Please use a PC Browser to access Register-Tadawul

Norwegian Cruise’s (NCLH) Major Debt Moves Might Change the Case for Investing in the Company

Norwegian Cruise Line Holdings Ltd. NCLH | 21.66 | +0.02% |

- Norwegian Cruise Line Holdings recently completed several capital market transactions, including follow-on equity and fixed-income offerings, with NCL Corporation raising US$850 million in new senior unsecured notes and announcing additional notes totaling over US$2.22 billion.

- These transactions were aimed at repurchasing existing debt and improving financial flexibility, signaling a proactive approach to balance sheet optimization as the company continues expanding its fleet and destination offerings.

- We'll examine how Norwegian’s enhanced financial flexibility from recent debt optimization could influence its investment narrative and long-term growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Norwegian Cruise Line Holdings Investment Narrative Recap

To be a Norwegian Cruise Line Holdings shareholder, you have to believe in post-pandemic demand for cruise vacations, the company’s ability to maintain pricing power and cost efficiency, and the successful rollout of destination enhancements like Great Stirrup Cay. The recent debt and equity transactions improve financial flexibility but do not materially alter the most significant near-term catalyst, record guest bookings and onboard spend, or directly resolve the largest risk: ongoing elevated leverage and refinancing pressures.

Among recent developments, Norwegian’s follow-on equity offering stands out, providing additional liquidity to support growth initiatives and address maturing debt. While helpful in strengthening the balance sheet, this action is especially relevant as the company eyes the expansion of its private island experience, a core component of its ambition to drive higher onboard spend and occupancy.

In contrast, persistent high debt levels and the need to refinance sizeable euro-denominated maturities in 2026 remain a key issue investors should be aware of, as...

Norwegian Cruise Line Holdings is forecast to achieve $12.6 billion in revenue and $1.7 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 9.5% and reflects a $980.8 million increase in earnings from the current level of $719.2 million.

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $30.79 fair value, a 16% upside to its current price.

Exploring Other Perspectives

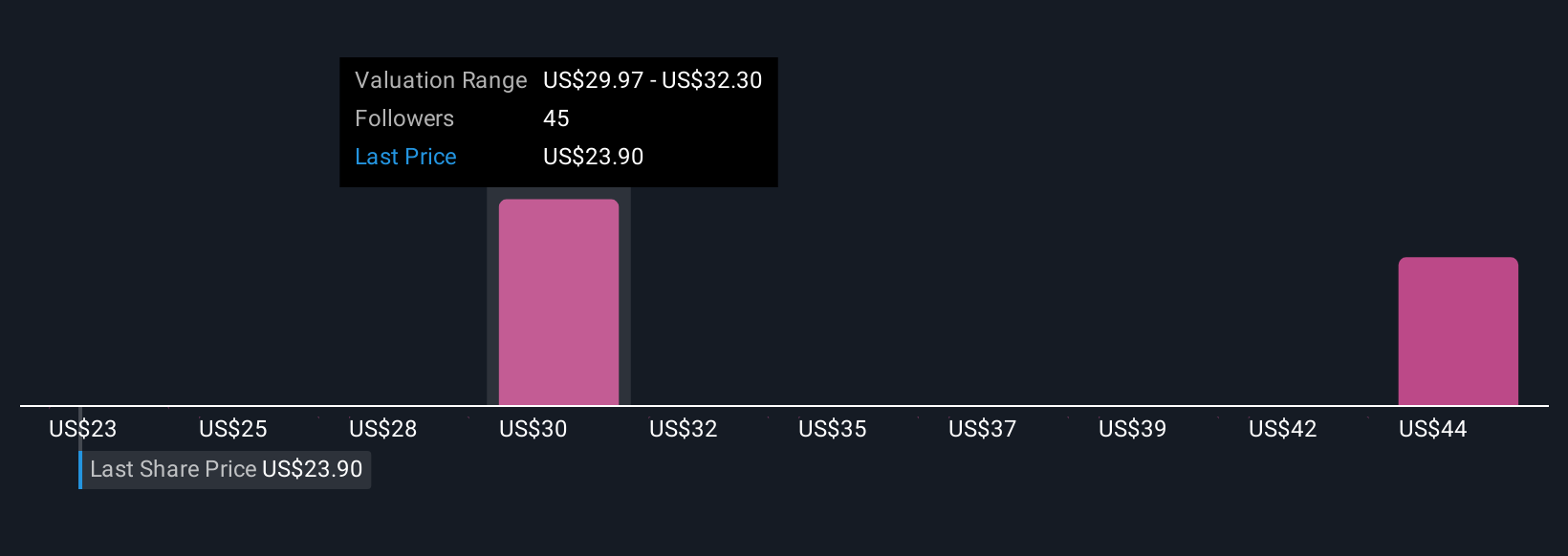

Five fair value estimates from the Simply Wall St Community range widely from US$23 to US$47.57 per share. While many are optimistic about onboard spend and destination offerings, keep in mind that persistent high leverage remains a prominent concern for long-term stability, so take the time to weigh diverse viewpoints.

Explore 5 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth as much as 78% more than the current price!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.