Please use a PC Browser to access Register-Tadawul

NRG Energy (NRG): A Fresh Look at Valuation After Recent Momentum

NRG Energy, Inc. NRG | 159.97 | -0.91% |

NRG Energy (NRG) has caught investors' attention lately, buoyed by steady gains over the past month. While market headlines may be quieter, the stock's upward trend places it on the radar for those tracking utility players.

NRG Energy's steady climb over the past month follows a year of consistent but unspectacular progress, culminating in a 1-year total shareholder return of just over 0.8%. The latest share price lift hints at renewed optimism, with some investors possibly seeing new growth or value signals taking shape for this utility player.

If NRG’s momentum has you scanning the market for your next move, this might be the perfect time to discover fast growing stocks with high insider ownership

But with returns holding steady and NRG trading close to analyst targets, the real question is whether the current momentum signals an undervalued stock or if the market has already priced in the company’s growth potential.

Most Popular Narrative: 5.5% Undervalued

With NRG Energy’s last closing price at $167.30 and the popular narrative assigning a fair value of $176.95, the stock’s share price is trailing the narrative’s estimate. This gap in value is based not on market noise, but on projections for earnings growth, operational flexibility, and evolving sector dynamics.

“The accelerated adoption of data centers, electrification, and the signing of long-term, premium-margin agreements for large, multi-year power delivery significantly increases NRG's exposure to growing electricity demand. This points to higher recurring revenue and margin expansion through 2030 and beyond.”

Want to know what powers that higher price target? The narrative hinges on strong profit expansion, margin growth, and shifting demand for electricity. Curious which projections could tip consensus? The answers are deeper in the data.

Result: Fair Value of $176.95 (UNDERVALUED)

However, growing reliance on natural gas and the need for ongoing large investments could limit flexibility. This could potentially challenge the company’s projected growth story.

Another View: Looking Through Market Ratios

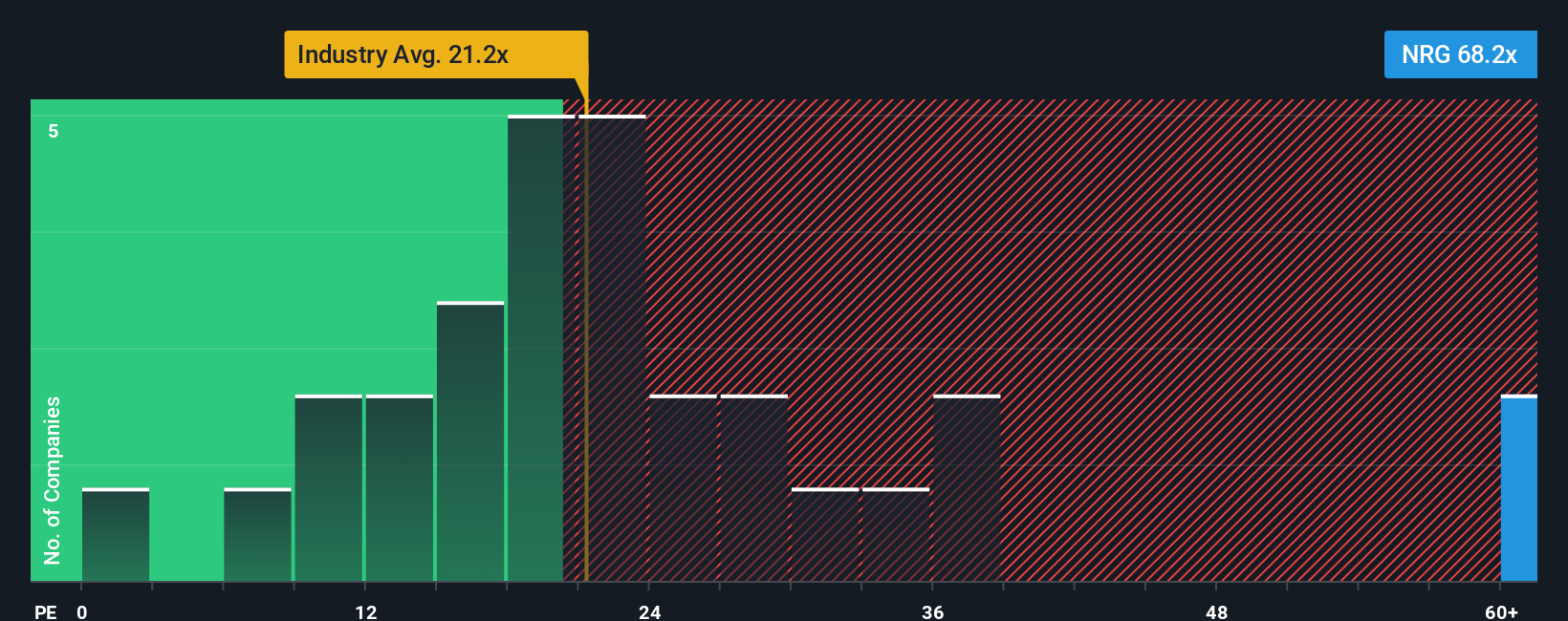

While some see value based on growth estimates and fair value calculations, the market's current ratio tells a more cautious story. NRG trades at 71.1 times earnings, a steep premium over the industry average of 21x and even higher than the peer average of 24.2x. This is also much greater than the fair ratio of 37.2x, suggesting the stock may be priced for near-perfect execution, which leaves limited room for error. Does this premium signal unique strengths, or does it hint at future valuation risk?

Build Your Own NRG Energy Narrative

If you want to dig into the figures and see if your view differs from consensus, you can build your own story in just a few minutes. Do it your way

A great starting point for your NRG Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let the next opportunity slip past you. The right stock could be hiding just outside your radar. Uncover potential winners and give your portfolio a boost with these timely angles:

- Tap into tomorrow's breakthroughs by checking out these 24 AI penny stocks, where growth and innovation reshape entire industries with intelligent applications.

- Maximize yield potential and secure your passive income goals by browsing these 19 dividend stocks with yields > 3% with consistently attractive payouts above 3%.

- Stay ahead of the curve on untapped value by reviewing these 910 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.