Please use a PC Browser to access Register-Tadawul

New TTFields Data Presentations Might Change The Case For Investing In NovoCure (NVCR)

Novocure Ltd. NVCR | 13.32 | -2.49% |

- In October 2025, NovoCure announced it would present new pre-clinical and Phase 3 trial data on its Tumor Treating Fields (TTFields) therapy at the European Association of Neuro-Oncology Meeting and the European Society for Medical Oncology Congress.

- These upcoming presentations highlight the potential for TTFields to improve cancer treatment outcomes by enhancing radiosensitivity in glioblastoma and evaluating combination therapies for pancreatic cancer.

- We’ll explore how the spotlight on TTFields therapy’s possible benefits in glioblastoma may influence NovoCure’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

NovoCure Investment Narrative Recap

NovoCure shareholders generally need to believe in the clinical and commercial trajectory of Tumor Treating Fields (TTFields) and its expansion into new cancer indications. The October 2025 data presentations reinforce this narrative but have limited immediate impact on the company's foremost short-term catalyst: broad validation and reimbursement of TTFields, especially in non-small cell lung cancer. Risks around consistent prescription growth and reimbursement stability remain front-of-mind, with this news unlikely to materially shift those dynamics in the near term.

Of the recent announcements, the August 2025 premarket approval submission for TTFields in pancreatic cancer stands out. This ties directly into the upcoming Phase 3 PANOVA-3 trial data at the ESMO Congress, highlighting management's focus on expanding TTFields into hard-to-treat indications, yet ultimate commercial outcomes still hinge on regulatory, payer and physician buy-in.

By contrast, investors should be aware of the ongoing uncertainty regarding payer reimbursement, as...

NovoCure's narrative projects $863.5 million revenue and $107.8 million earnings by 2028. This requires 11.1% yearly revenue growth and a $278.8 million increase in earnings from -$171.0 million.

Uncover how NovoCure's forecasts yield a $27.19 fair value, a 97% upside to its current price.

Exploring Other Perspectives

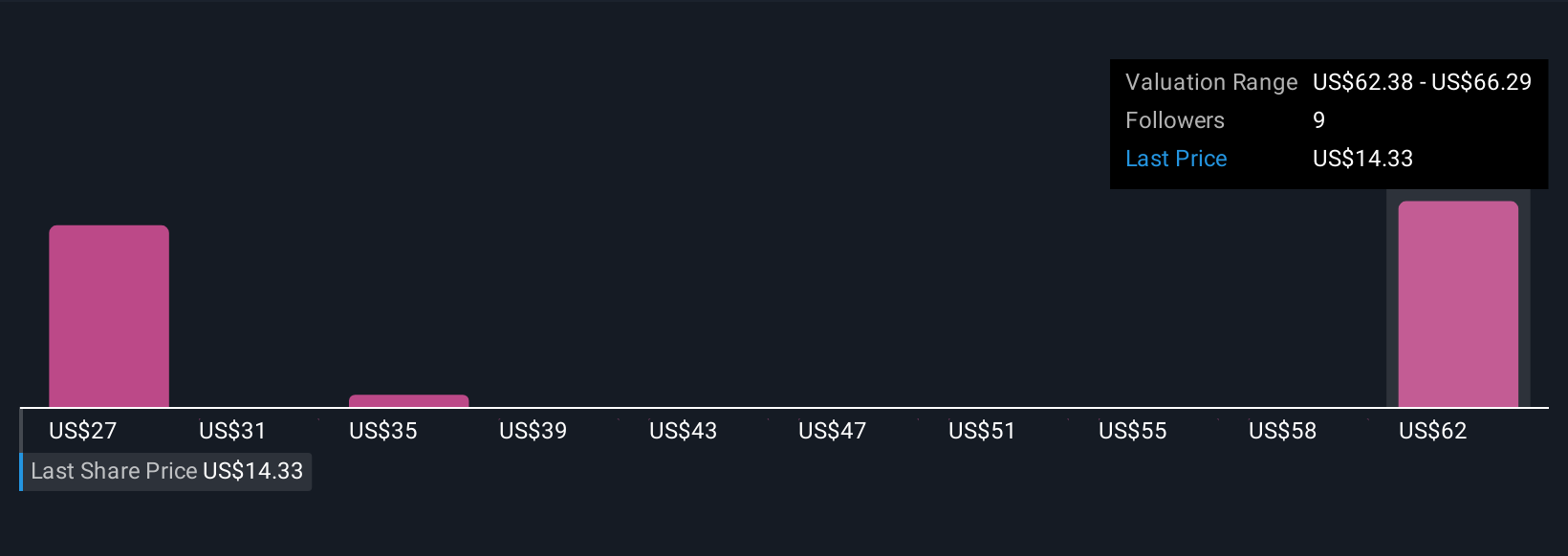

Private investors in the Simply Wall St Community assigned fair value estimates to NovoCure between US$27.19 and US$65.98, with 3 unique opinions published. While investor views vary widely, challenges in securing broad reimbursement continue to influence expectations for the company’s growth and profitability.

Explore 3 other fair value estimates on NovoCure - why the stock might be worth just $27.19!

Build Your Own NovoCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free NovoCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NovoCure's overall financial health at a glance.

No Opportunity In NovoCure?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.