Please use a PC Browser to access Register-Tadawul

Northrop Grumman (NOC) Is Up 9.1% After Strong Q2 Earnings Beat Expectations - What's Changed

Northrop Grumman Corporation NOC | 568.72 560.80 | -1.23% -1.39% Pre |

- Northrop Grumman recently reported its second quarter 2025 earnings, with revenue rising to US$10.35 billion and net income reaching US$1.17 billion, both up from a year ago.

- This quarterly performance highlights improvement in operational results, even as first half revenues saw a slight decrease compared to the prior year.

- We'll explore how these stronger quarterly earnings could influence Northrop Grumman's outlook amid ongoing industry and company developments.

Northrop Grumman Investment Narrative Recap

To be a Northrop Grumman shareholder, you typically need to believe that defense technology innovation, strong government relationships, and the company’s project backlog position it for long-term stability and growth. The recent Q2 2025 uptick in revenue and net income suggests Northrop Grumman is managing program cost pressures well in the short term, yet the ongoing risk of rising manufacturing and input costs, especially on programs like the B-21, remains material and could affect near-term margins and profitability.

Among recent announcements, the June 2025 collaboration with Raytheon on solid rocket motor development stands out in the context of catalysts. This type of partnership highlights the company’s push to secure new defense contracts and advance its backlog, which is crucial as timely contract awards remain a significant driver for future earnings growth in 2025.

However, despite this revenue momentum, investors should be mindful that cost overruns on complex projects, particularly those related to...

Northrop Grumman's outlook forecasts $46.8 billion in revenue and $4.3 billion in earnings by 2028. This is based on an expected 5.1% annual revenue growth and a $0.6 billion increase in earnings from the current $3.7 billion level.

Exploring Other Perspectives

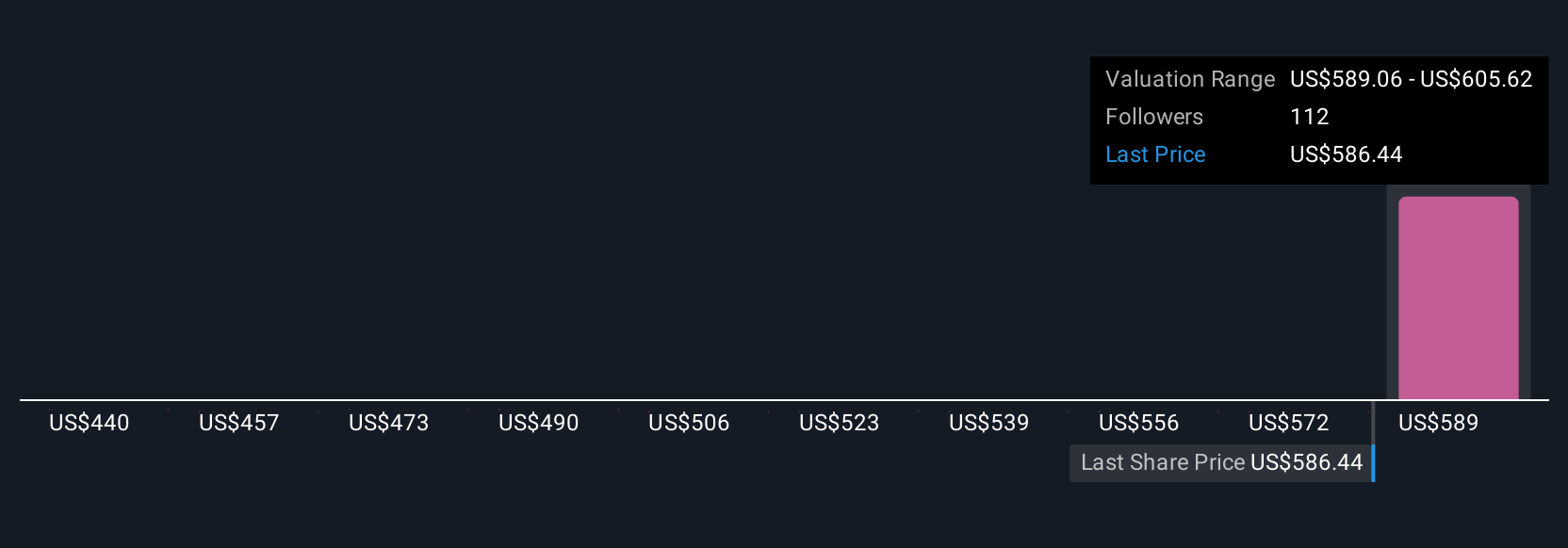

Community fair value estimates for Northrop Grumman range widely from US$440 to US$632, based on forecasts from five individual members of the Simply Wall St Community. With margins still pressured by higher-than-expected B-21 manufacturing costs, these differences underscore why it pays to compare multiple opinions before deciding.

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

No Opportunity In Northrop Grumman?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.