Please use a PC Browser to access Register-Tadawul

Mueller Water Products, Inc.'s (NYSE:MWA) P/E Is On The Mark

Mueller Water Products, Inc. Class A MWA | 24.99 | +0.93% |

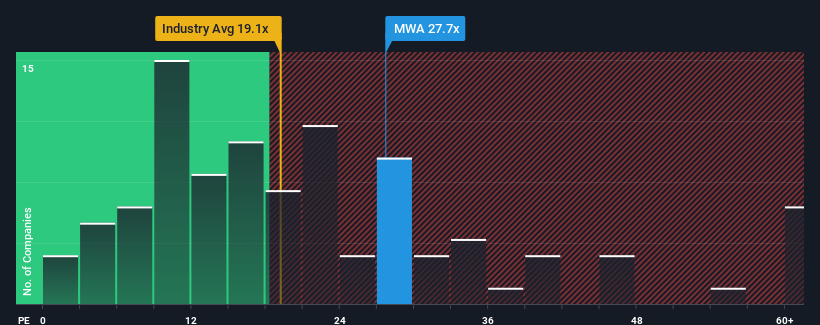

With a price-to-earnings (or "P/E") ratio of 27.7x Mueller Water Products, Inc. (NYSE:MWA) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Our free stock report includes 1 warning sign investors should be aware of before investing in Mueller Water Products. Read for free now.Recent times have been advantageous for Mueller Water Products as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is Mueller Water Products' Growth Trending?

In order to justify its P/E ratio, Mueller Water Products would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 77%. Pleasingly, EPS has also lifted 89% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 38% during the coming year according to the six analysts following the company. That's shaping up to be materially higher than the 13% growth forecast for the broader market.

In light of this, it's understandable that Mueller Water Products' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Mueller Water Products' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mueller Water Products' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks.

You might be able to find a better investment than Mueller Water Products.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.