Please use a PC Browser to access Register-Tadawul

November 2025's Top Growth Companies With Insider Ownership

Corcept Therapeutics Incorporated. CORT | 40.83 | +6.44% |

As of October 2025, the U.S. stock market has been experiencing a positive trend, with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly gains. This upward momentum is largely driven by strong earnings reports from tech giants such as Amazon and Apple, highlighting the potential for growth in sectors that are well-positioned to leverage technological advancements. In this environment of robust market performance, identifying growth companies with high insider ownership can be particularly appealing. Such companies often benefit from aligned interests between management and shareholders, potentially leading to strategic decisions that support long-term value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Let's review some notable picks from our screened stocks.

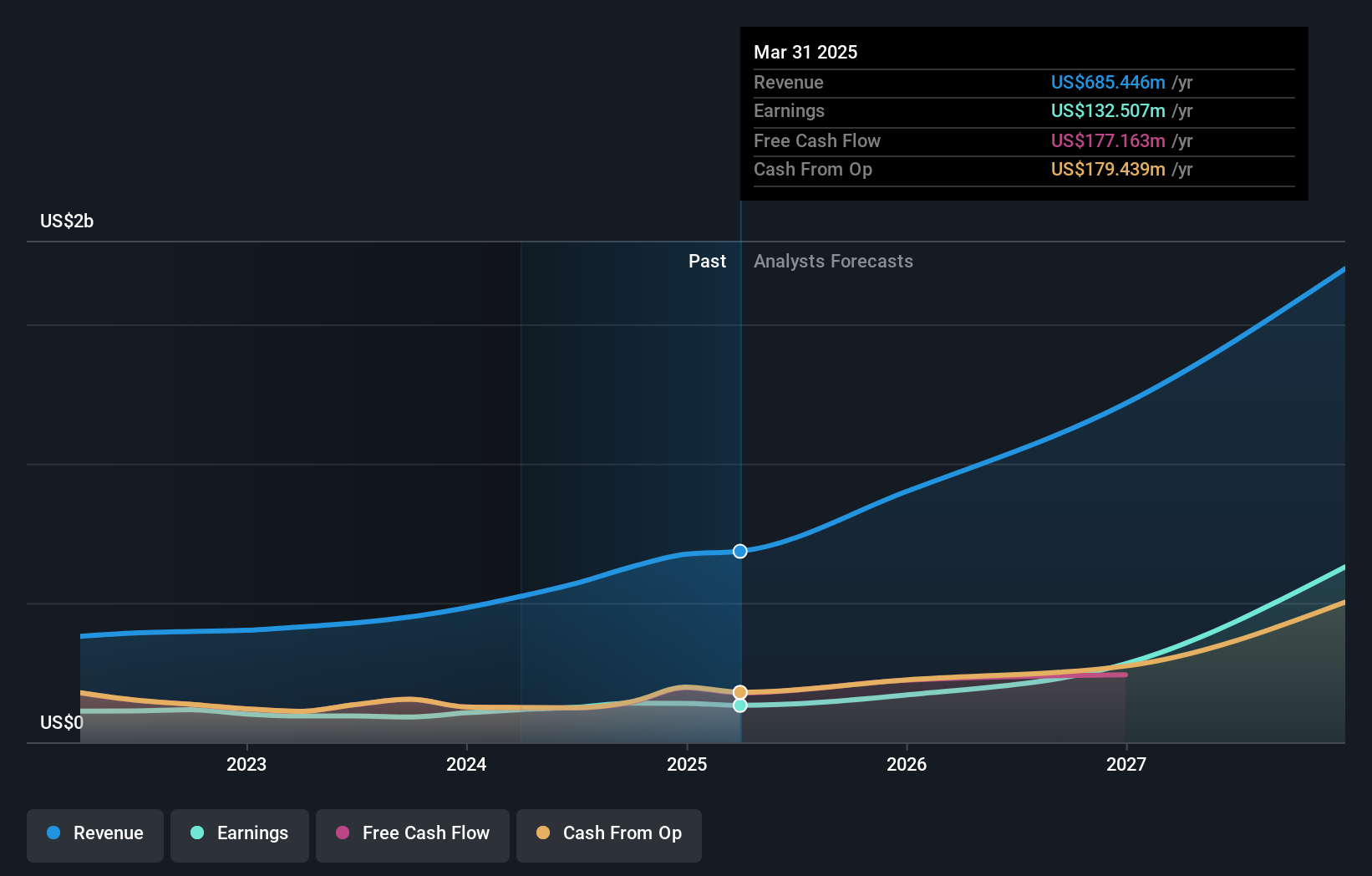

Corcept Therapeutics (CORT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corcept Therapeutics Incorporated is focused on the discovery and development of medications for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of approximately $7.74 billion.

