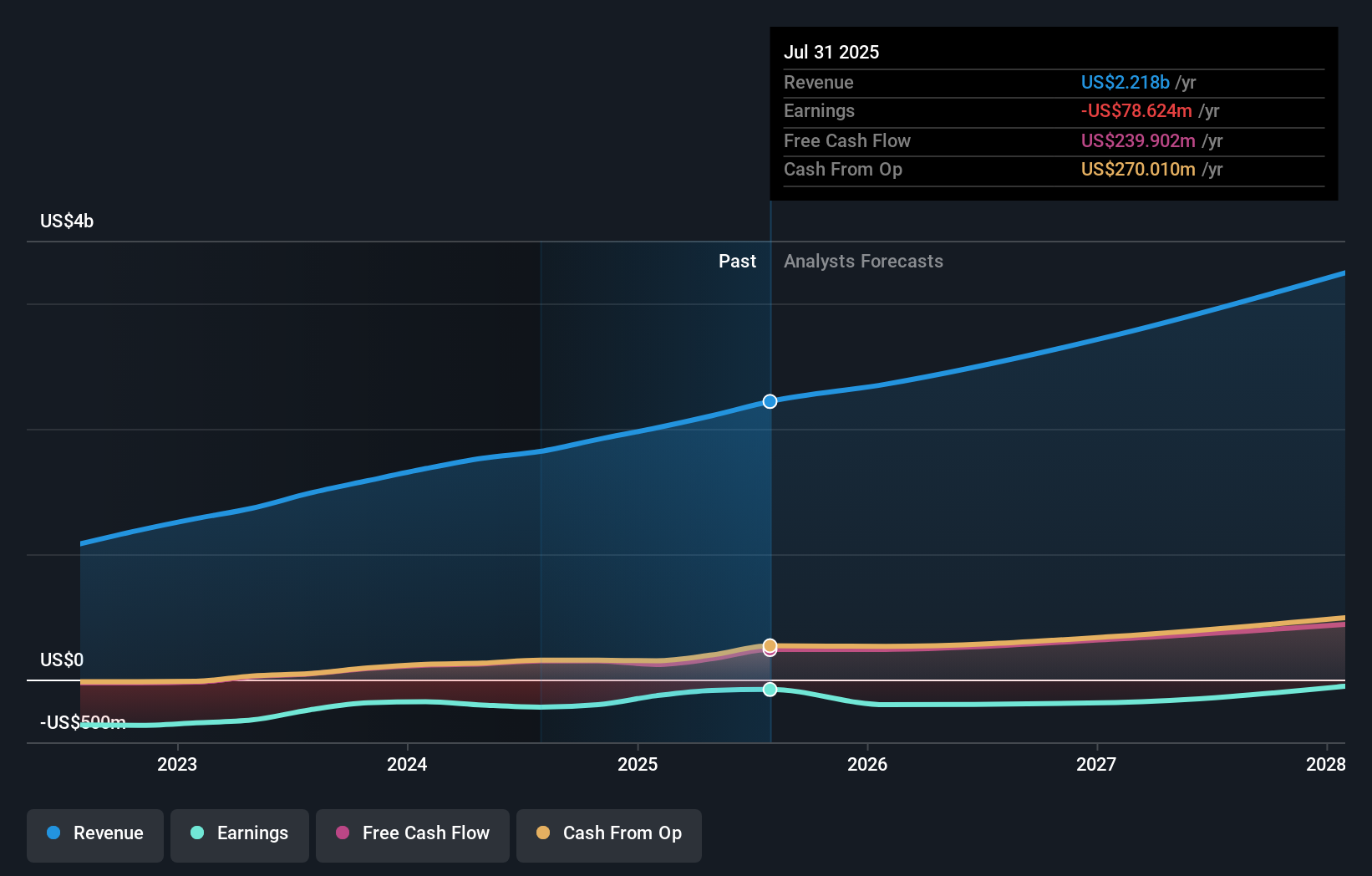

- 📊 Watch how usage of AI features, revenue growth in cloud services, and any changes in analyst targets evolve against the current US$344.35 price.

- ⚠️ A flagged minor risk is significant insider selling over the past 3 months, which some investors track closely when sentiment and momentum are weaker.

Dig Deeper

For the full picture including more risks and rewards, check out the complete MongoDB analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.