Please use a PC Browser to access Register-Tadawul

Neurocrine Biosciences (NBIX) Valuation Check After Strong 2025 Results And Late Stage Pipeline Progress

Neurocrine Biosciences, Inc. NBIX | 128.63 | -1.13% |

Neurocrine Biosciences (NBIX) just released its fourth quarter and full-year 2025 results, reporting revenue of US$805.5 million for the quarter and US$2.86 billion for the year, alongside higher net income compared with 2024.

Despite strong 2025 results and fresh guidance for INGREZZA, the share price has pulled back recently, with a 7 day share price return of a 12.1% decline and a 90 day share price return of a 13.5% decline, while the 1 year total shareholder return of 7.9% is still positive, so recent momentum has cooled compared with the longer term.

If this update on Neurocrine has you thinking about where growth in healthcare could come from next, it may be worth scanning our list of 25 healthcare AI stocks as a starting point for other ideas.

With the shares down over the past quarter despite rising revenue and net income in 2025, the key question now is whether Neurocrine looks undervalued, or if the market is already pricing in its future growth.

Most Popular Narrative: 30.9% Undervalued

Neurocrine Biosciences last closed at $124.12, while the most followed narrative pegs fair value around $179.59, creating a wide gap investors are watching closely.

A broad, late-stage and diversified CNS pipeline, including multiple Phase III programs targeting major depressive disorder and schizophrenia, leverages advances in precision medicine and increases visibility for future earnings, supporting potential future valuation multiple expansion.

Curious what kind of revenue path and margin profile could support that fair value with a discount rate of 7.12% and a higher future P/E than the sector? The full narrative unpacks how earnings, revenue mix and that projected multiple fit together into one valuation story.

Result: Fair Value of $179.59 (UNDERVALUED)

However, the bullish story can fray if pricing pressure on INGREZZA, or slower than expected uptake for CRENESSITY, takes hold and squeezes the earnings path underpinning that valuation.

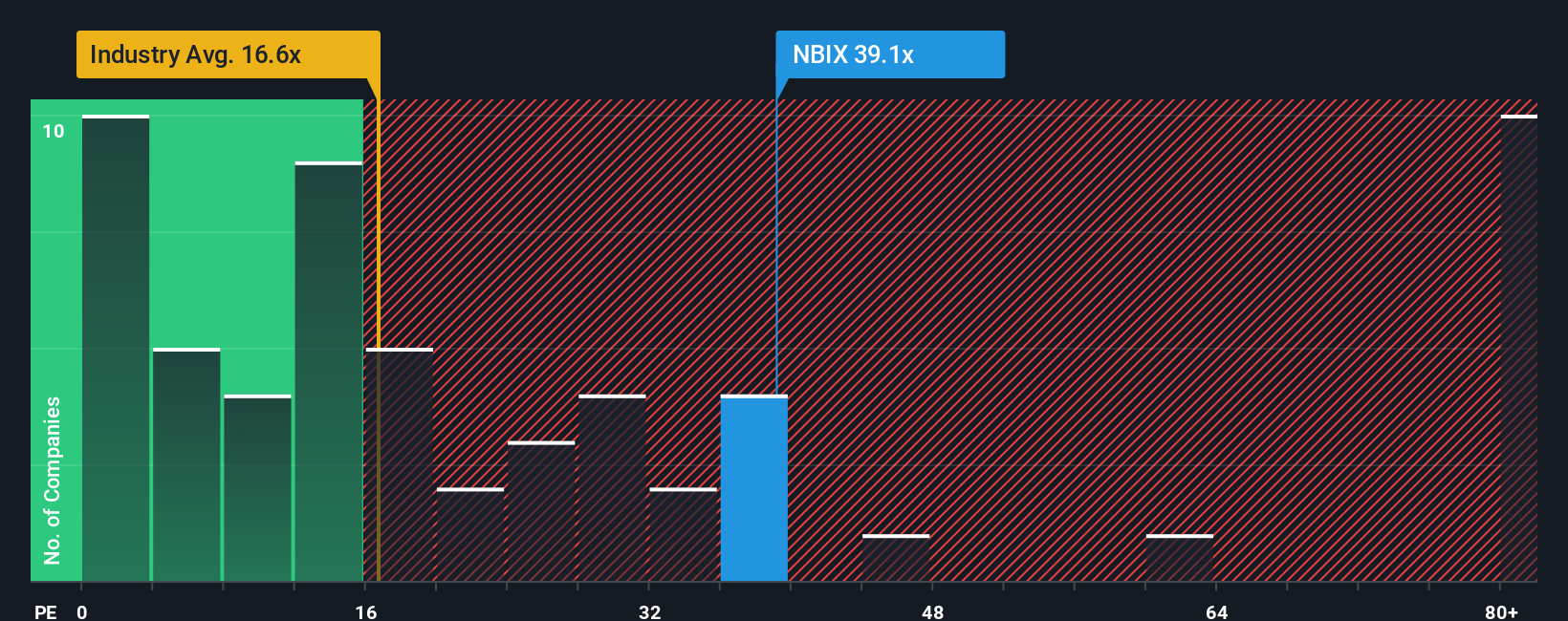

Another View: Earnings Multiple Sends A Different Signal

That 30.9% gap to the $179.59 fair value is grounded in one set of assumptions, but the current P/E of 25.9x tells a different story. It sits above the fair ratio of 23.6x and the US Biotechs average of 22.2x, which indicates there may be less valuation cushion if sentiment or forecasts cool.

Build Your Own Neurocrine Biosciences Narrative

If you think the current narratives miss something or you prefer to test the numbers yourself, it is quick to build your own view: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for more investment ideas?

If Neurocrine has sharpened your thinking, do not stop here, the wider market is full of other opportunities that could better match your checklist.

- Target long term compounding potential by scanning 53 high quality undervalued stocks where price and fundamentals may be out of sync.

- Prioritise resilience and sleep better at night with our 84 resilient stocks with low risk scores focused on companies with lower risk scores.

- Hunt for under the radar potential using the screener containing 23 high quality undiscovered gems and see which companies with strong fundamentals others might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.