Please use a PC Browser to access Register-Tadawul

MongoDB Expands AI Platform As Valuation And Momentum Raise Questions

MongoDB, Inc. Class A MDB | 344.56 | -3.18% |

- MongoDB (NasdaqGM:MDB) has integrated Voyage AI models into its core platform.

- The company has launched new embedding and reranking APIs to support AI retrieval.

- MongoDB introduced an AI assistant for database operations, aimed at production-ready AI workloads.

MongoDB, trading at $384.82, is adding AI capabilities directly within its database platform. The stock has seen a 49.2% return over the past year and a 92.5% return over three years, while the year-to-date return is a 3.7% decline. For investors watching NasdaqGM:MDB, these moves in AI come on top of already substantial multi-year performance.

For current and prospective users, the key takeaway is that MongoDB is aiming to keep more AI work inside its own environment, including support for video and multimodal data. As the new AI assistant and APIs are adopted by customers, MongoDB may be discussed less as a pure database vendor and more as a broader data and AI platform.

Stay updated on the most important news stories for MongoDB by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on MongoDB.

Quick Assessment

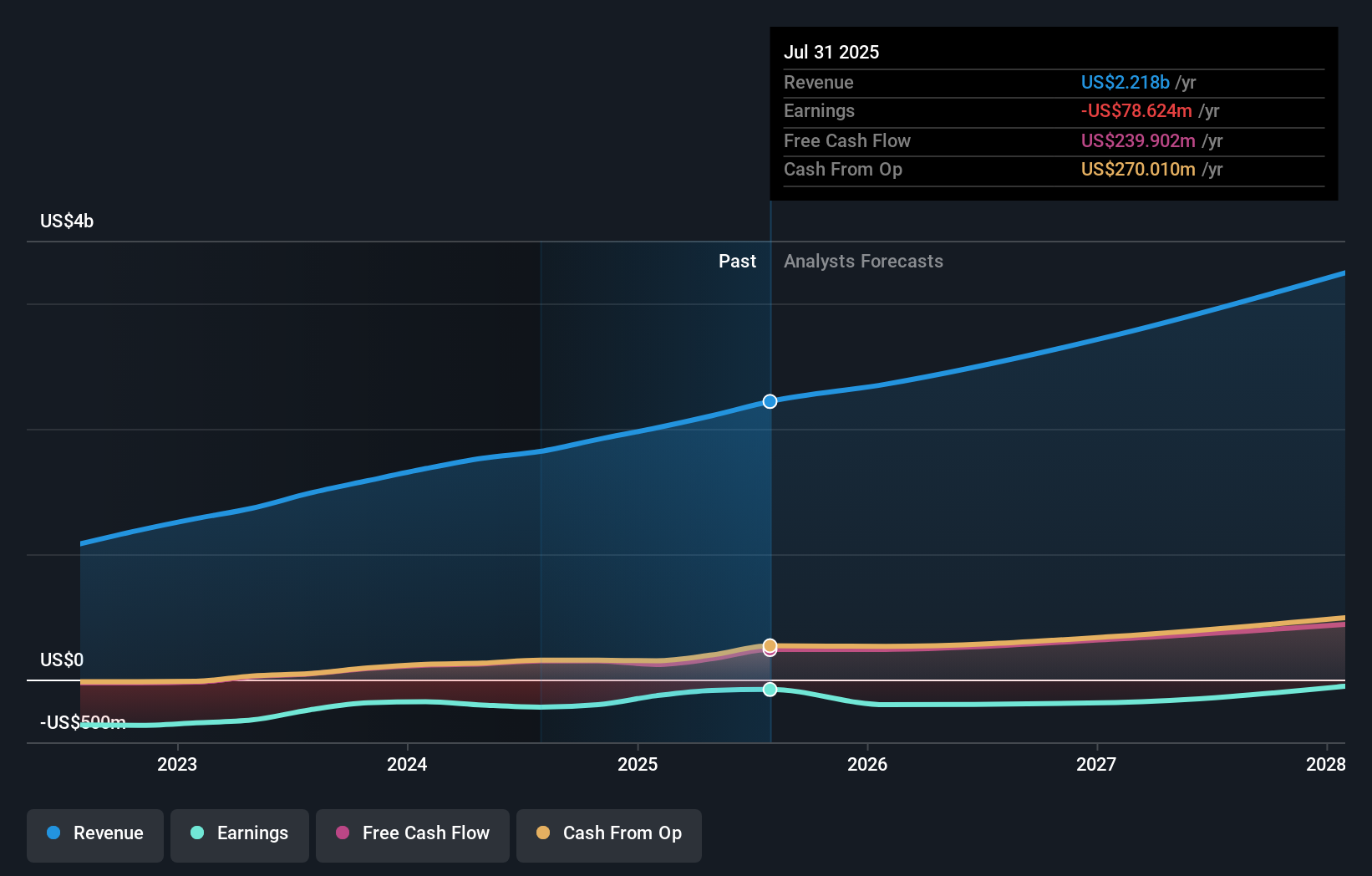

- ❌ Price vs Analyst Target: At US$384.82, MongoDB trades about 14% below the US$448.75 analyst target, with a wide target range of US$250 to US$550.

- ❌ Simply Wall St Valuation: Shares are described as trading 61.9% above estimated fair value, so the stock screens as overvalued on this model.

- ❌ Recent Momentum: The 30 day return of a 10.64% decline points to weak short term momentum despite the AI product news.

Check out Simply Wall St's in depth valuation analysis for MongoDB.

Key Considerations

- 📊 The Voyage AI integration and new AI assistant aim to keep AI retrieval and operations inside MongoDB, which may strengthen its role as a broader data and AI platform.

- 📊 It can be useful to monitor how AI related usage affects revenue, margins and customer adoption of the new embedding and reranking APIs over coming quarters.

- ⚠️ One highlighted factor is recent insider selling, which some investors may weigh carefully alongside a stock that already screens as overvalued.

Dig Deeper

For the full picture including more risks and potential rewards, check out the complete MongoDB analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.