Please use a PC Browser to access Register-Tadawul

Nova (NasdaqGS:NVMI) Valuation in Focus After Earnings Beat and Strong Revenue Growth

Nova Measuring Instruments Ltd NVMI | 326.06 | +3.24% |

If you’re holding shares of Nova (NasdaqGS:NVMI) or considering joining the party, this past quarter probably got your attention. Nova’s latest earnings report crushed estimates, with revenues jumping 40% year on year and beating expectations by over 2%. That kind of upside surprise rarely goes unnoticed, sparking fresh optimism among investors who have been watching the semiconductor sector heat up. This newfound momentum is particularly interesting now that Nova has just been added to the PHLX Semiconductor Sector Index, a move that often comes with extra attention and, at times, more trading volume.

It is not just about this single quarter, either. The stock soared nearly 21% after earnings and has gained 53% so far this year, with three- and five-year returns suggesting longer-term strength is still in play. Even day to day, Nova’s price action hints at growing conviction. Recent gains outpaced the broader market and follow a series of upbeat quarters. With revenue and net income both showing solid annual growth, the bigger picture seems to support the positive mood building around the name.

But with the share price racing ahead, the real question for investors is whether there is still room left for upside or if Nova’s future growth is already factored in at these levels. Is this a new entry point, or has the market already done the math?

Most Popular Narrative: 4% Overvalued

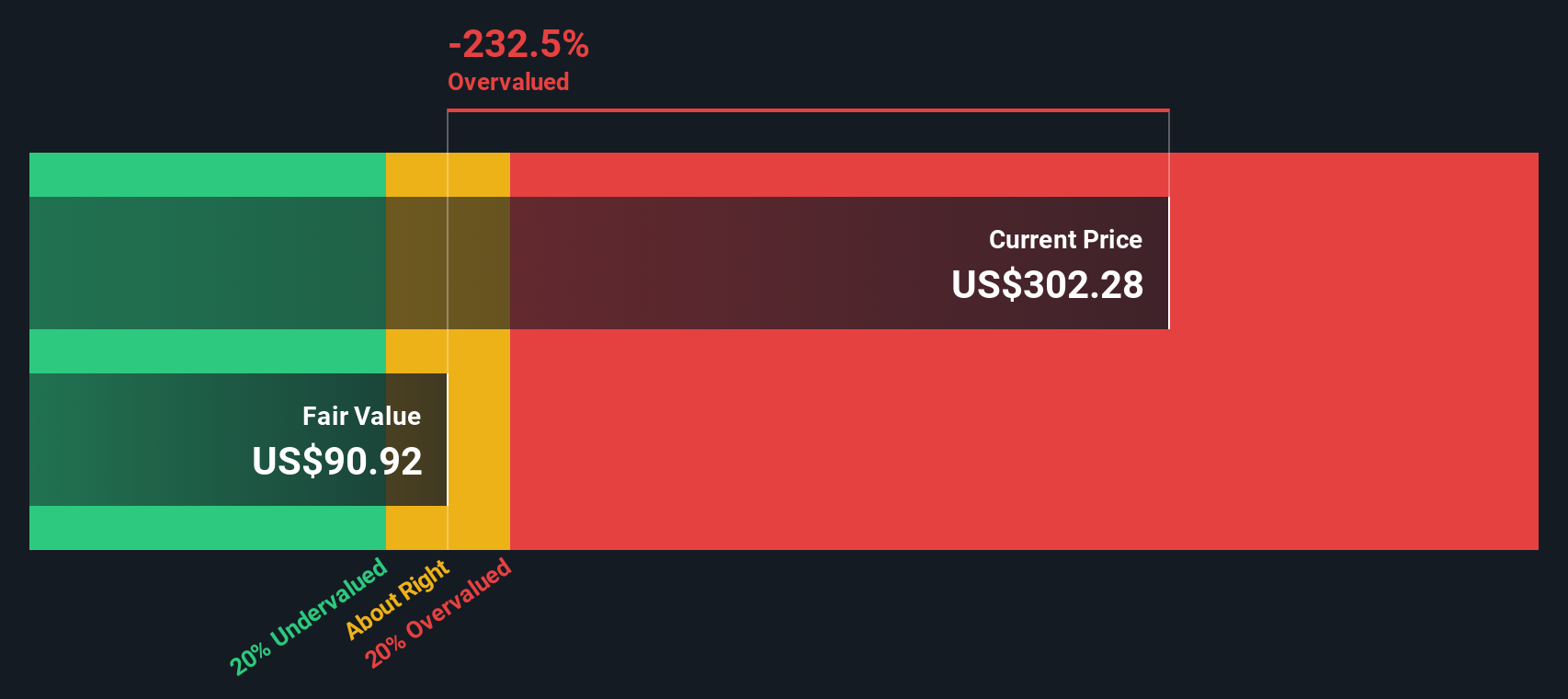

The prevailing market narrative sees Nova as trading above its fair value, with projections reflecting both optimism and caution. The analyst consensus suggests the stock price now exceeds the calculated fair value, largely due to bullish expectations around future growth and profit margins.

Ongoing global investments in semiconductor manufacturing capacity (including reshoring, new fabs in multiple regions, and government incentives) are broadening Nova's customer base and diversifying revenue streams. This supports sustained top-line growth and reduces reliance on any single geography or customer.

Curious why the market is so confident in Nova’s upside potential? Market-watchers are betting on a potent blend of aggressive expansion, profit growth targets, and ambitious future multiples to support this rich valuation. Want to uncover the bold financial forecast and the numbers that drive this popular price target? The next section reveals the make-or-break metrics behind Nova’s premium status.

Result: Fair Value of $298.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing dependence on a small number of key customers and rapid technology shifts could quickly challenge analysts’ optimistic growth path for Nova.

Find out about the key risks to this Nova narrative.Another View: DCF Tells a Very Different Story

While analyst consensus leans on future growth expectations, our SWS DCF model takes a closer look at Nova’s cash flows and suggests a far less optimistic valuation. This raises doubts about whether the current price is justified. Which narrative better reflects reality: steady long-term cash flows, or more aggressive growth forecasts?

Build Your Own Nova Narrative

If you see the story differently or want to dive deeper on your terms, you can shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nova.

Looking for more investment ideas?

Smart investing means always staying ahead of the trends. Supercharge your watchlist with fresh opportunities others might overlook by checking out these unique investment angles below.

- Spot undervalued gems that show strong cash flow potential by heading straight to our undervalued stocks based on cash flows and act before the crowd does.

- Capitalize on the AI revolution by targeting companies transforming industries with advanced tech. Browse our AI penny stocks to get started.

- Lock in reliable income streams and hedge against volatility by reviewing stocks with standout yields on our dividend stocks with yields > 3% list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.