Please use a PC Browser to access Register-Tadawul

Morgan Stanley: Evaluating Valuation After Startup Push, Compensation Shift, and Private Credit Expansion

Morgan Stanley MS | 178.41 | -1.04% |

If you have been following Morgan Stanley (NYSE:MS), the past few weeks have certainly given investors plenty to consider. The company has announced an expanded partnership with Carta, highlighting its ambitions to win over employees from start-ups preparing for IPOs. This group could unlock a new wave of wealth management clients. At the same time, Morgan Stanley has signaled a significant change in its 2026 compensation structure by reducing deferred advisor pay, and its private credit arm is stepping up with fresh financing for a high-growth fintech. Each of these moves points to evolving priorities in how the firm grows and rewards its people.

Amid these strategic adjustments, Morgan Stanley’s stock has climbed impressively, with a 28% gain year-to-date and a striking 61% total return over the past year. The recent run-up puts MS well ahead of many banking peers, as momentum has steadily built. Even zooming out to a longer horizon, investors have seen the value of sticking with Morgan Stanley, especially as its core businesses show healthy revenue and net income growth. Still, the flurry of new initiatives—from courting IPO-bound talent to restructuring advisor incentives—warrants a fresh look at how the market is viewing future growth and risk for this financial powerhouse.

After this year’s rally and a series of strategic updates, is Morgan Stanley offering investors an entry point, or is the market already looking ahead and pricing in the next stage of its growth?

Most Popular Narrative: 11.3% Overvalued

The most widely followed narrative currently views Morgan Stanley as overvalued by more than 10 percent compared to its estimated fair value, even as the company demonstrates resilient growth and strategic expansion. This perspective ties the stock's value to future earnings, margin improvement, and capital deployment amid ongoing shifts in global wealth and intense competition.

The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions. This is evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth. Rising interest from both retail and institutional clients in innovative and customized sustainable investing and alternative asset products (such as ESG and Parametric portfolios) presents opportunities for new revenue streams and improved client retention, supporting potential margin expansion.

Curious how much runway Morgan Stanley really has for future growth? One analyst calculation hints at a remarkable combination of expanding revenue, rising margins, and a valuation multiple rarely seen in traditional banking. The real story behind these numbers might upend what you thought about MS’s price. Ready to see which forecasts put the consensus fair value far below the current market price?

Result: Fair Value of $143.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened regulatory scrutiny or rapid digital disruption could put pressure on Morgan Stanley’s margins and challenge its current advisory-led growth story.

Find out about the key risks to this Morgan Stanley narrative.Another View: Multiple-Based Valuation

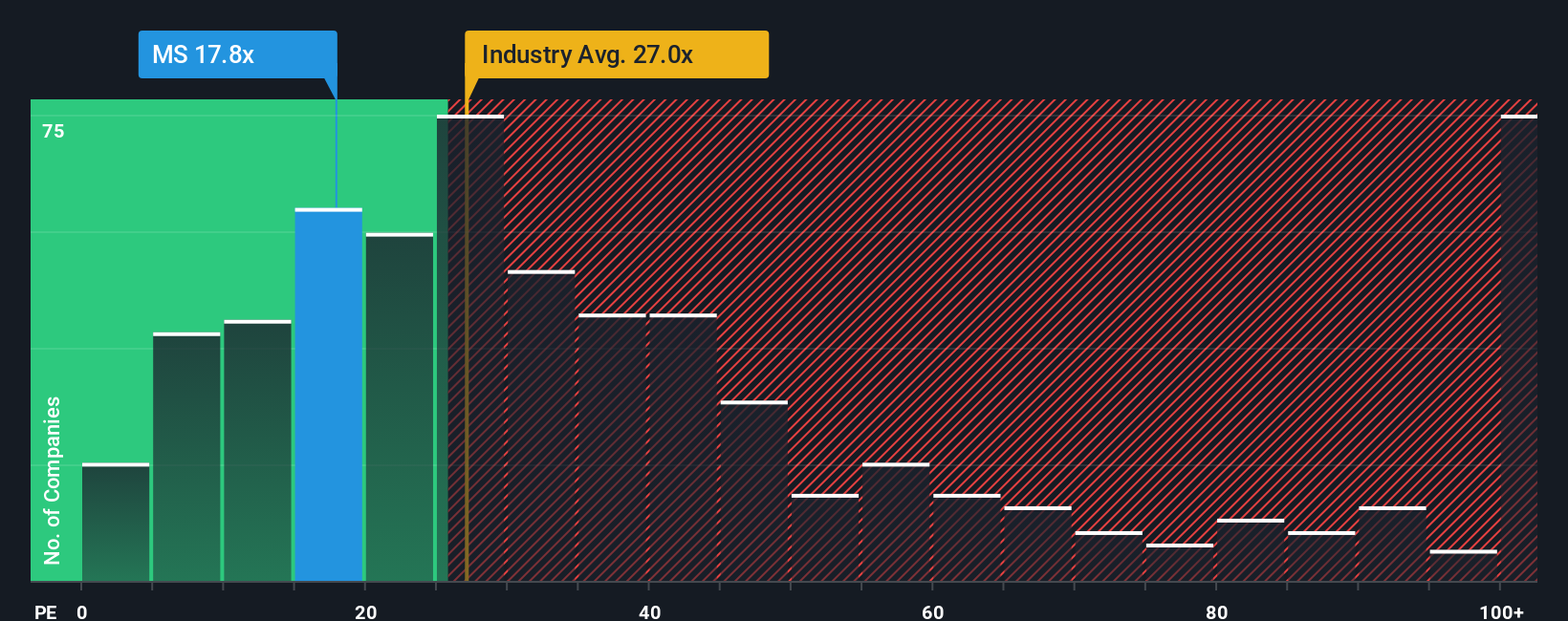

While analysts see Morgan Stanley trading above fair value, our comparison with the broader industry reveals that its current price-to-earnings ratio is actually lower than its sector peers. Does this shift your perspective on MS’s outlook?

Build Your Own Morgan Stanley Narrative

If you want to dig deeper or see Morgan Stanley's story from a different perspective, you can explore the numbers yourself and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smarter Ideas? Uncover What’s Next

Don’t wait for the next market move to pass you by. Expand your horizons and pinpoint opportunities that fit your strategy with these handpicked themes below.

- Uncover future blue chips among penny stocks with strong financials. These are gaining traction for their strong financials and growth potential before the crowd takes notice.

- Supercharge your portfolio by tapping into undervalued stocks based on cash flows. Identify companies whose current prices do not reflect their underlying cash flow strength.

- Start building reliable income streams by focusing on dividend stocks with yields > 3%. These offer robust yields and stable returns in any market condition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.