Please use a PC Browser to access Register-Tadawul

Monolithic Power Systems (MPWR): Does Strong Cash Flow Signal a New Era of Market Leadership?

Monolithic Power Systems, Inc. MPWR | 946.51 946.51 | -3.56% 0.00% Pre |

- In recent days, Monolithic Power Systems has been highlighted for its strong free cash flow generation, expanding market share, and impressive revenue growth over the past five years.

- This financial strength gives the company flexibility to invest in further innovation or return capital to shareholders, setting it apart from peers currently experiencing weakened fundamentals.

- We'll explore how Monolithic Power Systems' outstanding cash generation and revenue momentum shape its investment outlook and long-term prospects.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Monolithic Power Systems Investment Narrative Recap

To be a shareholder in Monolithic Power Systems, you need to believe in the company’s ability to sustain significant free cash flow amid strong expansion in AI, automotive, and industrial end markets. The recent spotlight on MPS's superior cash generation does not materially alter the short-term catalyst, its exposure to surging AI and data center demand, nor does it offset the primary risk of customer concentration and potential end-market volatility.

Among the latest company highlights, the Q2 2025 earnings results best reflect this theme: revenue and net income continued to rise year-over-year, reinforcing confidence in MPS's cash-generating ability and sector outperformance. With upcoming Q3 results and ongoing share buybacks, earnings stability remains critical to sustaining market optimism and returning value to shareholders.

Yet, unlike its headline momentum, investors should stay mindful of how short ordering cycles and periodic inventory corrections could...

Monolithic Power Systems' narrative projects $3.9 billion revenue and $1.0 billion earnings by 2028. This requires a robust yearly revenue growth rate (exact percentage not specified) and an increase in earnings of $X from current earnings (current earnings value not specified in excerpt).

Uncover how Monolithic Power Systems' forecasts yield a $979.43 fair value, a 5% downside to its current price.

Exploring Other Perspectives

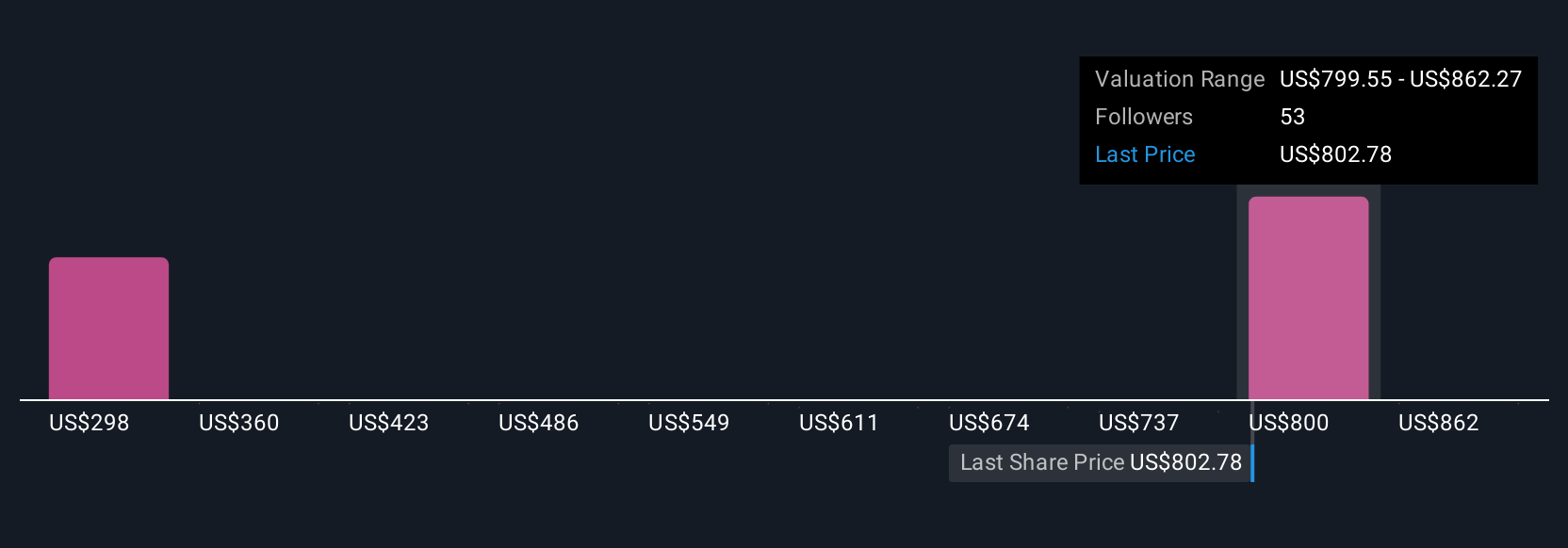

Eleven private investors in the Simply Wall St Community estimate Monolithic Power Systems’ fair value between US$369 and US$979 per share. Amid strong momentum in AI and automotive markets, your view on long-term industry adoption can shape how you interpret the wide range of expectations, explore the full spectrum of insights and make up your own mind.

Explore 11 other fair value estimates on Monolithic Power Systems - why the stock might be worth as much as $979.43!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.