Please use a PC Browser to access Register-Tadawul

Northwest Bancshares (NWBI): Evaluating Valuation After Fed’s Rate Cut Sparks Sector Rally

Northwest Bancshares, Inc. NWBI | 13.16 | -1.09% |

If you’ve been keeping an eye on Northwest Bancshares (NWBI), you probably noticed the recent buzz after the Federal Reserve trimmed its benchmark interest rate by 25 basis points and hinted at more cuts coming down the line. This kind of move tends to shake up the entire banking sector, and Northwest Bancshares is right in the thick of it. With this shift in policy, investors are left wondering what it could mean for bank profitability and risk in today’s changing interest rate environment.

Shares of Northwest Bancshares moved alongside other regional banks as the broader sector rallied after the Fed’s announcement, with optimism taking center stage for many investors hoping for better business conditions ahead. Over the past year, the stock has slipped about 2%, reflecting a year shaped by shifting expectations for rates and the banking landscape. It is still up over 80% when you zoom out to a five-year view. Momentum for the stock has been somewhat muted in the past month but these sorts of big-picture policy changes do tend to reset investor expectations quickly.

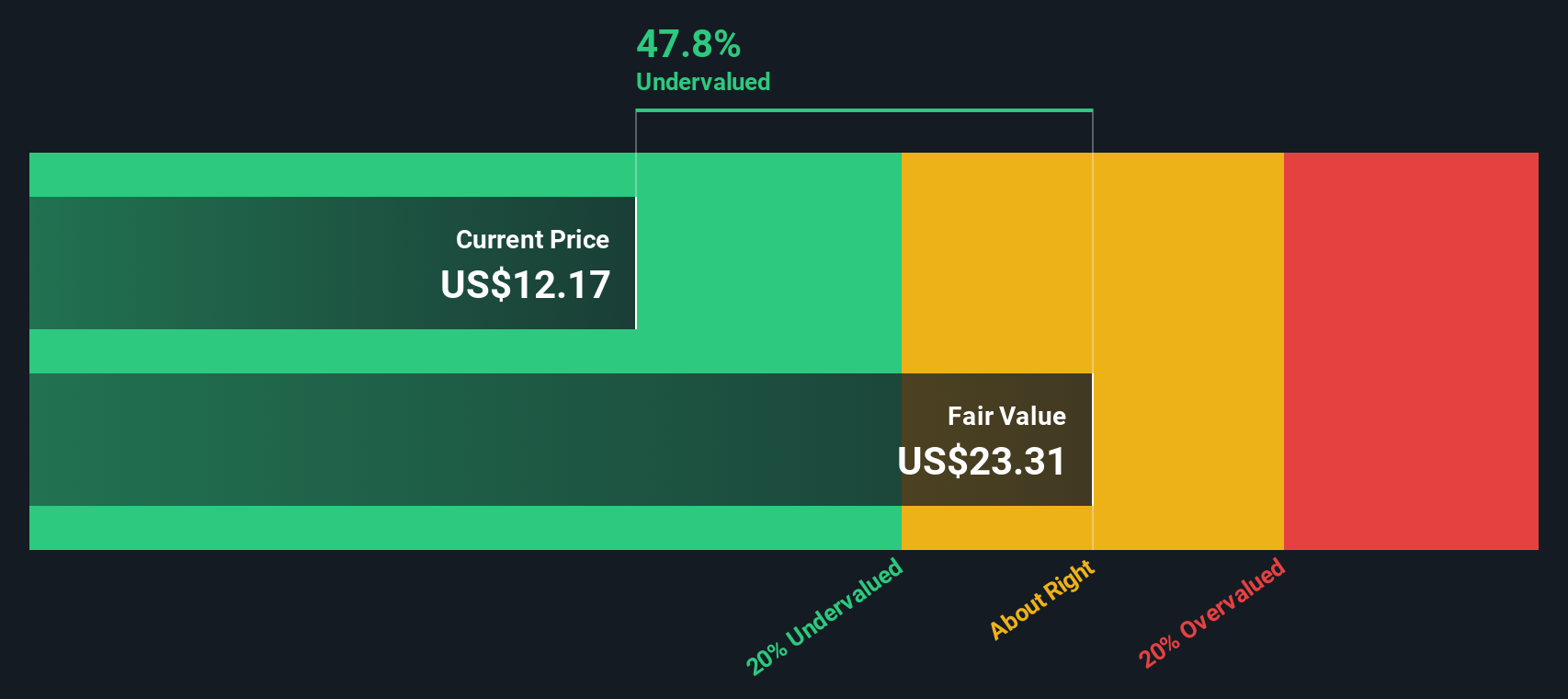

So after this latest rate-driven rebound, is Northwest Bancshares trading at an attractive valuation, or has the market already factored in all the future growth?

Most Popular Narrative: 7.4% Undervalued

The prevailing narrative suggests that Northwest Bancshares is trading below its estimated fair value, with analysts seeing meaningful upside potential based on expected growth in earnings and operational efficiencies.

Integration of acquisitions and digital transformation are driving efficiency improvements, better expense management, and enhanced customer retention. Expansion into suburban markets and a focus on commercial lending are positioning the bank for sustained revenue and deposit growth.

Curious how Northwest Bancshares could unlock its undervalued potential? The narrative hints at a transformation powered by market expansion and major financial shifts. Want to know the ambitious projections and the building blocks behind this bullish stance? The answers may surprise you. The secret is in the numbers and the vision.

Result: Fair Value of $13.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are real risks to watch, including slower regional growth and high branch costs. These factors could pressure margins if economic conditions deteriorate.

Find out about the key risks to this Northwest Bancshares narrative.Another View: Discounted Cash Flow Says There's More to the Story

While analyst targets point to the stock being below fair value, the SWS DCF model sees the picture differently. This approach suggests Northwest Bancshares could be more undervalued than most traditional measures imply. Which approach holds the real insight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northwest Bancshares Narrative

If you see things differently, or want to dig into the numbers your own way, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next smart move could be just a click away. Cut through the noise and find game-changing opportunities built on real data and actionable insights.

- Uncover hidden value by targeting companies underestimated by the market for their cash flow strength. Access these opportunities easily through our undervalued stocks based on cash flows.

- Fast-track your search for steady income by focusing on stocks with yields above 3%. Find these selections using our handpicked dividend stocks with yields > 3%.

- Get ahead of tomorrow’s tech trends by exploring the explosive potential of artificial intelligence growth movers highlighted in our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.