Please use a PC Browser to access Register-Tadawul

Nabors Industries (NBR) One Off US$449 Million Gain Challenges Bullish Profitability Narratives

Nabors Industries Ltd. NBR | 78.19 | +2.06% |

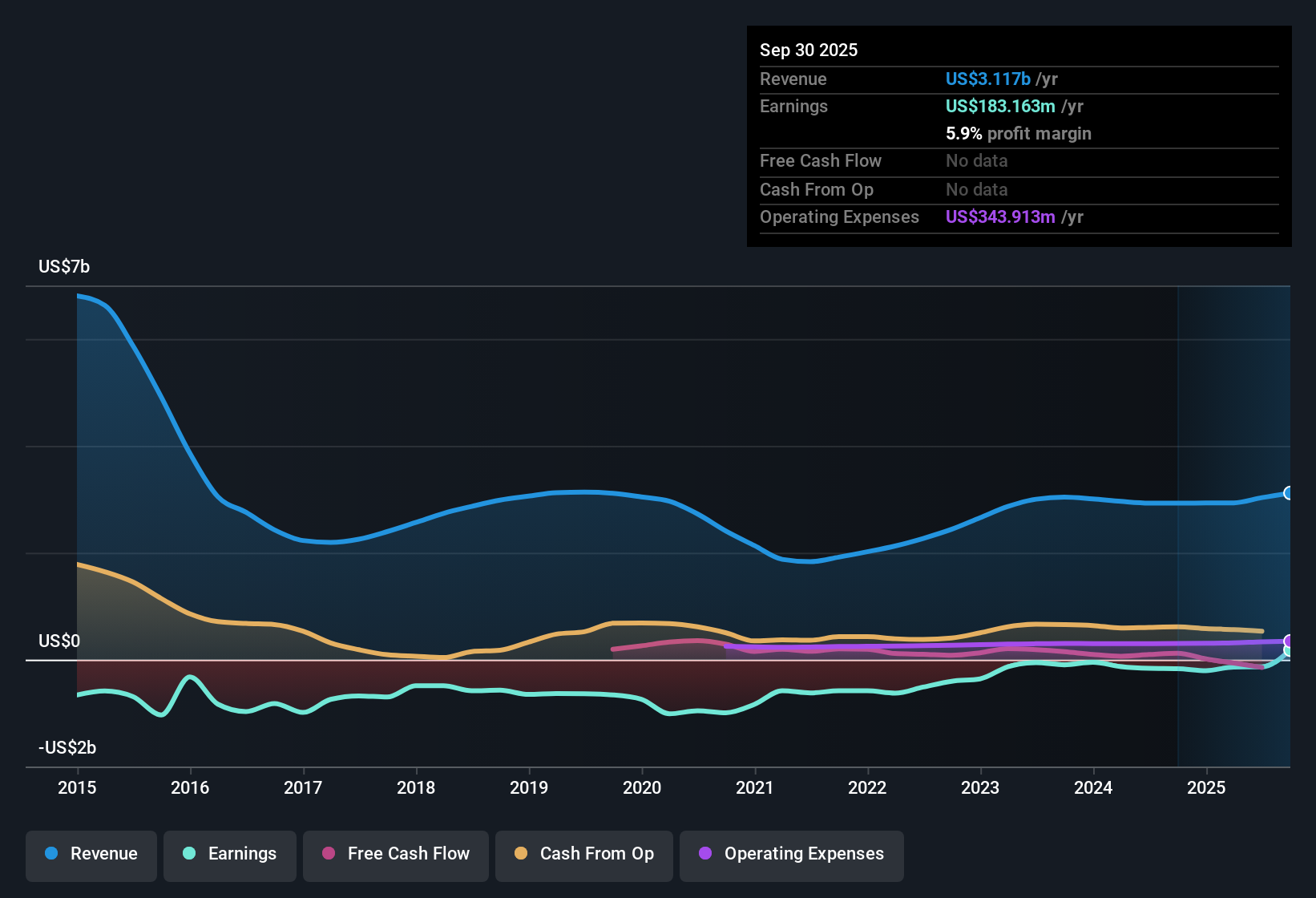

Nabors Industries (NBR) has just posted a sharp swing in its FY 2025 third quarter results, with revenue at US$818.2 million and Basic EPS of US$18.25, alongside trailing 12 month Basic EPS of US$15.31 supported by a one off gain of US$449.0 million and net income of US$183.2 million. The company has seen quarterly revenue move from US$734.8 million in Q2 2024 to US$832.8 million in Q2 2025, while quarterly Basic EPS ranged from a loss of US$6.86 in Q3 2024 to a profit of US$18.25 in Q3 2025. This sets up a story where profitability and margins are heavily influenced by that single large gain rather than a smooth earnings trend.

See our full analysis for Nabors Industries.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the most widely shared narratives about Nabors, and where the data pushes back against those stories.

TTM profit of US$183.2 million built on a US$449.0 million one off gain

- On a trailing 12 month view, Nabors reports net income of US$183.2 million and Basic EPS of US$15.31, even though one off gains of US$449.0 million had a large influence on those headline figures.

- Bulls often highlight five year earnings growth of 48.6% annually and the move into profit. Yet that optimism sits alongside quarterly numbers that ranged from a loss of US$6.86 per share in Q3 2024 to a profit of US$18.25 per share in Q3 2025, which shows how much that gain can skew the growth story.

Bulls argue this kind of swing could mark a turning point driven by long term contracts and higher tech services. However, the reliance on a single gain means you really need to separate ongoing performance from one off benefits before leaning on those growth metrics. 🐂 Nabors Industries Bull Case

Quarterly net income swings from losses to US$257.3 million profit

- Quarterly net income excluding extra items moved from losses of US$63.2 million in Q3 2024 to a profit of US$257.3 million in Q3 2025, with the intervening quarters also shifting between losses and smaller profits.

- Bears point to this pattern as evidence that earnings remain fragile. They pair it with concerns about high debt and weak interest coverage, arguing that even with a profitable trailing year, swings of this size in net income excluding extra items keep future cash generation exposed to setbacks.

Skeptics warn that when interest payments are not well covered and past shareholder dilution has already been substantial, large earnings jumps in a single quarter do not fully address the balance sheet questions they are watching. 🐻 Nabors Industries Bear Case

P/E of 5.1x and DCF fair value of US$352.94 flag a wide valuation gap

- The shares trade on a trailing P/E of 5.1x at a price of US$63.88, while the supplied DCF fair value of US$352.94 per share sits far above that level, and analysts are referenced with a single allowed price target of US$60.13.

- Analysts who lean toward a balanced view see the low P/E and the wide gap to DCF fair value as potential upside signals. However, they also point to weak interest coverage and recent shareholder dilution as reasons why the market might be cautious despite the appearance of cheapness.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nabors Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a fresh look at the figures and turn your take into a clear narrative in a few minutes, Do it your way.

A great starting point for your Nabors Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Nabors’ recent results lean heavily on a US$449.0 million one off gain, while underlying earnings and interest coverage look uneven and expose balance sheet concerns.

If that kind of financial pressure makes you uneasy, take a moment to check companies in our solid balance sheet and fundamentals stocks screener (45 results) list that prioritize resilience and steadier fundamentals over sharp one off swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.