Please use a PC Browser to access Register-Tadawul

Northwest Bancshares Steps Into Top Tier With Penns Woods Integration

Northwest Bancshares, Inc. NWBI | 12.99 | +0.23% |

- Northwest Bancshares (NasdaqGS:NWBI) has completed its largest acquisition to date, bringing Penns Woods under the Northwest Bank umbrella.

- The transaction makes Northwest Bancshares one of the top 100 US bank holding companies by size.

- The company reports that merger related cost reductions are tracking ahead of initial expectations.

- Penns Woods customers, employees, and financial centers are being integrated into the Northwest Bank brand.

For you as an investor, this move reshapes Northwest Bancshares from a regional player into a larger institution with a wider footprint. The bank remains focused on traditional lines of business, such as consumer and commercial banking, at a time when many regional banks are reassessing branch networks, technology spend, and funding mix.

With Penns Woods now folded into the business, the key questions are how effectively Northwest Bancshares (NasdaqGS:NWBI) can manage the larger platform and maintain service quality. The company is already reporting merger related cost savings ahead of plan, and investors will be watching future updates for how scale, integration progress, and capital priorities translate into long term outcomes.

Stay updated on the most important news stories for Northwest Bancshares by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Northwest Bancshares.

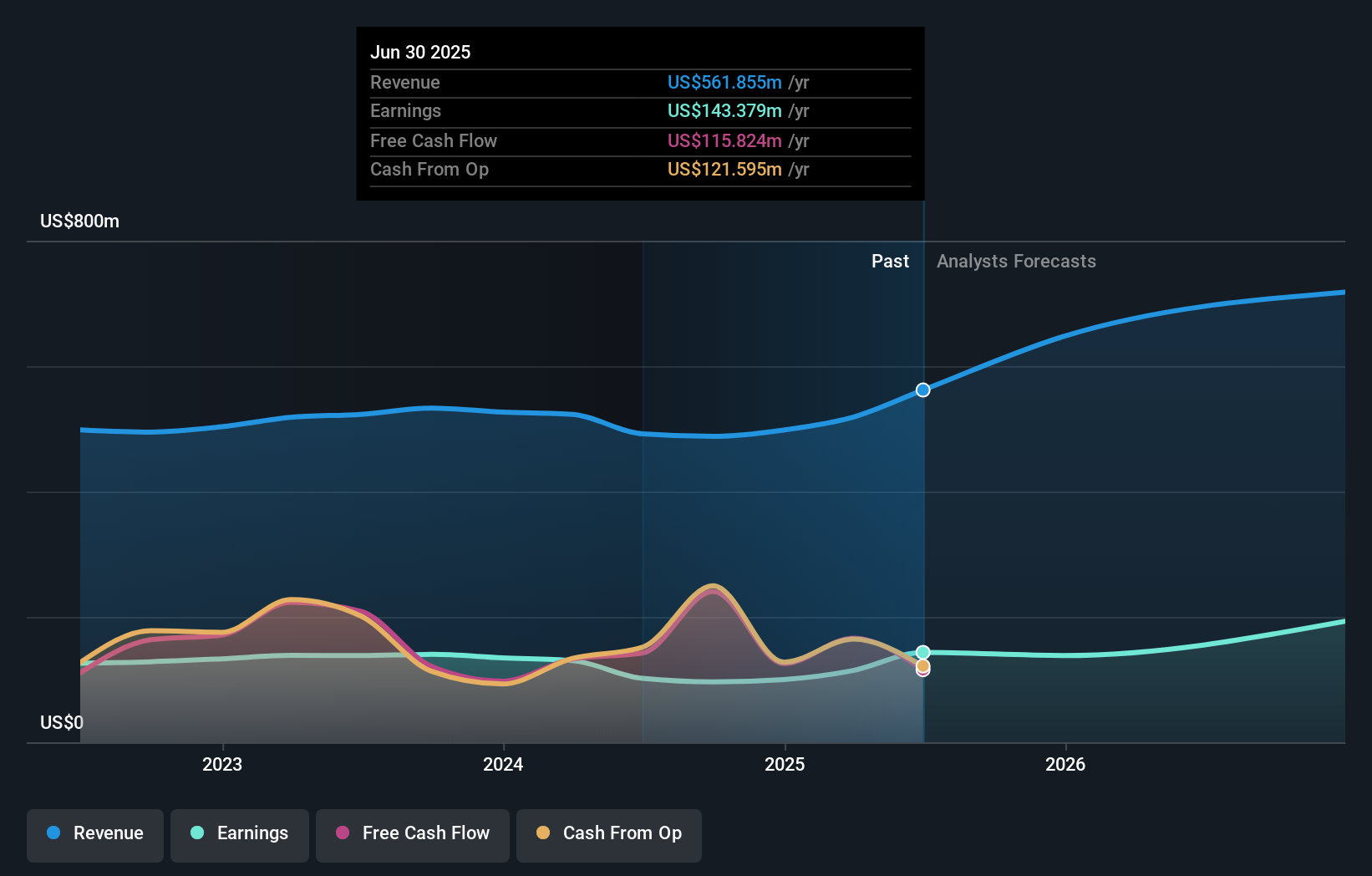

Northwest Bancshares’ completion of the Penns Woods deal comes alongside higher reported net interest income and net income for both the fourth quarter and full year 2025, which suggests the enlarged footprint is already being reflected in the financials. With the bank now at roughly US$17b in assets and within the top 100 US bank holding companies, the integration of Penns Woods gives it a larger deposit base and loan book to spread fixed costs across while it tracks merger related savings.

Northwest Bancshares narrative, upgraded to a bigger stage

Recent earnings that were ahead of analyst expectations and a share price trading near its 52 week high have supported a narrative of resilience among regional banks, and this transaction folds into that story by showing Northwest Bancshares leaning into scale rather than retrenching. For investors who have followed the stock on the back of sector wide sentiment shifts, the Penns Woods integration may be seen as a test of how well that stronger narrative holds up as the company operates as a larger institution.

Risks and rewards from this acquisition

- Larger balance sheet of about US$17b in assets gives Northwest Bancshares more room to allocate capital and pursue growth across a wider branch network.

- Management reports merger related cost reductions on or ahead of plan, which, if sustained, can support profitability on the combined platform.

- Integration work, including systems, culture, and branch optimization, can introduce one off items that affect reported results and make trends harder to read.

- The dividend yield, referenced at around 6.32%, is flagged as not well covered by earnings, so a larger payout alongside an acquisition adds another item for you to monitor.

What to watch next

From here, you may want to watch how cost savings, credit quality, and the dividend payout ratio trend over the next few quarters as the Penns Woods integration beds down and new branches come online. If you want to see how other investors are thinking about these shifts, you can read community views in this narrative hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.