Please use a PC Browser to access Register-Tadawul

Monro (MNRO) Returns To Quarterly Profitability And Tests Bearish Loss Narratives

Monro, Inc. MNRO | 22.79 | +0.89% |

Monro (MNRO) just posted Q3 2026 results with revenue of US$293.4 million and basic EPS of US$0.35, setting a clear marker after a stretch of mixed quarters. The company has seen quarterly revenue move between US$288.9 million and US$305.8 million over the past six reported periods, while basic EPS has ranged from a loss of US$0.72 to a profit of US$0.35, so this update lands at the higher end of that earnings range and keeps the focus firmly on margin recovery potential. With that backdrop, investors are likely to read this quarter through the lens of whether profitability is stabilizing and how much room management has to protect margins from here.

See our full analysis for Monro.With the headline numbers on the table, the next step is to see how this earnings print lines up against the widely followed narratives around Monro’s growth prospects, risks and the path back to more consistent profitability.

Profit swings from loss to US$11.1 million

- Net income moved from a loss of US$21.6 million in Q4 2025 and US$8.4 million in Q1 2026 to a profit of US$11.1 million in Q3 2026, with basic EPS ranging from a loss of US$0.72 to a profit of US$0.35 over the last six reported periods.

- Bears focus on the trailing 12 month loss of US$13.9 million and the reported 34.8% annualized increase in losses over five years. However, the recent sequence of quarterly figures shows:

- Back to back profits in Q2 2026 and Q3 2026, with basic EPS of US$0.18 and US$0.35, compared with losses in Q4 2025 and Q1 2026.

- Revenue holding in a relatively tight band between US$288.9 million and US$305.8 million across the last six quarters while profitability swings around that level.

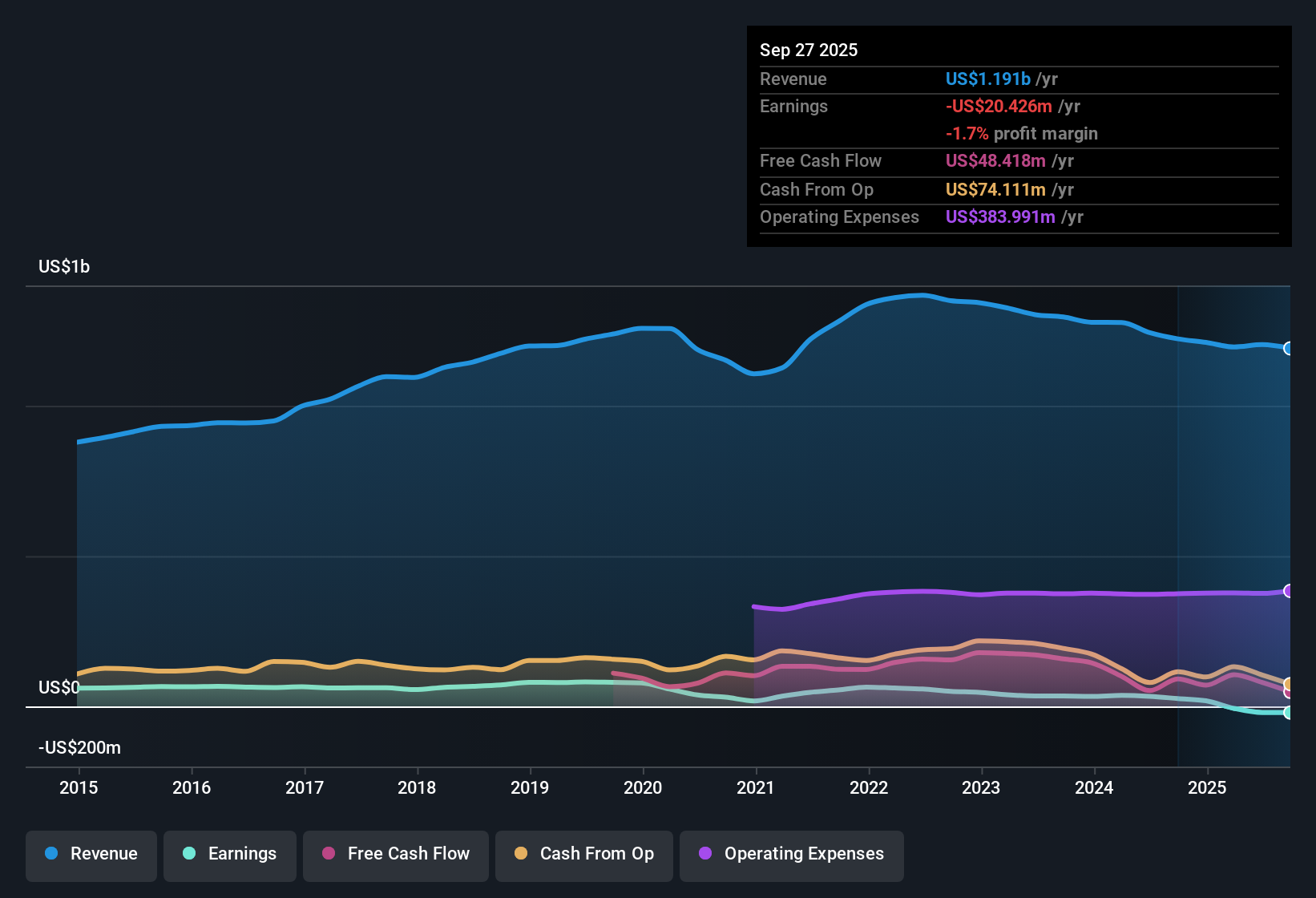

TTM revenue around US$1.2b, still unprofitable

- On a trailing 12 month basis, revenue is US$1.18b in Q3 2026, but net income over that same period is a loss of US$13.9 million and basic EPS is a loss of US$0.46.

- Critics highlight that revenue is forecast to grow at 1.5% per year versus a 10.6% US market forecast and argue this slow top line, combined with current losses, limits the appeal. At the same time:

- The shift from a TTM net loss of US$20.4 million in Q1 2026 to US$13.9 million in Q3 2026 shows the loss narrowing across the last three trailing snapshots.

- Quarterly net income excluding extra items has been positive in three of the last four reported quarters, even though the full year view is still in loss territory.

Valuation and dividend tension at US$20.05

- At a share price of US$20.05, Monro is trading at a P/S of 0.5x versus a cited peer average of 0.8x and a DCF fair value of US$28.89, while offering a 5.59% dividend yield that is not covered by trailing earnings.

- For a general market opinion, what stands out is the mix of potential upside and income against weak profitability, because:

- The current price sits about 30.6% below the DCF fair value of US$28.89 and below the single allowed analyst price target of US$20.67, yet the company remains loss making over the last 12 months.

- Forecasts call for very large EPS growth and a move to profitability within three years, while the current dividend is flagged as poorly covered by trailing losses, which income focused investors may weigh carefully.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Monro's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Monro’s recent quarter shows revenue holding in a tight band, while trailing 12 month losses, weak EPS coverage of the dividend, and an uncovered yield remain key pressure points.

If you want income that leans on stronger footing, check out these 1809 dividend stocks with yields > 3% to focus on companies offering yields above 3% backed by sturdier earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.