Please use a PC Browser to access Register-Tadawul

NextEra Energy Targets Data Center Demand With New Grid Projects

NextEra Energy, Inc. NEE | 92.18 | +0.59% |

- NextEra Energy (NYSE:NEE) received PJM board approval for a 220 mile, 765 kV transmission line developed with Exelon, aimed at expanding grid capacity and reliability across multiple regions.

- The company also signed a memorandum of understanding with Xcel Energy to deliver power to large load customers, including data centers with rapidly rising electricity needs.

- These moves target growing demand for dependable, large scale power and position NextEra Energy as a key player in supporting new generation and load growth.

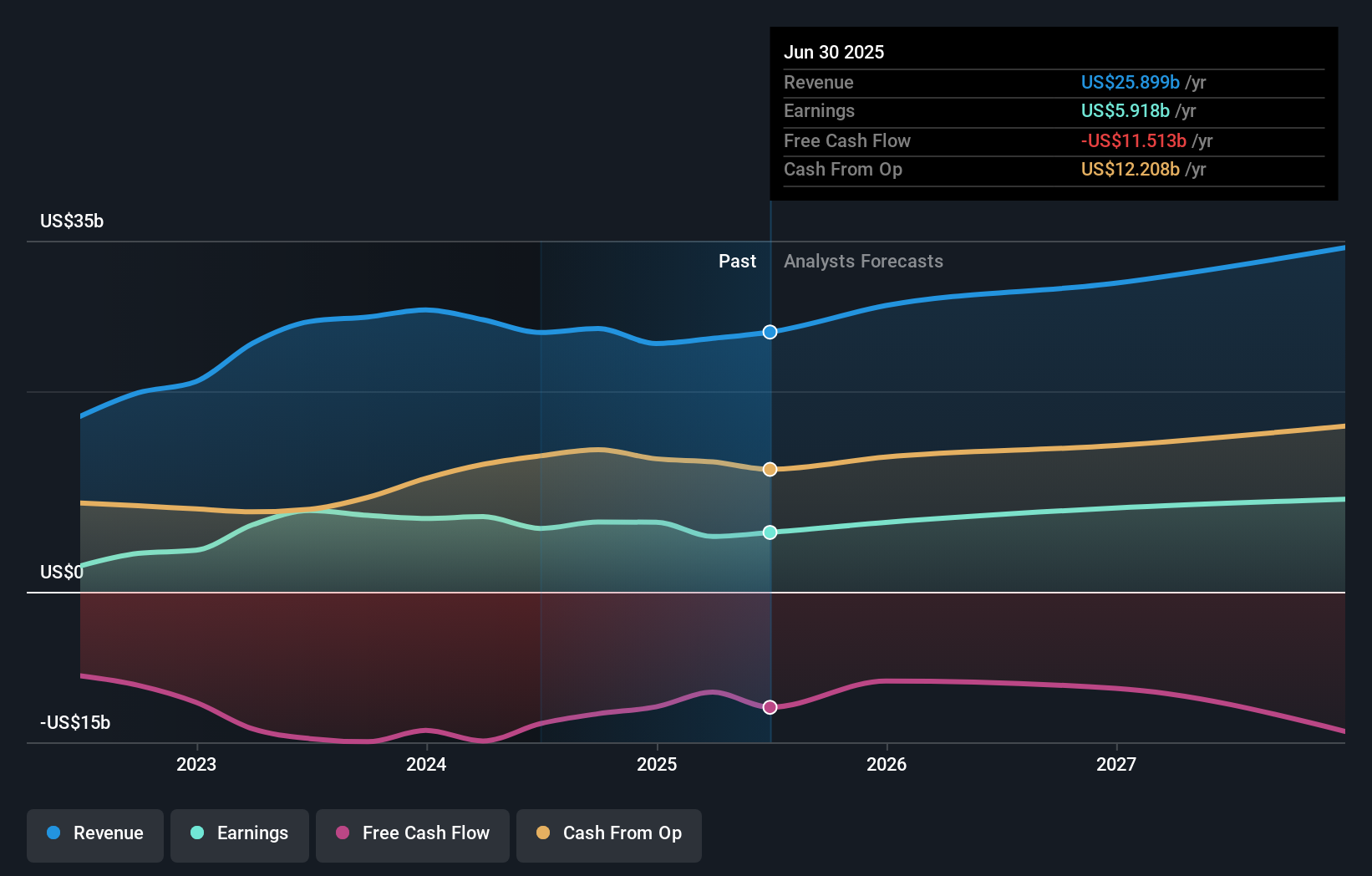

For investors watching NYSE:NEE, these grid and power delivery projects add context to a stock that is trading around $93.8 and has returned 42.1% over the past year and 36.5% over five years. The shares are also up 4.8% over the past week and 14.4% over the past month, with a 15.9% return year to date, which illustrates how the market is currently responding to the company.

In this context, the combination of PJM approved transmission expansion and the Xcel Energy alliance gives NextEra Energy additional avenues to serve large, power intensive customers such as data centers. For investors, a central consideration will be how effectively the company converts these projects into long term, contracted cash flows while managing execution risk and capital needs.

Stay updated on the most important news stories for NextEra Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on NextEra Energy.

The PJM approval and the Xcel MOU both point in the same direction for NextEra Energy: securing the infrastructure and commercial partnerships needed to serve very large, long term power loads such as AI data centers. The approximately 220 mile, 765 kV line with Exelon is aimed at grid reliability and affordability in the Mid Atlantic, but it also creates more paths to connect new generation to growing demand centers. The Xcel agreement, with key commercial terms already outlined, is about identifying where that demand is likely to show up and coordinating generation, storage and transmission so projects can move faster and with clearer economics. For you as an investor, the key questions are how these deals are structured, how much capital NextEra needs to commit, and whether the returns on those projects adequately reflect the size and duration of data center loads.

