Please use a PC Browser to access Register-Tadawul

Neogen (NEOG) Is Down After Reporting $1.09 Billion Loss and Facing Legal Challenges—What's Changed

Neogen Corporation NEOG | 6.86 | -2.56% |

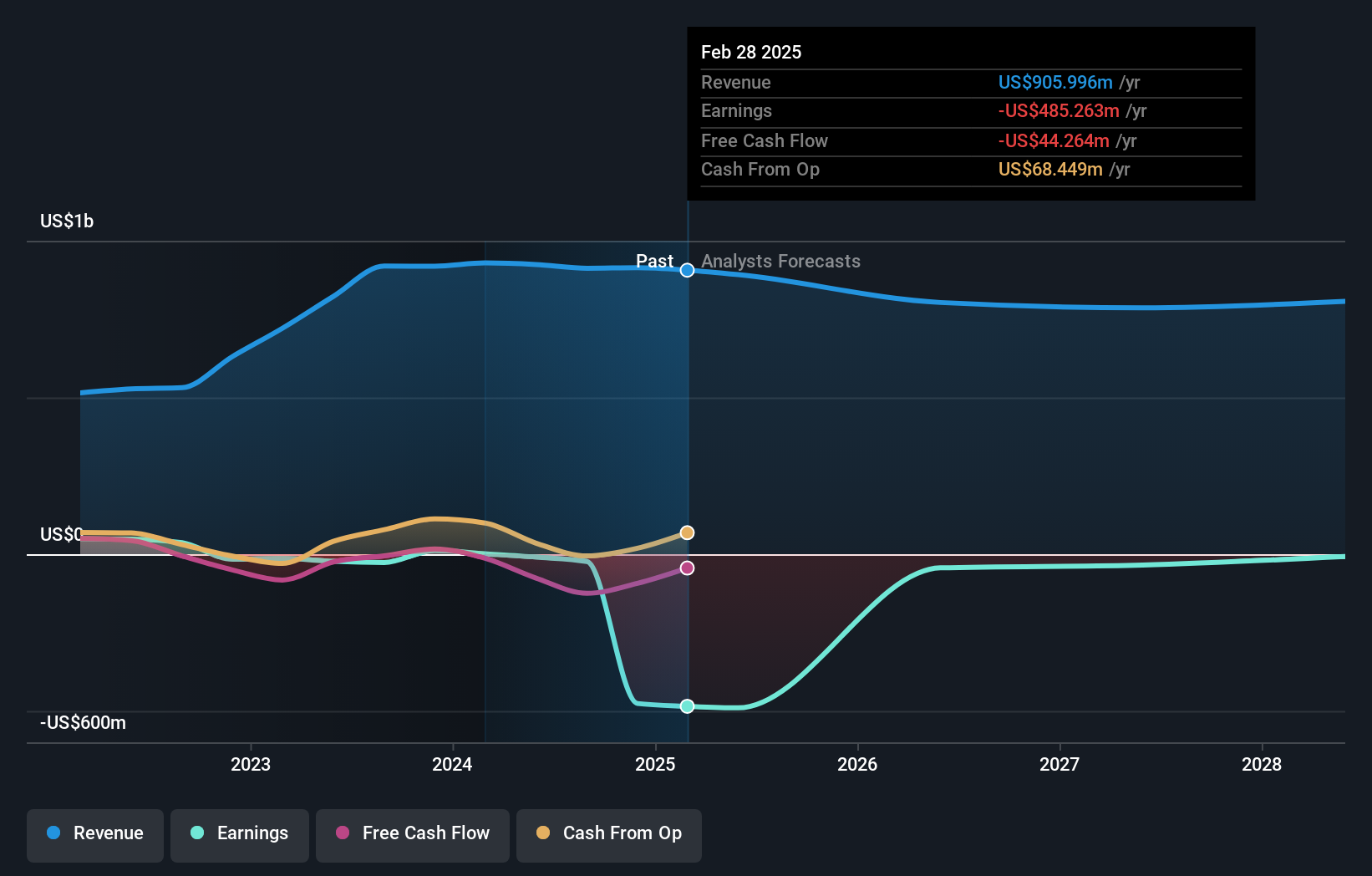

- Neogen Corporation recently reported full year earnings for the period ended May 31, 2025, highlighting a significant net loss of US$1.09 billion and revenue of US$894.66 million, alongside a goodwill impairment charge of nearly US$598 million and lowered revenue guidance for the next fiscal year.

- The company now faces multiple securities fraud class action lawsuits related to allegedly misleading statements about the integration of 3M's Food Safety Division, adding legal and operational uncertainty to its outlook.

- We'll examine how the sharp goodwill impairment and legal actions may alter Neogen's investment narrative and future earnings assumptions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

Neogen Investment Narrative Recap

To own shares of Neogen today, you have to believe the company can successfully integrate 3M’s Food Safety Division while navigating persistent end-market weakness and legal uncertainty. The recent US$1.09 billion net loss, driven by a US$598 million goodwill impairment, sharply intensifies short-term concerns around execution in integration, and with new securities class action lawsuits, the biggest risk right now is further operational or legal setbacks outweighing any quick recovery in earnings.

Of recent company announcements, the lowered FY 2026 revenue guidance to US$820 million–US$840 million stands out as most relevant. This guidance cut directly relates to both unresolved integration issues and broader demand softness, effectively resetting short-term expectations and highlighting the need for patience as management addresses margin and operational challenges before any catalysts can play out.

Yet, against all the talk of growth prospects, unresolved legal disputes about integration may force investors to confront...

Neogen's outlook anticipates $859.1 million in revenue and $106.1 million in earnings by 2028. This is based on a yearly revenue decline of 1.3% and an earnings improvement of $1.2 billion from current earnings of $-1.1 billion.

Uncover how Neogen's forecasts yield a $6.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 2 fair value estimates for Neogen stock, ranging from US$6.50 to US$14.15. While these varied views reflect wide expectations for recovery, ongoing integration and legal risks continue to shape the conversation around future performance and return potential, see how your perspective stacks up against others.

Explore 2 other fair value estimates on Neogen - why the stock might be worth over 2x more than the current price!

Build Your Own Neogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neogen research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Neogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neogen's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.