Please use a PC Browser to access Register-Tadawul

nLIGHT Equity Raise Fuels Defense Laser Expansion And Execution Focus

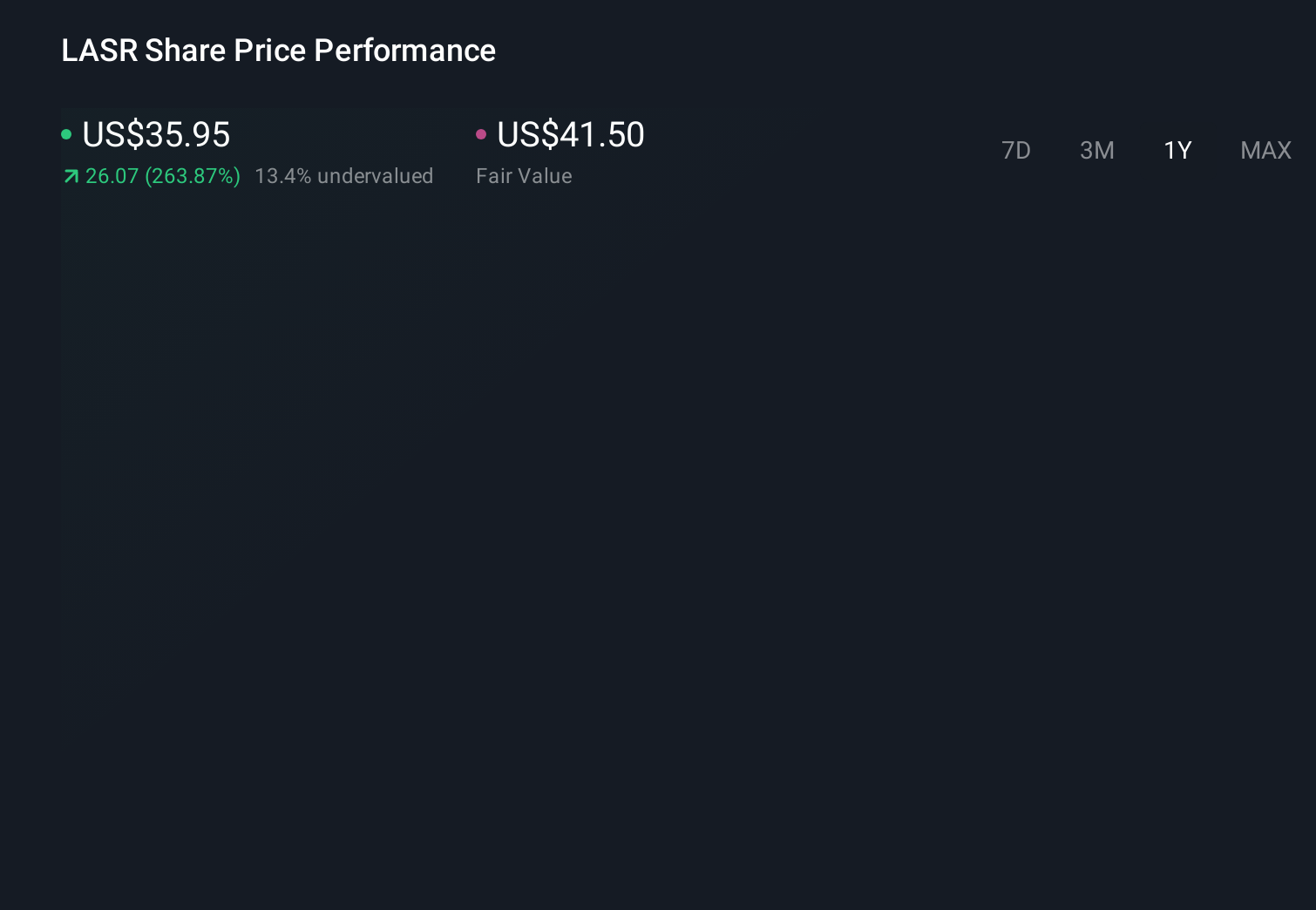

NLIGHT, INC. LASR | 54.84 54.84 | +3.63% 0.00% Post |

- nLIGHT (NasdaqGS:LASR) completed a public follow-on equity offering of about $175 million in gross proceeds.

- The company plans to use the capital to support its high energy laser manufacturing expansion for defense applications.

- The offering follows recent pre-announcements referencing strong revenue trends, additional defense contracts, and increased production capacity.

nLIGHT focuses on high power semiconductor and fiber lasers, with a growing emphasis on systems built for defense use. Recent company updates have highlighted demand for high energy laser capabilities across multiple defense domains, alongside references to expanded production capacity and new defense-related business wins.

For investors, this capital raise indicates that nLIGHT is allocating additional resources to scale its defense laser operations. The new equity and recent commercial updates position the next phase for NasdaqGS:LASR as one where execution, contract conversion, and manufacturing performance are likely to draw close attention.

Stay updated on the most important news stories for nLIGHT by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on nLIGHT.

The US$175 million follow-on equity raise signals that nLIGHT is leaning into high-energy laser capacity just as interest in directed-energy defense solutions is getting more visible. The deal size, use of an existing shelf registration, and addition of Cantor Fitzgerald as co-lead underwriter point to strong access to capital markets. At the same time, the share price drop around the offering highlights that investors are weighing near-term dilution against the potential benefits of a larger balance sheet.

How This Fits Into The nLIGHT Narrative

This funding round lines up with the existing narratives that focus on capacity expansion for defense programs and the tension between growth and execution risk. Recent moves, such as doubling Longmont manufacturing space and showcasing a 70kW-class laser weapon system, support the view that nLIGHT is leaning harder into defense revenue. Previous analyst narratives already flagged this as both a growth driver and a source of concentration risk compared with peers like Coherent, IPG Photonics, and Lumentum.

Risks And Rewards Investors Are Weighing

- 🎁 The offering gives nLIGHT additional capital to support working capital, capex, and defense-focused manufacturing scale, which may help it compete in larger directed-energy programs.

- 🎁 Expanded production capacity and a visible product lineup in high-energy lasers may help the company convert recent defense interest into longer-running contracts.

- ⚠️ Issuing 3,977,273 new shares at a discount creates dilution for existing holders. The pre- and post-announcement share price moves show that not all investors are comfortable with that trade-off.

- ⚠️ Heavy reliance on defense programs, together with recent insider selling flagged in risk data, leaves the story sensitive to changes in government priorities and internal confidence.

What To Watch Next

From here, the key questions are how quickly nLIGHT puts this fresh capital to work in its expanded Colorado facilities, what kind of order visibility emerges around its 10kW, 30kW, and 70kW-class systems, and how the upcoming Q4 2025 results and World Defense Show presence shape investor sentiment around execution. If you want to see how different investors are connecting these moves to the longer-term story, check out the community narratives on the dedicated company page through a collection of community narratives for nLIGHT.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.