Please use a PC Browser to access Register-Tadawul

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) Soars 27% But It's A Story Of Risk Vs Reward

NCS Multistage Holdings, Inc. NCSM | 42.25 | -2.27% |

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 101% in the last year.

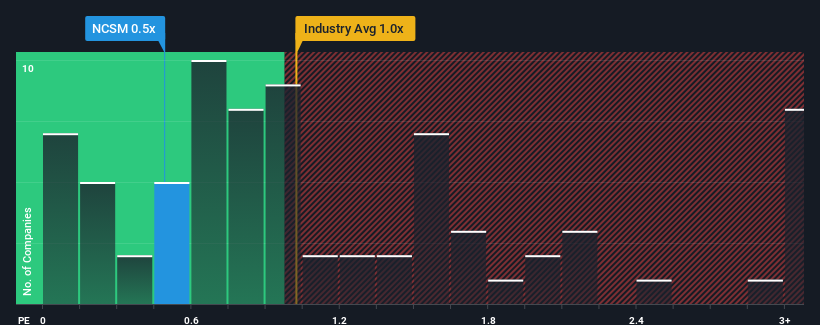

Even after such a large jump in price, when close to half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider NCS Multistage Holdings as an enticing stock to check out with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has NCS Multistage Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, NCS Multistage Holdings has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NCS Multistage Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as NCS Multistage Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.7%. This was backed up an excellent period prior to see revenue up by 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 6.5% per year over the next three years. That's shaping up to be materially higher than the 3.7% per year growth forecast for the broader industry.

With this information, we find it odd that NCS Multistage Holdings is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite NCS Multistage Holdings' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at NCS Multistage Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - NCS Multistage Holdings has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If you're unsure about the strength of NCS Multistage Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.