Please use a PC Browser to access Register-Tadawul

nLIGHT’s Capacity Expansion for Defense Lasers Might Change The Case For Investing In nLIGHT (LASR)

NLIGHT, INC. LASR | 56.01 | +0.59% |

- In January 2026, nLIGHT, Inc. expanded its Longmont, Colorado operations by leasing an additional 50,000 square feet of manufacturing and office space, more than doubling capacity to support beam-combined high-energy laser production for the U.S. Department of War and other agencies.

- This expansion highlights nLIGHT’s vertically integrated, U.S.-based high-energy laser supply chain, from semiconductor chips through fiber amplifiers to fully beam-combined systems, for domestic and allied defense programs.

- We will now examine how this capacity expansion for high-energy laser manufacturing shapes nLIGHT’s investment narrative and future opportunities.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is nLIGHT's Investment Narrative?

To own nLIGHT, you need to believe its coherent beam-combined laser technology can translate defense demand into a sustainably larger, higher‑quality revenue base, even while the company remains unprofitable. The Longmont expansion is a clear signal that management expects continued, if not stronger, HEL orders from the U.S. Department of War and allied programs, and it could reinforce recent revenue momentum that already prompted raised Q4 2025 guidance. In the near term, key catalysts remain further contract awards, proof that higher capacity is actually filled, and continued progress in narrowing losses. On the risk side, the stock’s rich sales multiple, large insider selling and dependence on government budgets all look more important as the valuation has already rerated sharply. This new capacity raises the stakes on execution.

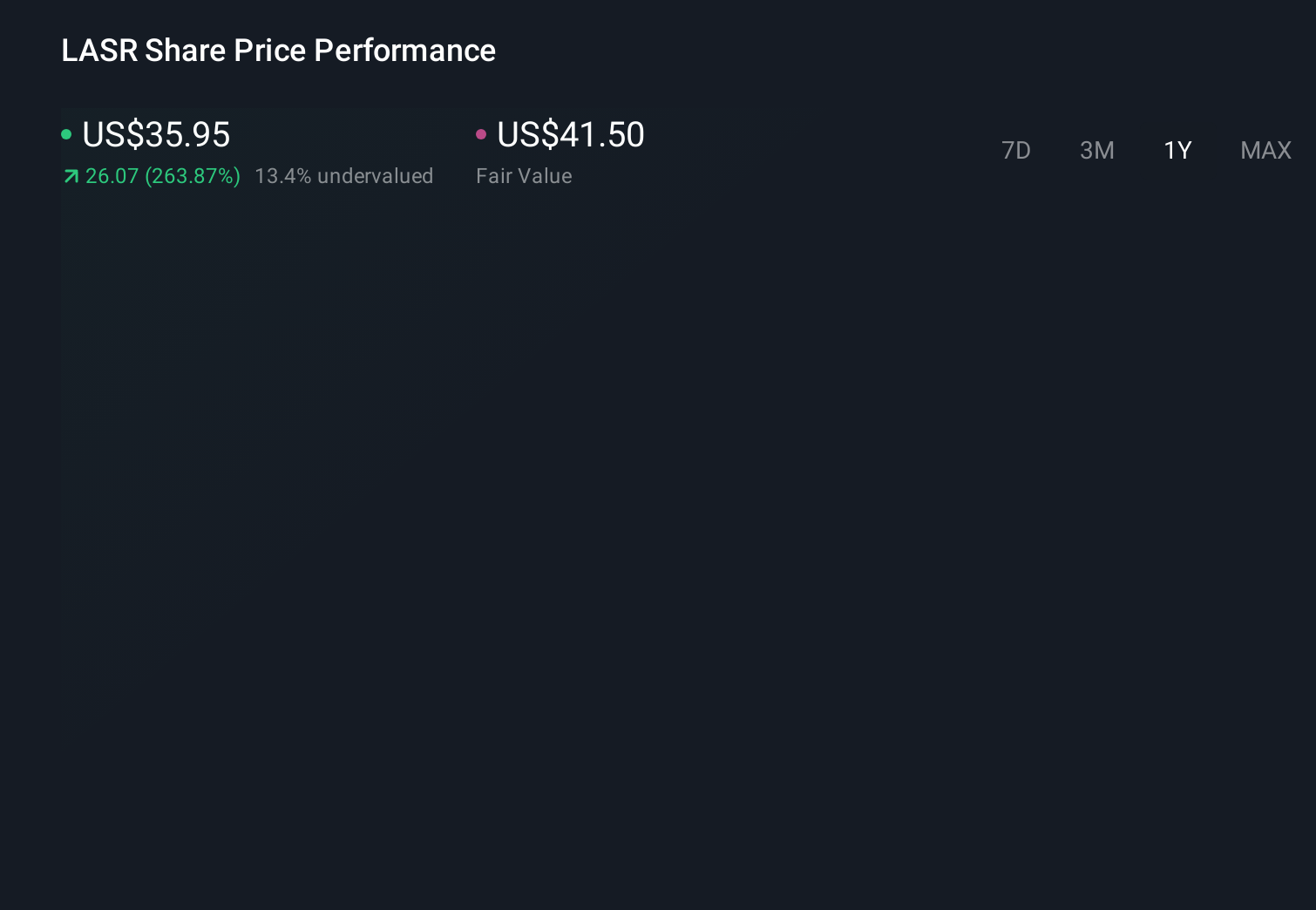

However, capacity is only an advantage if demand actually shows up. In light of our recent valuation report, it seems possible that nLIGHT is trading beyond its estimated value.Exploring Other Perspectives

Three fair value views from the Simply Wall St Community span about US$17.70 to US$47.43, showing how far apart expectations sit. Set against nLIGHT’s steep valuation, ongoing losses and fresh capacity ramp, that spread underlines why it can pay to study several perspectives before forming your own view on the company’s prospects.

Explore 3 other fair value estimates on nLIGHT - why the stock might be worth as much as $47.43!

Build Your Own nLIGHT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nLIGHT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nLIGHT's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.