Operations: The company's revenue primarily comes from the discovery, development, and commercialization of pharmaceutical products, totaling $716.08 million.

Insider Ownership: 11.4%

Corcept Therapeutics is experiencing significant growth, with earnings projected to increase by 46% annually, surpassing the US market average. The company has proprietary rights to relacorilant, which shows promising results in treating platinum-resistant ovarian cancer and hypercortisolism. Recent data from the Phase 3 ROSELLA trial highlights improved progression-free survival rates. Analysts predict an 84.1% stock price increase, reflecting strong market confidence despite no recent insider trading activity reported.

FinWise Bancorp (FINW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FinWise Bancorp is the bank holding company for FinWise Bank, offering a range of banking products and services to individual and corporate customers in Utah, with a market cap of $260.43 million.

Operations: The company's revenue segment primarily comprises $80.20 million from its banking operations.

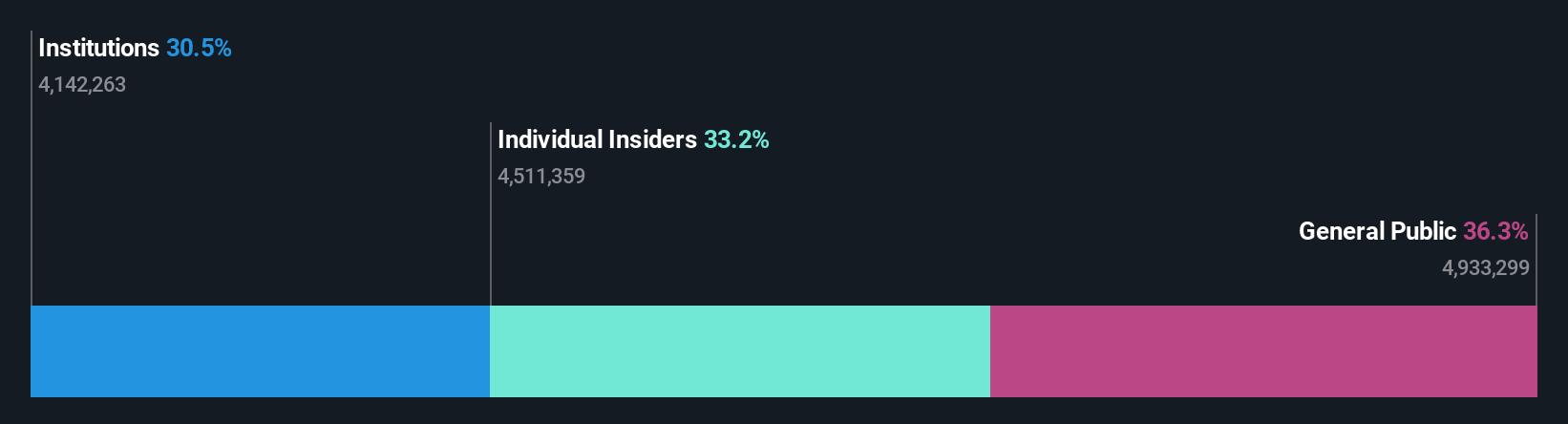

Insider Ownership: 34.6%

FinWise Bancorp is experiencing robust growth, with revenue and earnings expected to outpace the US market. Recent partnerships with Tallied Technologies and DreamFi Inc. aim to diversify revenue streams through new credit card programs and financial products, enhancing its market presence. Despite a high level of bad loans at 7.5%, insider buying activity indicates confidence in future prospects. The company also reported increased net income for Q3 2025, reflecting strong operational performance.

