Please use a PC Browser to access Register-Tadawul

NextDecade Faces Brownsville LNG Crowding As Rio Grande Project Advances

NextDecade Corp. NEXT | 5.48 | -1.79% |

- NextDecade’s Rio Grande LNG project at the Port of Brownsville continues to progress, with construction activity moving ahead.

- Peer operator Texas LNG has secured debt financing for a separate LNG facility at the same port, adding another major project to the area.

- These parallel developments concentrate more LNG infrastructure in Brownsville and could influence how NextDecade positions Rio Grande LNG over time.

NextDecade, trading as NasdaqCM:NEXT, is pushing forward with Rio Grande LNG while its shares recently closed at $5.2. The stock has seen a 36.0% decline over the past year, alongside a 3.3% year to date pullback, even though the 5 year return stands at 126.1%. This mix of long term gains and more recent weakness shapes the context for how investors may react to new project related news around the port.

With Texas LNG now funded for its own facility at Brownsville, the result is a more crowded LNG hub that could influence future partnership options, contract discussions, and financing conditions for NextDecade. The concentration of projects in one port may affect how Rio Grande LNG fits into customer portfolios and how stakeholders evaluate long term capacity and competition in the area.

Stay updated on the most important news stories for NextDecade by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on NextDecade.

This news puts a spotlight on execution for NextDecade. Rio Grande LNG is already under construction, which gives the company a tangible project footprint at the Port of Brownsville. At the same time, Texas LNG’s US$5.7b debt package and long term offtake agreement with RWE signal that lenders and customers are also willing to back other Brownsville projects. For you as an investor, the question is how Rio Grande LNG differentiates itself on project timing, contract mix and its focus on integrating carbon capture, compared with peers such as Cheniere Energy, Sempra and other Gulf Coast LNG developers.

The Risks and Rewards Investors Should Consider

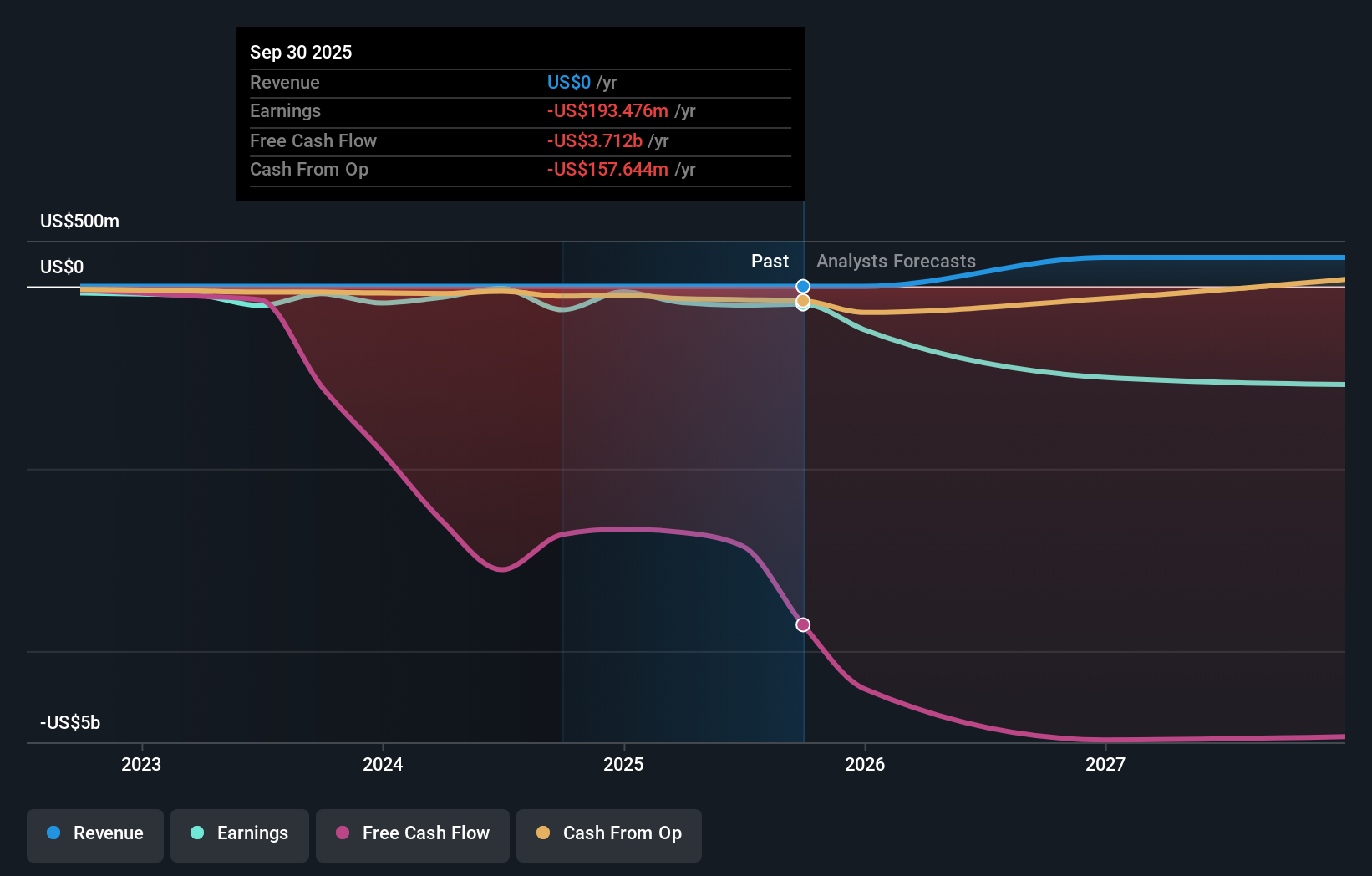

- ⚠️ NextDecade currently reports less than US$1m in revenue, so progress at Rio Grande LNG and any future project cash flows are not yet reflected in reported sales.

- ⚠️ The company has less than one year of cash runway and is not forecast to be profitable over the next three years, which makes continued access to financing and partner capital especially important as construction advances.

- 🎁 Analysts expect revenue to grow at 56.12% per year, so successful execution and commercial ramp up at Rio Grande LNG could materially change the scale of the business over time.

- 🎁 Concentrating LNG infrastructure at Brownsville, alongside long term contracts like Texas LNG’s 20 year RWE deal, may help reinforce the port’s role for export customers, which can support commercial discussions for established projects.

What To Watch Going Forward

You may want to watch a few practical milestones from here. First, how quickly NextDecade reports progress on construction, contracting and any updates related to carbon capture integration at Rio Grande LNG. Second, whether further funding arrangements are needed, given the short cash runway and lack of meaningful current revenue. Third, how Texas LNG’s financing and Final Investment Decision timeline shapes customer preferences and infrastructure planning at the port. Together, these factors will help you judge whether NextDecade is turning its Brownsville position into long term contracted cash flows or facing tougher competition for capital and buyers.

To ensure you're always in the loop on how the latest news impacts the investment narrative for NextDecade, head to the community page for NextDecade to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.