Please use a PC Browser to access Register-Tadawul

Neogen Recall Puts Veterinary Quality Controls And Investor Confidence In Focus

Neogen Corp NEOG | 11.33 | +3.19% |

- Neogen Corporation initiated a voluntary recall of its HYCOAT Hyaluronate Sodium Sterile Solution used in veterinary settings.

- The recall was triggered by microbial contamination identified in certain product lots.

- The affected product is intended for animal use, and the company has reported adverse events in animals linked to the issue.

- Neogen is working with the U.S. Food and Drug Administration on the recall process.

For investors tracking Neogen (NasdaqGS:NEOG), this recall comes at a time when the shares trade around $10.8. Recent price moves have been mixed, with return_3yr at 45.0% and return_5yr at 75.6%, while the stock is up 54.3% year to date and 46.3% over the past month. Those swings provide context for how the market may react to a product safety setback tied to one of its veterinary offerings.

From here, it will be important to watch how Neogen manages its relationships with regulators, veterinarians, and animal health customers as it works through the recall. Key points to monitor include how quickly the company can resolve the issue, restore confidence in its quality controls, and maintain continuity of supply across its broader product portfolio.

Stay updated on the most important news stories for Neogen by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Neogen.

The HYCOAT recall concentrates attention on Neogen’s execution in its Animal Safety segment at a time when the business is already unprofitable and facing revenue headwinds. Because HYCOAT is manufactured by a third party, this event also tests Neogen’s supplier oversight and quality assurance, which are critical if it wants veterinarians to trust its broader wound-care and animal health portfolio in a market that includes competitors like Zoetis and IDEXX.

How this recall fits into the Neogen narrative

The bullish and cautious narratives around Neogen both lean heavily on improved operations and tighter execution, so a contamination issue directly touches one of the core debate points. Bulls may see the voluntary recall and cooperation with the FDA as evidence that governance and compliance controls are working, while more conservative investors may focus on how incidents like this interact with the already weak margins and integration challenges the company is working through.

Risks and rewards in focus

- ⚠️ Product safety concerns can weigh on brand trust in veterinary channels, especially if any further adverse events are reported.

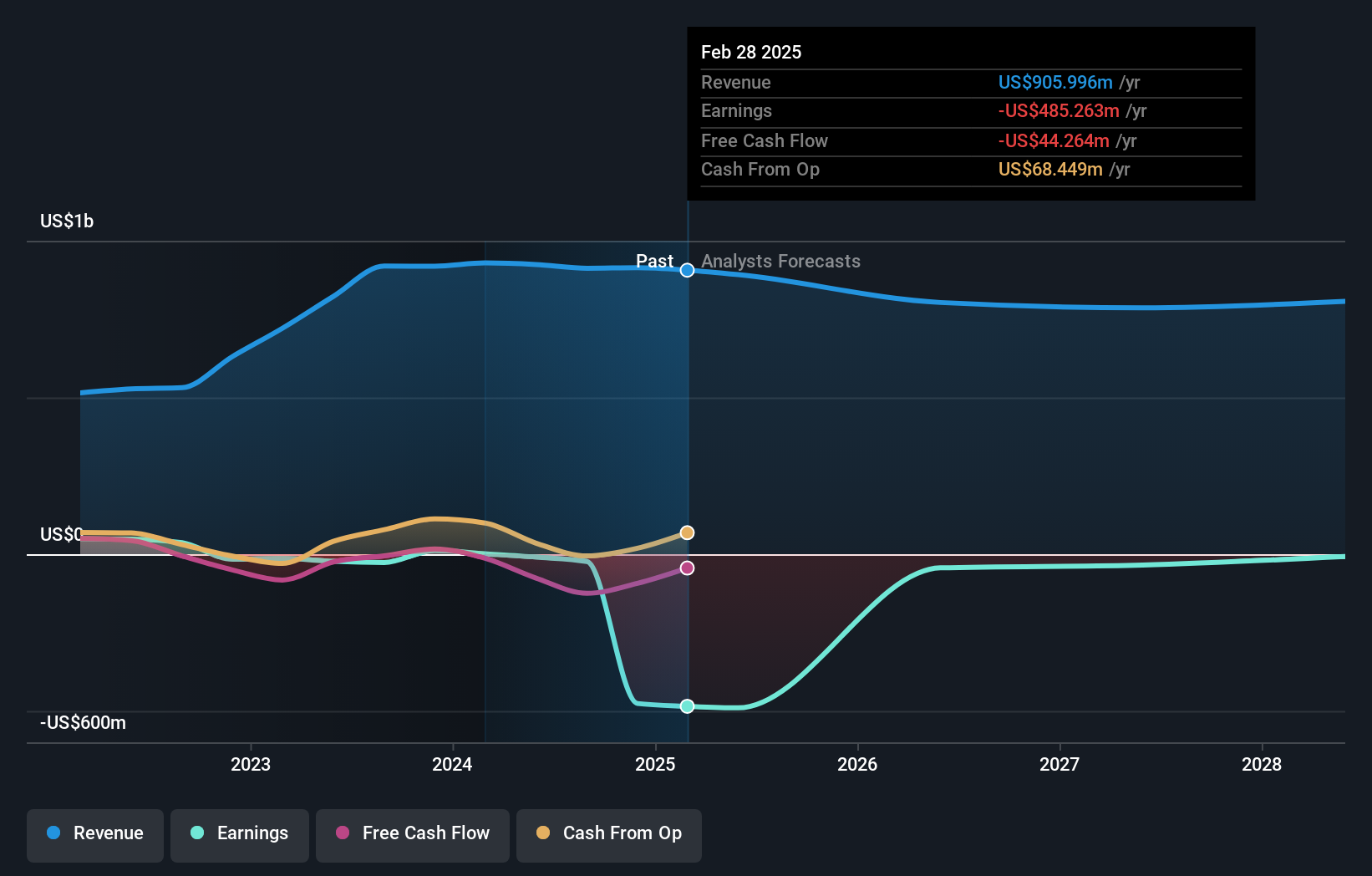

- ⚠️ Neogen is currently loss-making with pressure on sales growth, so recall-related costs and potential process upgrades could add to financial strain.

- 🎁 Proactive engagement with the FDA and veterinarians may help contain reputational damage and support longer-term commercial relationships.

- 🎁 A visible tightening of supplier and quality controls could support the case that Neogen can strengthen its animal and food safety franchise relative to peers like Zoetis and IDEXX.

What to watch next

From here, the key things to watch are whether additional products are pulled, how quickly Neogen replaces affected stock for clinics, and whether management comments on recall costs alongside broader efforts to improve profitability. If you want to see how different investors are interpreting this recall in the context of Neogen’s long-term story, check out the community narratives for Neogen.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.