Please use a PC Browser to access Register-Tadawul

Natural Gas and Solar Expansion Plan Could Be a Game Changer for FirstEnergy (FE)

FirstEnergy Corp. FE | 44.41 | +0.34% |

- FirstEnergy Corp. subsidiaries Mon Power and Potomac Edison recently submitted an Integrated Resource Plan to West Virginia regulators, proposing a 1,200-megawatt natural gas power plant and new solar capacity to address projected electricity demand and support economic development.

- This long-term planning move aims to align with West Virginia's '50 by 50' initiative while responding to increased load from data centers and advanced manufacturing.

- We’ll now explore how the proposed natural gas plant in West Virginia may influence FirstEnergy’s long-term investment outlook and growth assumptions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

FirstEnergy Investment Narrative Recap

To be a FirstEnergy shareholder, you generally need to believe in steady, regulated utility growth fueled by infrastructure investment and rising electricity demand from sectors like data centers and advanced manufacturing. The proposed 1,200-megawatt natural gas plant in West Virginia directly addresses these catalysts, though it does not immediately resolve the ongoing business risk tied to regulatory scrutiny and required capital investments, so the short-term outlook remains largely unchanged, with cash flows and debt levels still in focus.

The most relevant recent announcement to this development is FirstEnergy’s board declaring a regular quarterly dividend of $0.445 per share, highlighting management’s priority on consistent shareholder returns even as the company pursues major capital projects. This dividend affirmation aligns with investor expectations around predictability, but it comes at a time when future free cash flow coverage faces pressure from continuing high capital requirements and potential debt increases.

But as infrastructure investment grows, so do the pressures on free cash flow and debt, which is something investors should keep in mind as...

FirstEnergy's narrative projects $15.6 billion revenue and $1.7 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $0.4 billion increase in earnings from $1.3 billion.

Uncover how FirstEnergy's forecasts yield a $46.25 fair value, in line with its current price.

Exploring Other Perspectives

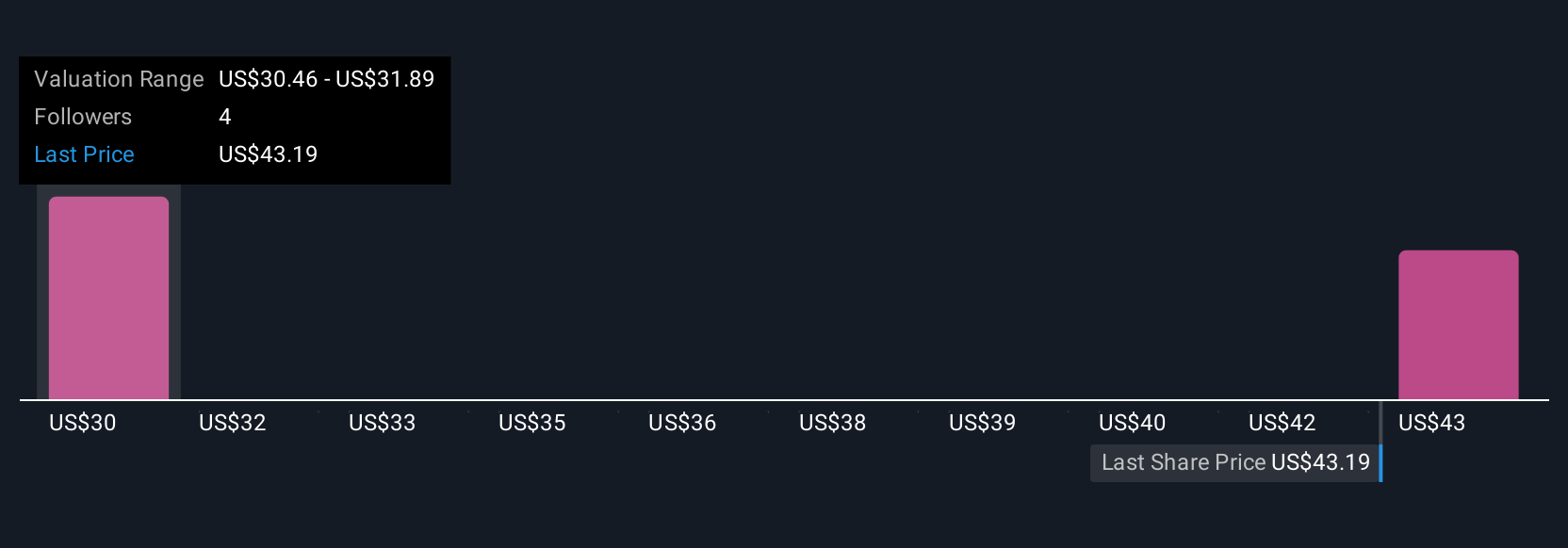

Community opinions on FirstEnergy’s fair value range from US$28.64 to US$46.25, based on two separate Simply Wall St Community analyses. While most see positive catalysts in rising data center demand, you should also pay close attention to how major infrastructure investment could impact long-term debt and free cash flow, explore the full spectrum of investor views for a more informed outlook.

Explore 2 other fair value estimates on FirstEnergy - why the stock might be worth 37% less than the current price!

Build Your Own FirstEnergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstEnergy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstEnergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstEnergy's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.