Please use a PC Browser to access Register-Tadawul

Neurocrine Biosciences (NBIX) Valuation Check After New Mid Stage VMAT2 Inhibitor Trial Update

Neurocrine Biosciences, Inc. NBIX | 128.63 | -1.13% |

Why this new trial matters for Neurocrine Biosciences (NBIX) shareholders

Neurocrine Biosciences (NBIX) has kicked off a Phase 2 trial of NBI-1065890, a next generation VMAT2 inhibitor for tardive dyskinesia. This marks fresh pipeline activity that investors may watch closely.

The Phase 2 trial news lands at a time when the share price, at US$136.06, has seen a 30 day share price return of 4.07% decline and a 1 year total shareholder return of 10.38% decline, while the 3 year total shareholder return of 23.66% and 5 year total shareholder return of 17.15% suggest a longer term record that some investors may still weigh positively.

If this kind of pipeline update has your attention, it could be a good moment to size up other opportunities across healthcare stocks as you broaden your watchlist.

With the shares at US$136.06, revenue of US$2.68b, net income of US$428.0m, and a value score of 3 plus an indicated intrinsic discount of 56%, an investor may need to consider whether this represents a potential opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 24.3% Undervalued

With Neurocrine Biosciences trading at $136.06 against a narrative fair value of about $179.66, the current setup focuses on future earnings and margin potential.

A broad, late-stage and diversified CNS pipeline, including multiple Phase III programs targeting major depressive disorder and schizophrenia, leverages advances in precision medicine and increases visibility for future earnings, supporting potential future valuation multiple expansion.

Want to see what earnings path and margin profile sit behind that fair value? The narrative leans on compounding revenue, rising profitability, and a re-rated earnings multiple. Curious which assumptions matter most and how they fit together? Read on to see how this story is built.

Result: Fair Value of $179.66 (UNDERVALUED)

However, this story can change quickly if pricing pressure around INGREZZA intensifies or late stage trials stumble and undercut the earnings path that analysts are betting on.

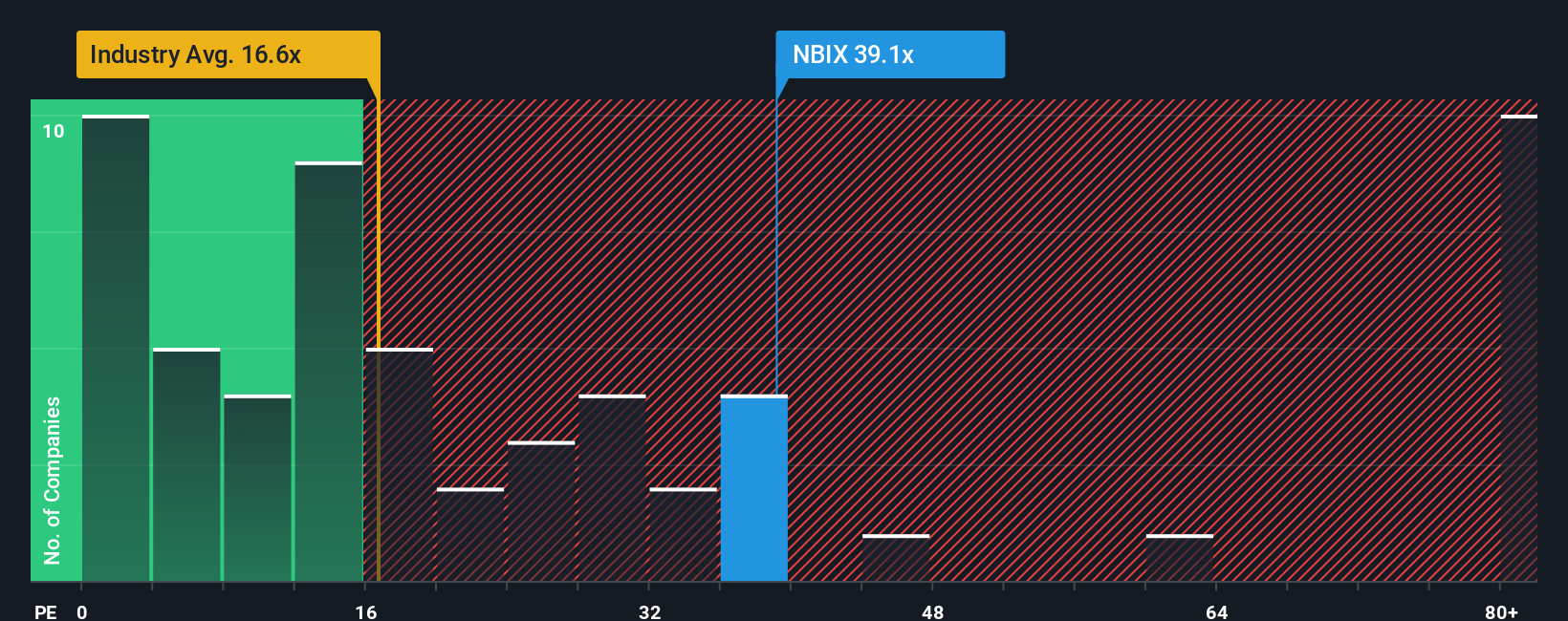

Another View: Multiples Still Look Demanding

The fair value narrative leans on future earnings potential, but today the stock trades on a P/E of 31.7x versus 20.3x for the US Biotechs industry, 16.8x for peers, and a fair ratio of 24x. That premium can mean less room for error if expectations shift.

Build Your Own Neurocrine Biosciences Narrative

If this fair value view does not quite fit how you see Neurocrine Biosciences, you can use the same data to develop your own perspective in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for more investment ideas?

If Neurocrine Biosciences is on your radar, this is a smart moment to widen your search and line up a few more candidates worth watching closely.

- Spot potential value by scanning these 868 undervalued stocks based on cash flows that might be pricing in less optimism than their underlying cash flows suggest.

- Chase growth themes by reviewing these 25 AI penny stocks tapping into the expanding use of artificial intelligence across different parts of the economy.

- Boost your income focus by checking out these 14 dividend stocks with yields > 3% that already offer yields above 3% on current prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.