Please use a PC Browser to access Register-Tadawul

Navient (NAVI) Faces Fresh Questions as Student Loan Repayments Resume—Is Subprime Exposure a Key Risk?

Navient NAVI | 12.92 | +0.94% |

- Earlier this week, investor Lawrence McDonald cautioned that the resumption of federal student loan payments could trigger widespread credit stress, particularly affecting credit-sensitive companies such as Navient, SLM Corp., and Upstart Holdings Inc.

- He pointed out that the financial strain on the bottom 60% of U.S. consumers from inflation and elevated interest rates could heighten systemic risks in subprime lending.

- We'll explore how increasing concerns about credit stress among vulnerable borrowers may change the outlook for Navient’s growth and earnings potential.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Navient Investment Narrative Recap

To be a shareholder in Navient, you need confidence in the company’s ability to manage credit risks while benefiting from potential growth in private student lending. The recent warning about rising credit stress underscores the key risk: that persistent financial strain on borrowers could drive up delinquency and provision expenses, putting near-term pressure on both margins and earnings. While this news spotlights credit quality, it highlights the importance of monitoring changes in borrower health as the central catalyst, and risk, right now.

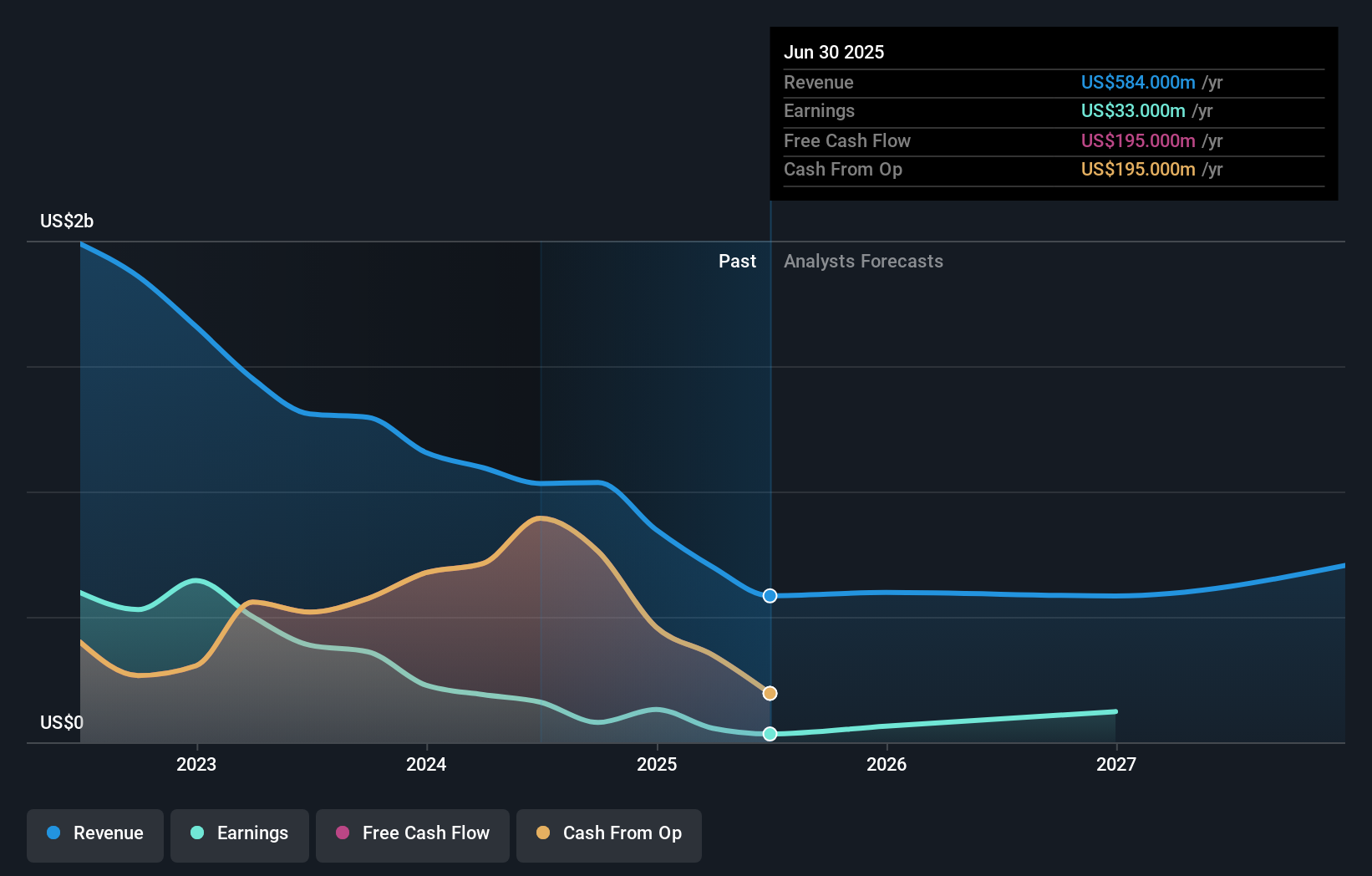

One of Navient’s most recent earnings reports showed Q2 2025 net income dropping sharply year-over-year, with ongoing weakness in profitability and elevated provisioning. This financial performance ties directly to concerns about borrower credit health and provides critical insight into how macro conditions are impacting short-term results and the company’s ability to meet its growth targets.

On the other hand, there is a factor that investors should be aware of: repeated increases in provision expenses signal credit losses could be less predictable than expected...

Navient's narrative projects $668.0 million in revenue and $321.8 million in earnings by 2028. This requires 4.6% yearly revenue growth and a $288.8 million earnings increase from current earnings of $33.0 million.

Uncover how Navient's forecasts yield a $14.10 fair value, a 10% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community put Navient’s worth at US$14.10 per share. With mounting borrower credit concerns emphasized in recent news, opinions on the company’s performance could expand sharply, discover several viewpoints here.

Explore another fair value estimate on Navient - why the stock might be worth as much as 10% more than the current price!

Build Your Own Navient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navient research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Navient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navient's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.