Please use a PC Browser to access Register-Tadawul

Napco Security Technologies (NSSC): Evaluating Valuation as Analyst Expectations Rise Ahead of Q1 2026 Earnings

NAPCO Security Technologies, Inc. NSSC | 42.09 | -1.98% |

Napco Security Technologies (NSSC) is in the spotlight as it prepares to release its Q1 2026 earnings. With full-year revenue and earnings estimates recently revised upward, investors are watching closely after the company’s prior earnings exceeded expectations.

Napco Security Technologies has ridden a wave of momentum, with its share price jumping 42% over the past three months as upbeat earnings and revised outlooks have caught investors’ attention. For context, the company’s total shareholder return has surged 84% over three years and a striking 225% over the past five years. This underscores its ability to deliver consistent long-term growth, even as the most recent news drives short-term excitement.

If you’re on the lookout for more companies with impressive track records and growth potential, consider broadening your search and discover fast growing stocks with high insider ownership

With shares riding high and growth metrics turning heads, the question now is whether Napco Security Technologies is undervalued at current levels or if the strong performance and optimism are already fully priced in. Is this a fresh buying opportunity, or has the market already anticipated what lies ahead?

Most Popular Narrative: Fairly Valued

Napco Security Technologies recently closed at $44.15, just a fraction below the most widely followed fair value estimate of $44.50. Buyers and sellers look evenly matched at these levels, setting up a decisive battleground for the quarters ahead.

Ongoing digital innovation and pricing actions, backed by a strong balance sheet, drive product innovation, gross margin recovery, and long-term growth. Operational discipline, strong cash generation and a debt-free balance sheet enable Napco to reinvest in innovation, pursue strategic acquisitions, and flexibly return capital to shareholders. This supports long-term earnings growth and valuation recovery.

Curious about the financial engine powering that fair value? The core of this valuation centers on margin-boosting product strategies and bold growth forecasts that could surprise even savvy investors. Want the details? Find out exactly which numbers shape the future outlook and why consensus is this confident.

Result: Fair Value of $44.50 (ABOUT RIGHT)

However, ongoing softness in hardware demand and continued dependence on one key recurring revenue product could present challenges for Napco Security Technologies’ growth and margin outlook going forward.

Another View: Multiples Tell a More Cautious Story

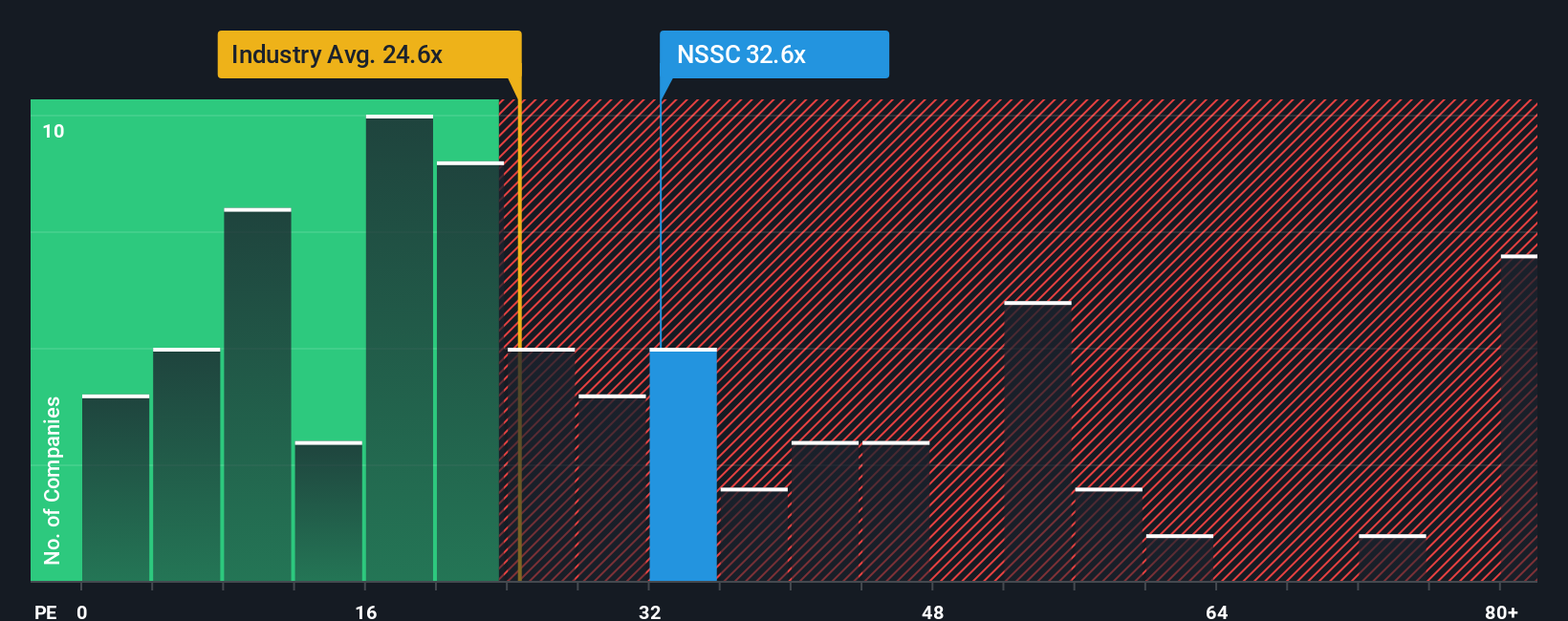

Looking at the company's price-to-earnings ratio, Napco Security Technologies trades at 36.3x, which is noticeably higher than the US Electronic industry average of 24.3x and also above its fair ratio of 24.4x. This signals investors are paying a premium compared to both the industry and what the market could move toward if sentiment changes. Could Napco's strong narrative justify its rich valuation?

Build Your Own Napco Security Technologies Narrative

If you want a fresh take or enjoy digging into the details yourself, you can shape your own interpretation in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Napco Security Technologies.

Ready for Even More High-Potential Ideas?

Smart investors keep their edge by keeping options open. If you want the next breakthrough, these handpicked stock ideas could be your best move.

- Spot overlooked gems with strong fundamentals and ambition by checking out these 840 undervalued stocks based on cash flows in the current market landscape.

- Stay ahead of emerging trends by catching these 33 healthcare AI stocks transforming medicine and patient care with artificial intelligence.

- Strengthen your portfolio with passive income while you pursue these 22 dividend stocks with yields > 3% promising reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.