Please use a PC Browser to access Register-Tadawul

Nebius Group (NBIS) Is Up 32.3% After Surging Q2 Profit and Raised Revenue Guidance

Nebius Group N.V. Class A NBIS | 92.88 | +7.87% |

- Nebius Group N.V. recently reported second-quarter 2025 earnings, delivering sales of US$105.1 million versus US$14.5 million a year ago and swinging to a US$584.4 million net profit from a US$97.5 million net loss.

- A standout feature was management's decision to substantially raise its full-year annualized run-rate revenue guidance to US$900 million–US$1.1 billion, signaling confidence in strong AI infrastructure demand and execution capacity.

- To understand what these results mean for the investment narrative, we'll explore how Nebius Group's raised revenue guidance highlights robust momentum in its AI infrastructure expansion.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Nebius Group's Investment Narrative?

For investors considering Nebius Group, the big picture is all about relentless expansion in AI infrastructure and cloud services. The recent Q2 results, with sales up to US$105.1 million and a swing to net profit, could shift the near-term narrative in a significant way. Previous risks, like unproven profitability, rapid cash burn, and the inexperience of its board and management, now sit alongside a company that's proven it can monetize a surge in AI demand at scale, at least this quarter. The new full-year revenue guidance in the US$900 million to US$1.1 billion range hints that catalysts for further stock momentum could sustain if execution holds up. However, the valuation remains expensive relative to peers, much of the growth is priced in, and recent profits are heavily influenced by one-off gains. The company’s aggressive capital spending and frequent board changes remain areas that could unsettle some investors, even in light of this strong update. On the other hand, questions about earnings quality and management depth remain pressing for those weighing Nebius Group’s future.

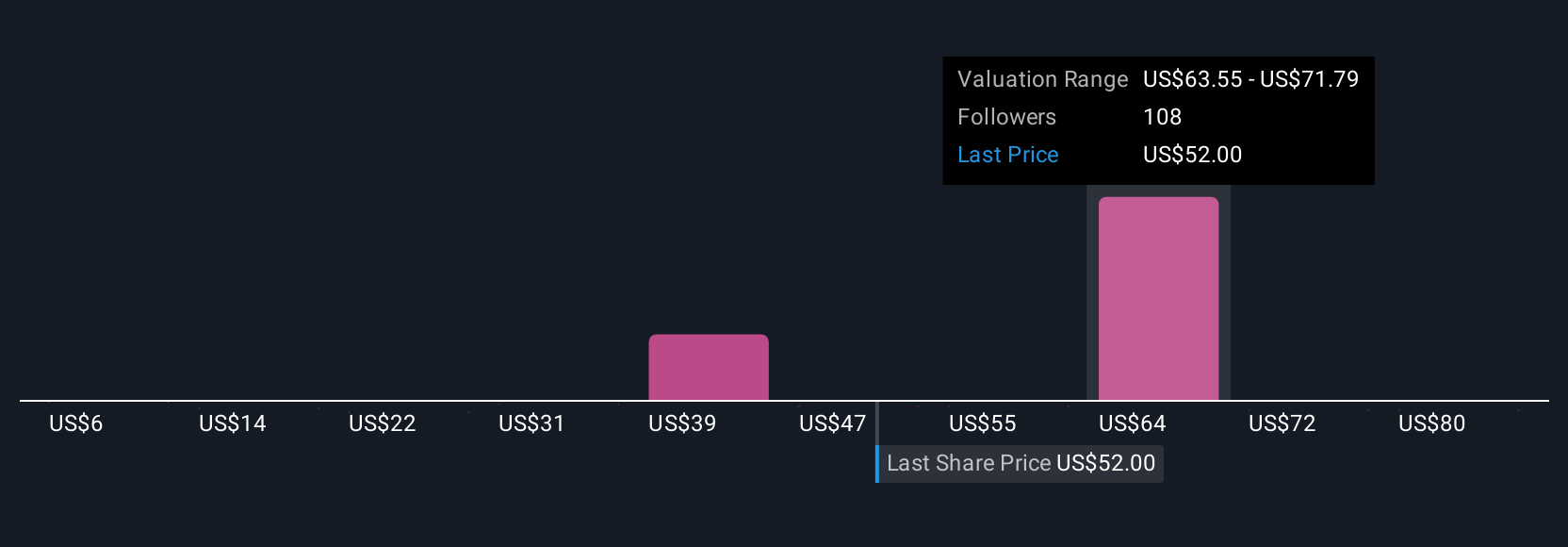

Our valuation report unveils the possibility Nebius Group's shares may be trading at a premium.Exploring Other Perspectives

Explore 29 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

No Opportunity In Nebius Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.