Please use a PC Browser to access Register-Tadawul

NetScout Wi Fi 7 Launch Puts Focus On Valuation And Earnings Potential

NetScout Systems, Inc. NTCT | 29.70 | -0.30% |

- NetScout Systems launched upgraded nGeniusONE observability features that support Wi Fi 7 and advanced SSL/TLS certificate management.

- The release targets remote site monitoring, digital resilience, and cybersecurity needs for enterprises using hybrid and cloud environments.

- The company highlights these tools as a way to reduce outage risk, address certificate issues earlier, and support compliance efforts.

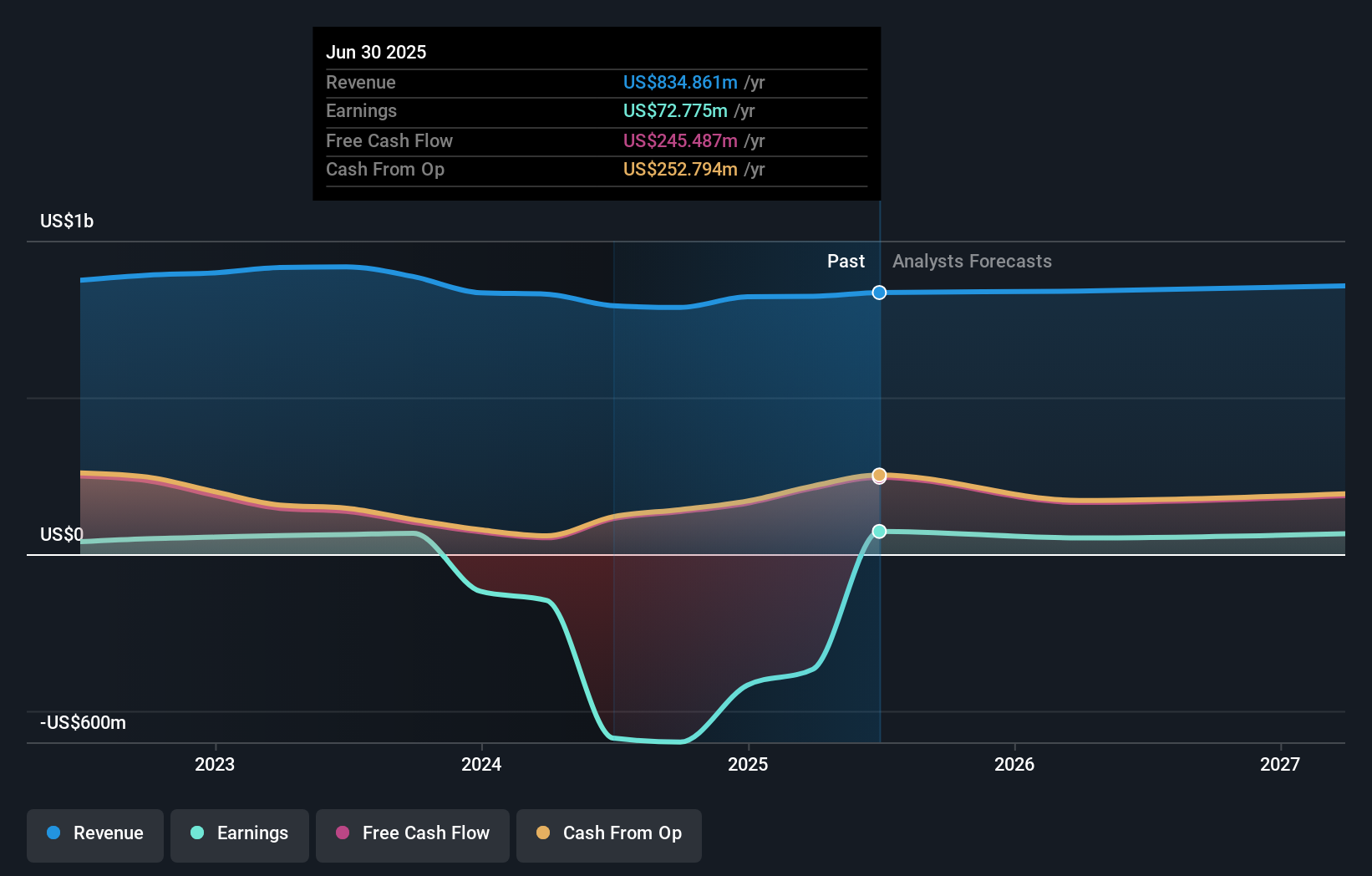

For investors watching NasdaqGS:NTCT, the product update comes with the stock trading around $27.67 and a 1 year return of 14.2%, while longer 3 year and 5 year returns have been negative at 7.5% and 12.2%. This mix of recent share price improvement and weaker multi year performance may prompt some investors to focus more closely on how new product capabilities are received by customers.

Looking ahead, the new Wi Fi 7 and SSL/TLS features position NetScout to address ongoing demand for observability and security tooling in remote and hybrid environments. If enterprises adopt these capabilities at scale, investors may pay closer attention to how they affect customer retention, deal sizes, and the breadth of NetScout's role in critical network monitoring.

Stay updated on the most important news stories for NetScout Systems by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on NetScout Systems.

Quick Assessment

- ⚖️ Price vs Analyst Target: At $27.67 versus a consensus target of $30.42, the price sits about 9% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St currently flags the shares as trading about 54.2% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return is roughly flat at a 0.2% decline, which does not signal strong short term momentum.

Check out Simply Wall St's in depth valuation analysis for NetScout Systems.

Key Considerations

- 📊 The Wi Fi 7 and SSL/TLS update ties NetScout even more closely to remote and hybrid observability needs, which may influence how investors view its core offering.

- 📊 Watch how customer adoption of the new features shows up in revenue of $861.4m, net income of $95.9m, and any changes in the 11.1% net margin.

- ⚠️ With no flagged risks in the current data, the key watchpoint is whether the product refresh translates into sustained earnings per share beyond the current $1.33.

Dig Deeper

For the full picture including more risks and rewards, check out the complete NetScout Systems analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.