Please use a PC Browser to access Register-Tadawul

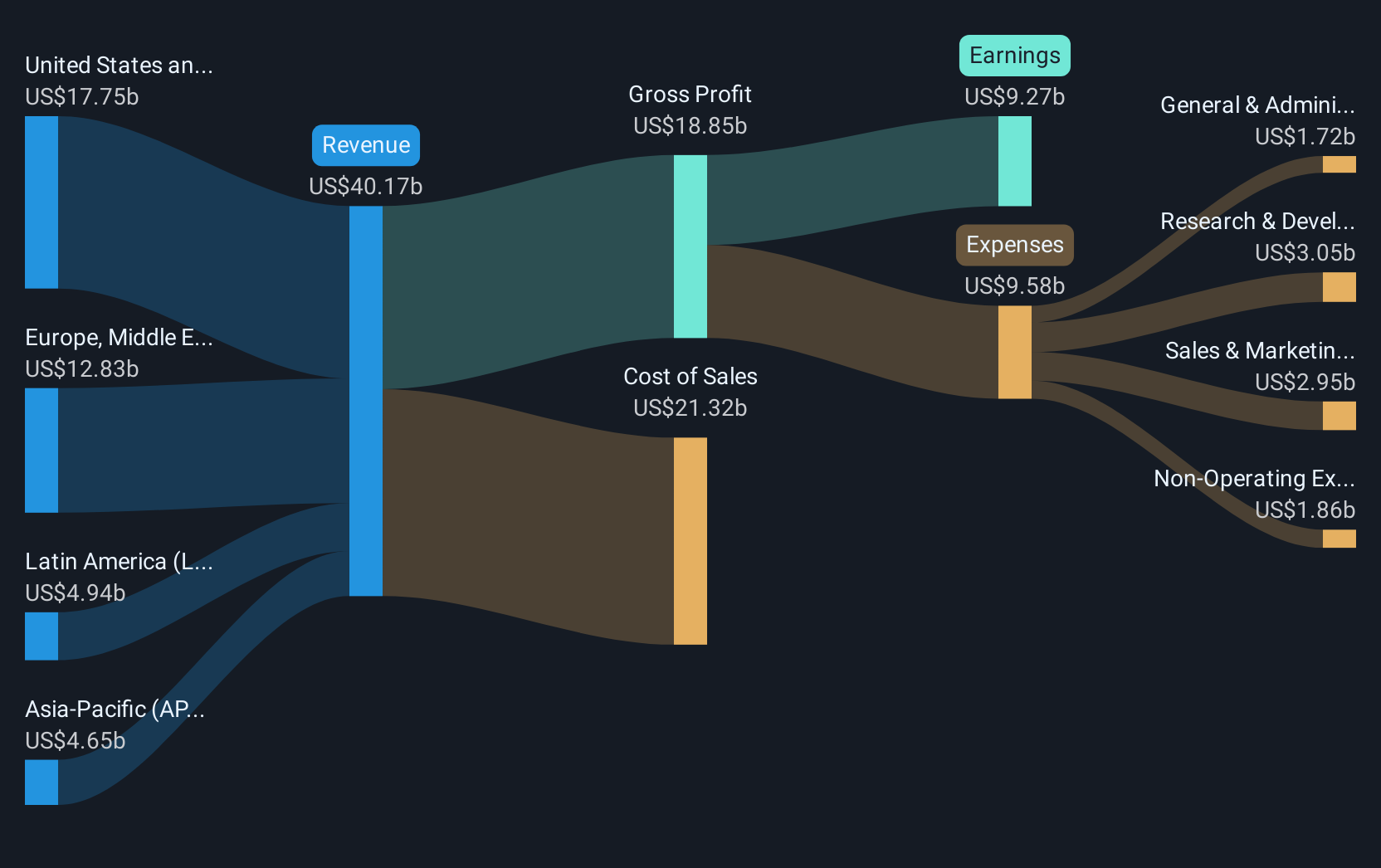

Netflix (NFLX) Completes US$18 Billion Buyback; Reports Strong Q2 Earnings Growth

Netflix, Inc. NFLX | 94.57 | +0.85% |

Netflix (NFLX) saw a notable 31% increase in its share price over the last quarter, a move that aligns somewhat with the positive broader market trends. Key drivers included the company's share buyback program, where it repurchased 1.5 million shares, and strong second-quarter earnings results showing increased sales and net income. Despite a 5% drop following the earnings announcement, the stock remains buoyant, benefiting from an improved revenue outlook and the market's overall optimism about strong corporate earnings. Meanwhile, developments such as the introduction of Netflix House locations also potentially contributed to positive investor sentiment.

The recent developments at Netflix, including the share buyback program and the introduction of Netflix House locations, are expected to reinforce the company's strategic efforts to expand into new markets and bolster revenue streams. These initiatives align with the company's narrative to enhance ad tech capabilities and venture into gaming, indicating potential for increased engagement and sales. While short-term fluctuations, such as a 5% drop post-earnings, can occur, the company remains committed to its growth strategy.

Over a longer three-year timeframe, Netflix's total shareholder return, including share price and dividends, was a very large 469.13%. This performance benchmarks it significantly above the US market, which returned 14.1% over the past year. The company's earnings growth over the last year similarly exceeded the Entertainment industry's decline of 3.6%, highlighting Netflix's relative strength and market position within the sector.

Analysts forecast Netflix's revenue to grow at 10.5% annually, with earnings expected to grow at 16.24% per year, reflecting high growth potential. The current share price of US$1,274.17 surpasses the consensus price target of US$1,235.83, indicating a slight premium. This suggests a market perception of possible future growth beyond analyst expectations, although investors must weigh this against potential economic risks and competitive pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.