Please use a PC Browser to access Register-Tadawul

Monolithic Power Systems (MPWR): Is Renewed Investor Confidence Justified by Its Current Valuation?

Monolithic Power Systems, Inc. MPWR | 954.27 | +0.82% |

Monolithic Power Systems (MPWR) has made waves recently after attracting renewed attention for its stellar financial health and efficiency. Market watchers are buzzing about the company's strong balance sheet and low levels of debt, both of which stand out in a sector where volatility is common. With high marks for both profitability and growth compared to peers, MPWR’s profile is catching the eye of investors looking for steady performers in the semiconductor space.

This spotlight on financial stability comes at a time when the stock's performance over the past year has been relatively modest, but momentum is building. Shares are up nearly 32% over the past three months and have delivered a five-year total return of more than 250%. While growth over twelve months has been more subdued, the recent uptick suggests investors are becoming more confident in MPWR’s ability to execute, possibly thanks to its consistent dividend affirmations and continued operational excellence.

With the company’s fundamentals and recent price moves in view, investors may be wondering whether MPWR is now undervalued and set for a run or if the market has already priced in all the good news related to its growth story.

Most Popular Narrative: 8.7% Overvalued

The prevailing narrative from market analysts deems Monolithic Power Systems overvalued by nearly 9% based on a blend of forward-looking growth, profit margin, and risk factors.

The company's significant investments in manufacturing, technology innovation, and expansion into new markets are assumed by the market to translate into continuous margin expansion and earnings leverage. However, increasing R&D and compliance costs, as well as rising environmental and supply chain requirements, could erode net margins over time.

Curious why analysts say the share price is running ahead of reality? The most popular narrative is built on some bold assumptions about future growth, profits, and what investors are willing to pay for each dollar earned. Discover which key calculations shape this valuation and what could flip the story on its head.

Result: Fair Value of $843.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong momentum in automotive and major AI customer wins could help MPWR deliver higher growth and margins than current forecasts suggest.

Find out about the key risks to this Monolithic Power Systems narrative.Another View: A Market-Based Check

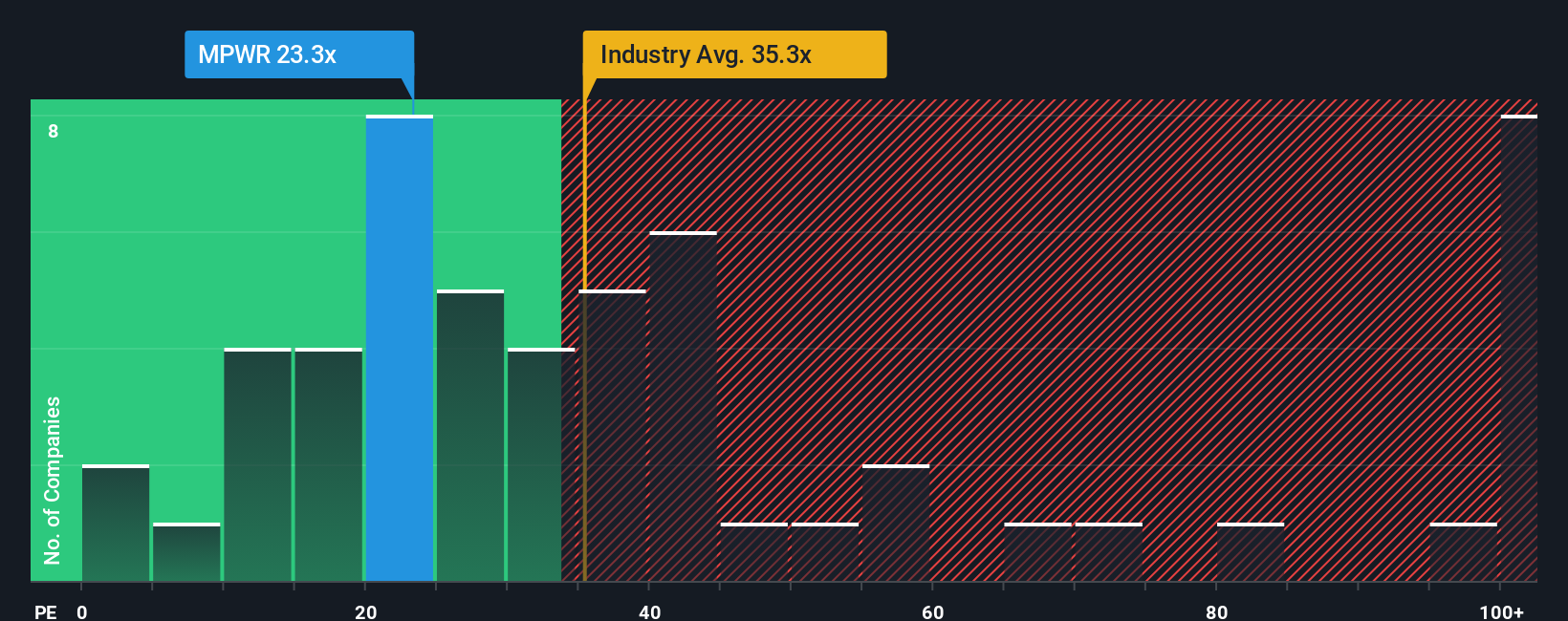

If we compare Monolithic Power Systems to the broader US semiconductor market using earnings ratios, the picture shifts. Market prices suggest the company is actually a better value relative to industry peers. Could this signal untapped upside, or are risks still lurking below the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Monolithic Power Systems Narrative

Keep in mind, if this perspective doesn’t fit your outlook or you want to dive into the numbers yourself, you can quickly build your own Monolithic Power Systems narrative in just a few minutes. Do it your way

A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead and uncover tomorrow’s biggest winners, don’t stop here. Use these hand-picked tools to spot companies on the move before everyone else does.

- Supercharge your search for companies harnessing artificial intelligence by checking out AI penny stocks to see those driving innovation in machine learning and smart automation.

- Lock in opportunities with steady income potential by reviewing dividend stocks with yields > 3% that deliver attractive yields for long-term investors seeking reliable payouts.

- Jump on underpriced gems with undervalued stocks based on cash flows that may be flying under the radar and offer strong upside based on robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.