Please use a PC Browser to access Register-Tadawul

NIO (NYSE:NIO) Valuation in Focus After Major Equity Raise and Record Deliveries Boost Outlook

NIO NIO | 5.03 | +0.80% |

It has been an eventful stretch for NIO (NYSE:NIO), with shares leaping after the company wrapped up a major $1.16 billion equity offering. This move immediately put fresh capital into NIO’s hands to drive more innovation, ranging from new electric vehicles to expanding its battery swapping and charging infrastructure. Investors are paying close attention, as this combination of a stronger balance sheet, strong delivery growth, and new product launches has put NIO front and center in the electric vehicle conversation again.

Looking at the broader context, NIO’s story over the past year has kept traders on their toes. The stock has surged nearly 40% in the past year, with recent weeks fueled by both the successful capital raise and growing anticipation for the all-new ES8 and the record-setting ONVO L90. While momentum is clearly building after a multi-year rough patch, the bigger picture remains focused on whether NIO’s fundamentals can carry the rally further.

With fresh capital, improving delivery trends, and renewed excitement around its pipeline, investors are now considering whether the current price presents an entry point, or if the market has already factored in NIO’s comeback story.

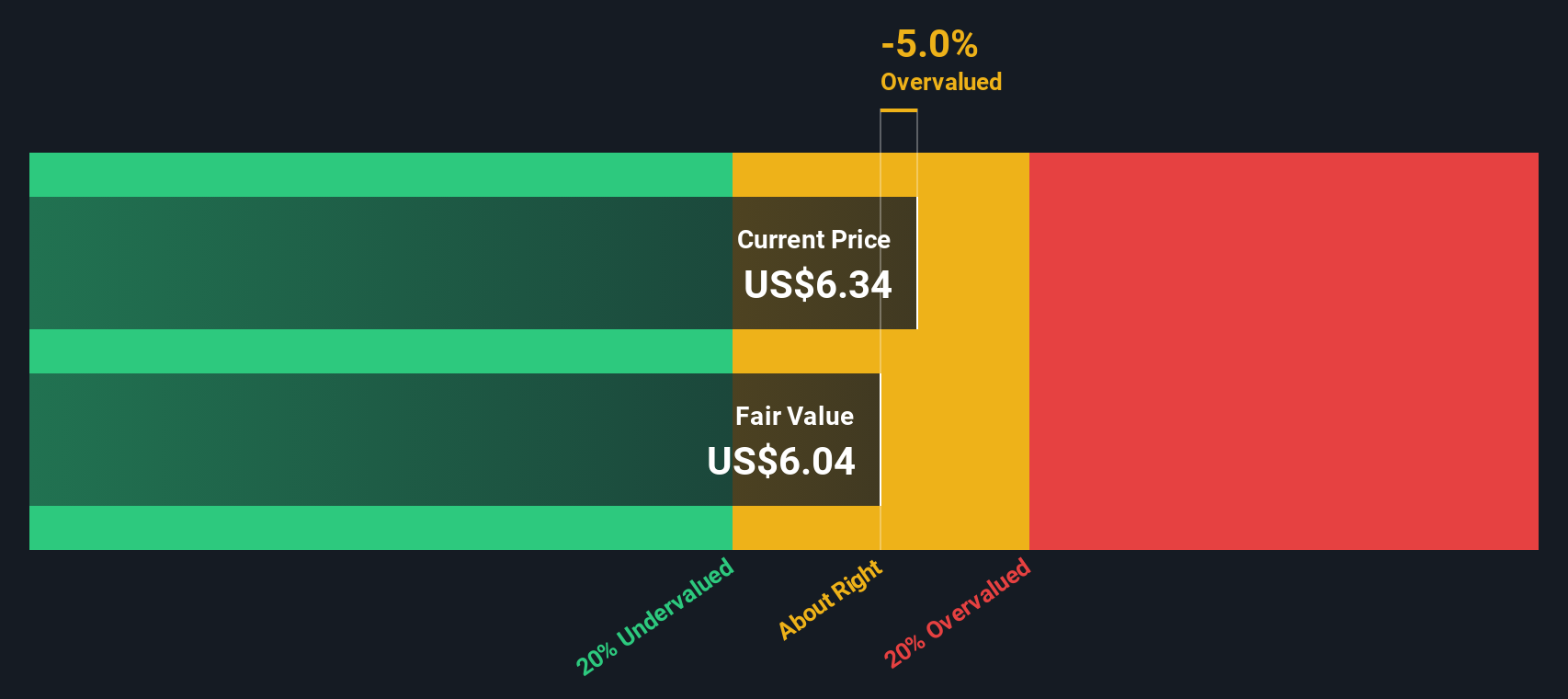

Most Popular Narrative: 18% Overvalued

According to the most widely read narrative, NIO shares are trading above their calculated fair value. This premium is based on expectations of rapid revenue growth and market expansion.

"If NIO can execute its expansion plans while managing costs, it could see significant upside. Current price levels may reflect an opportunity if the company meets or exceeds its targets."

What could power NIO’s future leap? This valuation relies on ambitious growth plans and transformative innovations included in the company’s outlook. Which critical forecasts drive this bold call? Discover the factors that distinguish this valuation.

Result: Fair Value of $6.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing losses and intense competition in the EV sector could quickly challenge optimism around NIO’s growth story.

Find out about the key risks to this NIO narrative.Another View: SWS DCF Model Offers a Different Perspective

While many see NIO as overvalued when looking at its sales compared to auto industry standards, our DCF model suggests a closer call. This approach examines future cash flows and provides a separate lens on value. Which view will prove right as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NIO Narrative

If you see things differently or want to draw your own conclusions, the data is yours to explore and a custom narrative is just minutes away. Do it your way

A great starting point for your NIO research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Take control of your investment strategy and uncover companies with genuine momentum using our curated stock screeners.

- Maximize your income by targeting companies that regularly pay attractive yields with our handpicked list of dividend stocks with yields > 3%.

- Accelerate your portfolio’s growth by tapping into the exciting boom in healthcare technology. Get started with the best picks in healthcare AI stocks.

- Uncover tomorrow’s market leaders still flying under the radar by searching for hidden value among penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.