How This Fits Into The NextEra Energy Narrative

- The PJM project and the Xcel alliance both align with the narrative that rising electricity use from AI and data centers could support higher volumes and help NextEra use its renewables and grid expertise to support revenue and earnings growth over time.

- At the same time, these capital intensive projects reinforce existing concerns in the narrative around financing costs and regulatory hurdles, since more grid and generation buildout can mean more exposure to permitting delays and interest expense.

- The focus on transmission and third party utility partnerships is not fully reflected in the earlier emphasis on Florida Power & Light and renewables, and could be an additional part of the story that shapes how NextEra competes with peers such as Duke Energy, Dominion Energy and Southern Company.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for NextEra Energy to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Transmission and large load projects can require heavy upfront investment, which matters for a company where interest payments are not well covered by earnings.

- ⚠️ The PJM line and any Xcel related projects still depend on detailed contracts and regulatory approvals, so timing, allowed returns and cost recovery are not fully visible yet.

- 🎁 The PJM approval supports the idea that regulators see a need for more grid capacity, which can create long lived, regulated asset opportunities if terms are favorable.

- 🎁 The MOU with Xcel is intended to help both companies serve more data center demand through the 2030s, potentially giving NextEra access to large, contracted customers that value reliable, low carbon power.

What To Watch Going Forward

From here, it is worth watching how quickly the PJM transmission project moves toward detailed design, cost estimates and allowed returns, and whether there are any pushbacks on siting or permitting. On the Xcel side, focus on when the joint development agreement is signed, how responsibilities and economics are split and how many concrete data center or large load projects are publicly tied to the partnership. You can also compare how NextEra positions itself versus other large utilities competing for data center loads, such as Duke or Dominion, in terms of contract length, pricing and clean energy mix.

To ensure you're always in the loop on how the latest news impacts the investment narrative for NextEra Energy, head to the community page for NextEra Energy to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.