Please use a PC Browser to access Register-Tadawul

Northern Trust (NTRS): A Fresh Look at Valuation Following Recent Share Price Momentum

Northern Trust Corporation NTRS | 139.44 | +0.66% |

After a steady climb over the past year, Northern Trust’s share price momentum has begun to show signs of building, supported by modest gains and renewed investor interest. Measured by total shareholder return, the company has delivered solid progress for long-term holders. Recent price moves hint at cautious optimism returning to the sector.

If you’re exploring which stocks have momentum right now, it might be time to expand your horizons and discover fast growing stocks with high insider ownership

With Northern Trust’s steady gains and solid fundamentals, is this a moment when the stock is trading below its true value, or have investors already accounted for the company’s future growth prospects in the share price?

Most Popular Narrative: 5% Overvalued

With Northern Trust closing at $133.24, the most widely followed narrative suggests a slightly lower fair value, highlighting friction between current enthusiasm and the analysts’ careful outlook. This aligns with modest consensus price target increases and competing forces shaping expectations for future returns.

Expansion into alternatives and digital initiatives faces challenges from competition, regulation, technology disruption, and heavy reliance on global rate and market trends. Expansion in alternatives, operational automation, client diversification, and capital strength position Northern Trust for sustained margin growth, innovation investment, and competitive financial outperformance.

Curious what key assumptions are driving this eye-catching valuation? The consensus expectation includes bold projections about profit margins and industry dynamics that could shift the entire earnings outlook. Find out which levers analysts think could transform the company’s trajectory and what wildcards might turn the tables.

Result: Fair Value of $126.38 (OVERVALUED)

However, rapid growth in alternatives or successful tech-driven cost reductions could boost margins and challenge today’s cautious analyst consensus.

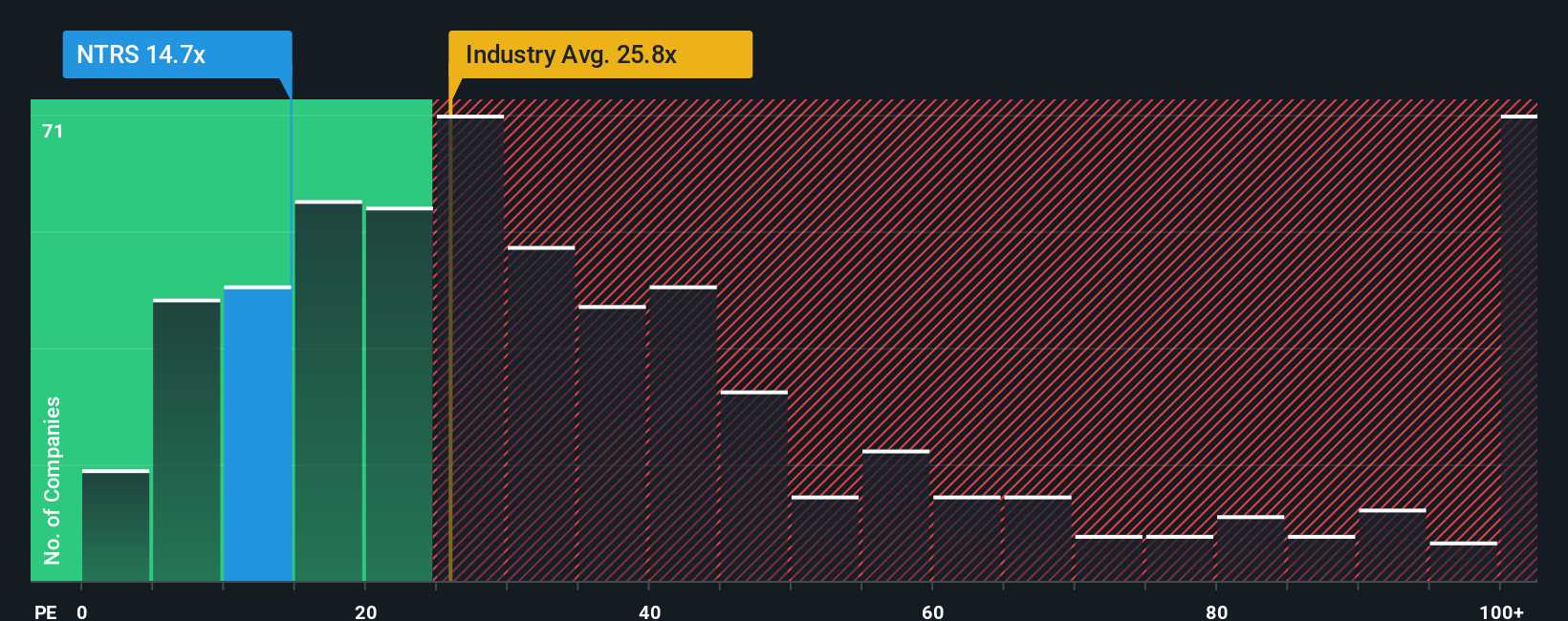

Another View: Multiples Tell a Different Story

Looking beyond analyst projections, Northern Trust trades at a price-to-earnings ratio of 15.1x, which is far below the industry average (26.3x) and its peers (45x), yet close to the fair ratio of 16.1x. This suggests the market sees less potential or perhaps less risk. Could the market be underestimating future returns, or is this a warning sign?

Build Your Own Northern Trust Narrative

If you have your own perspective or want to dive deeper into the figures, you can build your own story from the data in just a few minutes, Do it your way

A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself an edge by taking action now. There are outstanding opportunities beyond Northern Trust that you’ll want to catch before everyone else.

- Spot undervalued gems others are missing by seizing the moment with these 900 undervalued stocks based on cash flows to access stocks trading well below their fair value.

- Supercharge your potential returns by tapping into these 19 dividend stocks with yields > 3% to find shares boasting attractive yields above 3%.

- Ride the wave of technological innovation by checking out these 24 AI penny stocks to get in early on companies redefining entire industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.