Please use a PC Browser to access Register-Tadawul

NeoGenomics (NEO): Assessing Valuation as New MRD Assay Data Highlights Precision Oncology Innovation

NeoGenomics, Inc. NEO | 11.85 | +0.68% |

NeoGenomics (NEO) recently announced the presentation of new molecular residual disease assay data at the European Society for Medical Oncology Congress. This highlights its push to enhance visibility with pharmaceutical partners in precision oncology.

NeoGenomics’ push to spotlight its MRD assay comes as the stock rebounds sharply in the short term, with a 22% share price return over the past month and an impressive 58% surge over the last 90 days. However, despite these recent gains, the year-to-date share price return is still down 37%, and the one-year total shareholder return sits at negative 21%. This highlights the ongoing challenges the company faces as it works to regain long-term momentum.

If major advancements in oncology spark your curiosity about what’s next in healthcare, take a moment to check out See the full list for free.

After a turbulent year and a recent surge from lows, the question facing investors is clear: Is NeoGenomics trading below its true value, or is the latest optimism fully reflected in the price?

Most Popular Narrative: 10% Undervalued

According to the most widely followed narrative, NeoGenomics’ fair value stands at $10.44 per share, which is moderately above its last close at $10.43. This small difference signals that the current price is nearly in alignment with latest expectations, but also hints that the growth story is far from settled.

Investments in new digital pathology capabilities, automation, and the integration of a unified LIMS are expected to generate material operating efficiencies and enable greater operating leverage, supporting future expansion in EBITDA margins and earnings growth.

Ever wondered what's behind the optimism? The recipe for this valuation includes aggressive operational upgrades and expansions, fueling margin expansion that the market does not fully see yet. Discover the financial levers that set this price target apart.

Result: Fair Value of $10.44 (UNDERVALUED)

However, continued unpredictability in pharma and biotech demand or growing competition in oncology diagnostics could quickly undermine NeoGenomics' momentum and valuation outlook.

Another View: Relative Value Signals Caution

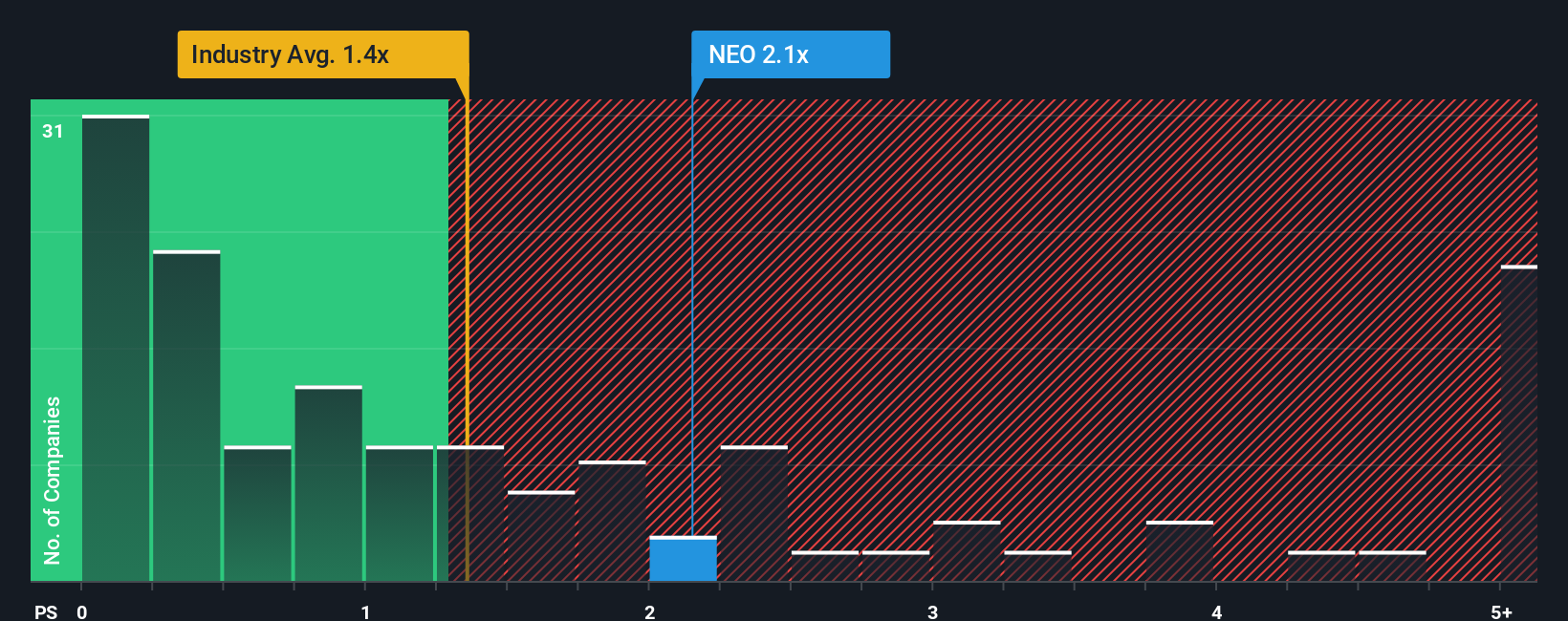

Taking a different tack, looking at NeoGenomics’ valuation through its price-to-sales ratio brings up some warning signs. Shares are trading at 2x sales, which is not only higher than the US Healthcare industry average of 1.3x, but also above the fair ratio of 1.4x calculated by the market. This premium might limit further upside unless the company outperforms expectations. Could buyers be overlooking potential overvaluation?

Build Your Own NeoGenomics Narrative

If you see things differently or want to dive into the numbers yourself, building your own assessment takes just a few minutes. So why not Do it your way?

A great starting point for your NeoGenomics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you want every chance to get ahead, don’t stop at just one opportunity. Let Simply Wall St’s powerful screeners connect you with the right stocks today.

- Tap into future trends by finding these 24 AI penny stocks that are fueling the rise of artificial intelligence and shaping tomorrow’s industries.

- Maximize your income potential and boost your portfolio with these 17 dividend stocks with yields > 3% that offer over 3% in yields.

- Unlock growth possibilities with these 879 undervalued stocks based on cash flows that present what could be the best current value opportunities on the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.