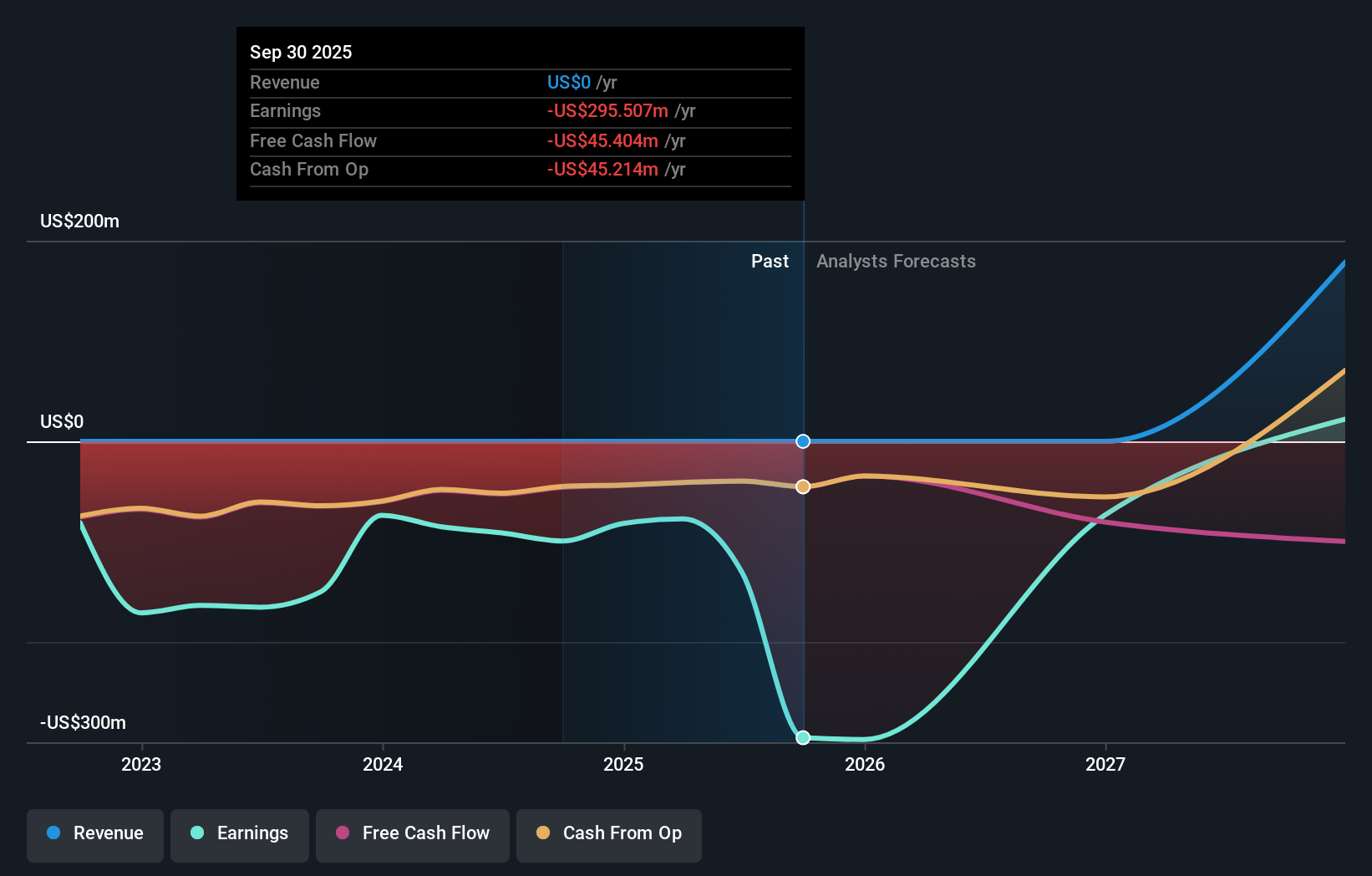

TMC the metals (TMC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TMC the metals company Inc. is a deep-sea minerals exploration firm engaged in collecting, processing, and refining polymetallic nodules from the seafloor in California, with a market cap of approximately $2.87 billion.

Operations: TMC the metals company Inc. generates revenue through its operations in collecting, processing, and refining polymetallic nodules located on the seafloor in California.

Insider Ownership: 12.2%

TMC the metals company is navigating a challenging financial landscape, with significant insider ownership and recent substantial insider selling. Despite reporting a net loss of US$74.34 million for Q2 2025, TMC's earnings are forecast to grow at an impressive rate of over 70% annually. The company anticipates becoming profitable within three years, driven by expected high returns on equity. However, shareholder dilution and volatile share prices present ongoing challenges for investors to consider.

Next Steps

- Discover the full array of 204 Fast Growing US Companies With High Insider Ownership right here.

- Interested In Other Possibilities? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.