Please use a PC Browser to access Register-Tadawul

Nucor (NUE) Valuation in Focus Following Weaker Third-Quarter Guidance and Profitability Concerns

Nucor Corporation NUE | 165.11 | -0.88% |

If you’re holding shares of Nucor (NUE) or thinking about taking a position, the company’s latest third-quarter guidance demands your attention. Nucor announced it expects earnings between $2.05 and $2.15 per diluted share, down from $2.60 in the prior quarter and below what many market watchers had hoped for. The company points to a combination of factors behind this softer outlook: lower steel volumes, tighter margins in its mills, and higher production costs across its steel products. These factors are coming together to squeeze profitability ahead of the company’s Q3 earnings release in late October.

The market’s reaction was swift, with Nucor’s shares falling nearly 6% in response to the disappointing update. This move marks a shift in momentum for the stock, particularly after strong gains earlier in the year. Nucor remains up by roughly 18% year to date, but is now down about 7% over the past year. While near-term sentiment has soured, the company’s longer-term track record, including a 217% return over five years and a continued commitment to returning cash to shareholders, remains on the radar for valuation-focused investors.

With profit forecasts flashing warning signs but long-term value still in play, investors may be considering whether this dip represents a potential buying window or if the market is adjusting its expectations for Nucor’s future growth.

Most Popular Narrative: 15.7% Undervalued

The prevailing narrative identifies Nucor as currently undervalued, with analysts assigning a fair value over 15% above the latest market price. The narrative focuses on significant operational changes, protectionist trade policies, and the impact of new U.S. steel tariffs as major factors driving future valuations.

“Nucor's significant capital reinvestment of $860 million, with two-thirds directed towards projects commencing operations within two years, is expected to diversify and strengthen future earnings. This impacts revenue and net margins through enhanced production capacity and efficiencies.”

Curious about what’s fueling that double-digit upside? The engine behind this bullish thesis is a mix of bold moves, ambitious expansion, and financial assumptions rarely seen in a cyclical sector. Wonder what makes analysts confident Nucor can command such a premium? Unlock the full narrative to see the core projections and key numbers the market might be missing.

Result: Fair Value of $159.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sharp drops in steel demand or setbacks in launching new facilities could quickly undermine these bullish expectations and challenge Nucor’s upward trajectory.

Find out about the key risks to this Nucor narrative.Another View: What Do Market Ratios Say?

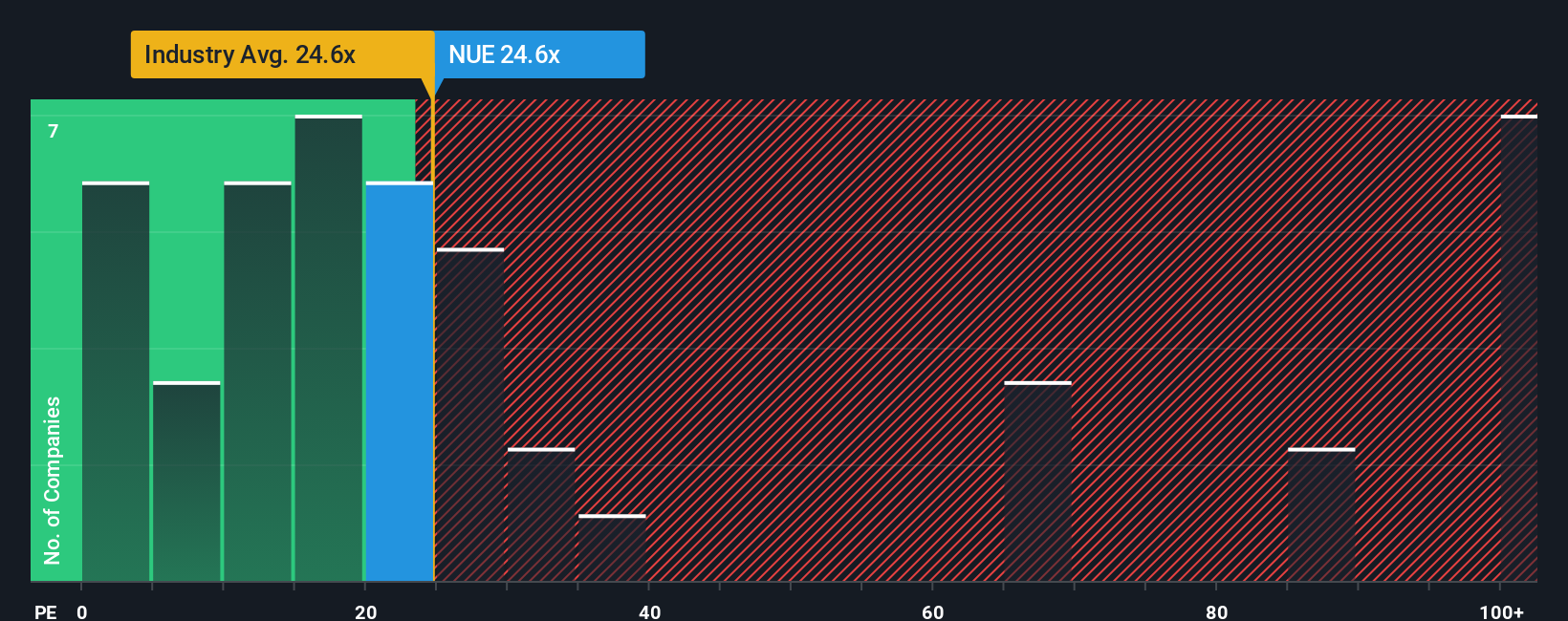

Looking through the lens of standard valuation ratios, Nucor appears pricier than its industry peers. This approach paints a less optimistic picture compared to the one presented by analysts. Which set of numbers truly reflects reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nucor Narrative

If you believe there’s more to the story or want to investigate the numbers firsthand, you can construct your own Nucor outlook in just a few minutes. Do it your way

A great starting point for your Nucor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Powerful trends are shaping today's markets and new winners are emerging. Use these research shortcuts to pinpoint promising stocks in minutes and give your portfolio a competitive edge.

- Capture income potential by targeting companies with strong and consistent payouts, thanks to our handy dividend stocks with yields > 3%.

- Spot tomorrow’s technology leaders at the cutting edge of artificial intelligence development by leveraging AI penny stocks.

- Pounce on companies that analysts believe are trading below their true worth using the undervalued stocks based on cash flows tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.