Please use a PC Browser to access Register-Tadawul

NetScout Systems (NTCT): Valuation in Focus as Shelf Registration Signals Possible Strategic Shift

NetScout Systems, Inc. NTCT | 27.46 | -2.24% |

Most Popular Narrative: Fairly Valued

According to the most popular narrative, NetScout Systems is currently considered fairly valued. This outlook is driven by a mix of steady growth expectations, elevated profit multiples, and the company's strategic positioning in AI-driven cybersecurity markets.

Market optimism appears to be driven by strong recent growth in NetScout's cybersecurity segment. This is underpinned by customers prioritizing spending to counter increasingly complex and expanding cyber threats, which could lead investors to expect above-trend long-term revenue and earnings growth.

Curious what’s fueling this valuation call? This fair value hinges on bold projections for future margins and a much higher profit multiple than the industry average. The numbers behind this price target include assumptions that might surprise even seasoned investors. Want to know which forecasted growth factors set NetScout apart? The answer lies in the unusual combination of analyst consensus and the company’s current momentum.

Result: Fair Value of $25.82 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Unexpected weakness in legacy products or increased challenges from cloud migration could quickly reshape expectations for NetScout’s future growth.

Find out about the key risks to this NetScout Systems narrative.Another View: Is the Discount Too Good to Be True?

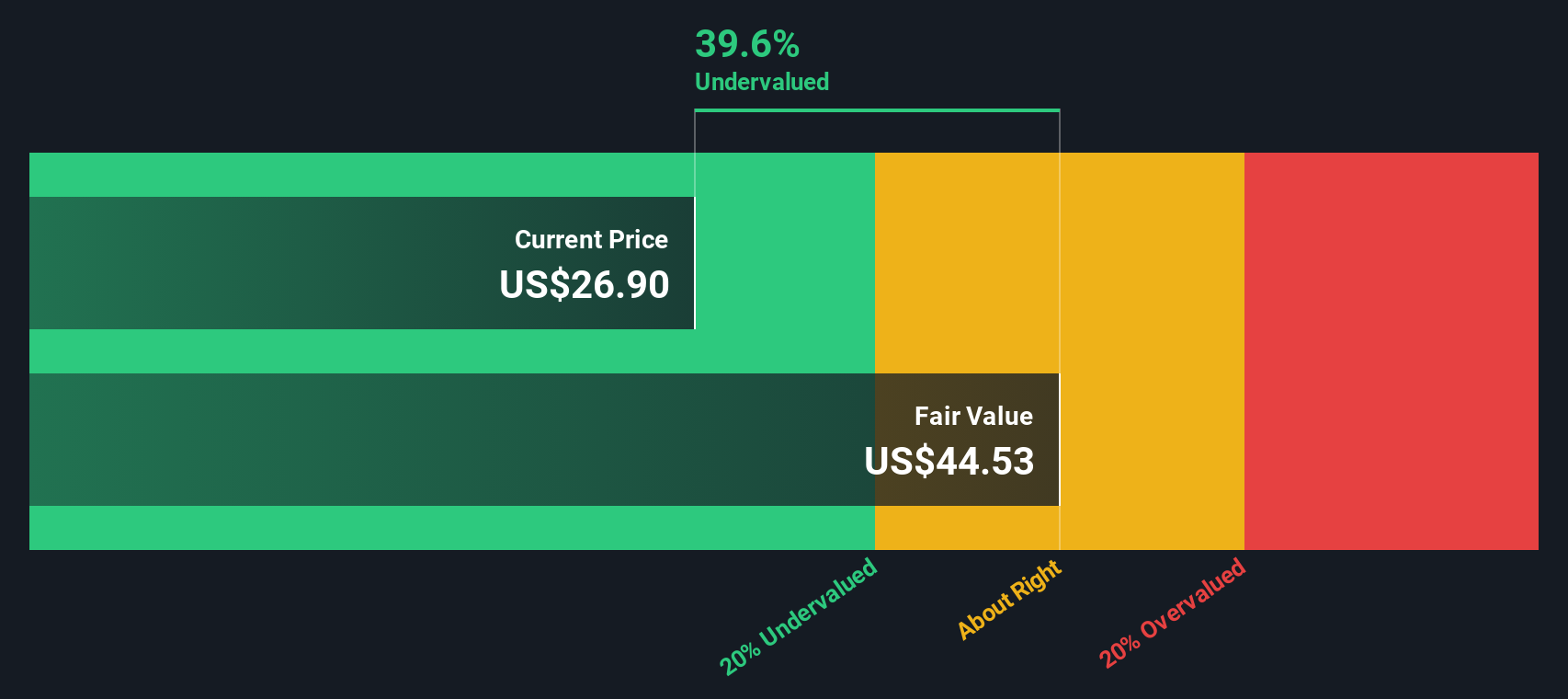

Taking a step back from analyst assumptions, our DCF model suggests NetScout may be trading well below its long-term value. However, can cold cash flow math capture all the market’s concerns, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NetScout Systems Narrative

If you see things differently or prefer to crunch the numbers on your own terms, you can easily shape your own view in just a few minutes. Do it your way

A great starting point for your NetScout Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

There is a world of opportunity beyond NetScout Systems. You do not want to miss out on standout stocks in innovative sectors and undervalued markets. Get a head start finding tomorrow’s leaders with Simply Wall Street’s powerful screener, which can help you spot companies with strong financials, bold potential, and the momentum you need for your portfolio.

- Uncover high-potential technology names shaking up markets by checking out AI penny stocks.

- Seize value opportunities with real upside by using undervalued stocks based on cash flows.

- Tap into the newest trends and smart digital assets with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.