Please use a PC Browser to access Register-Tadawul

NuScale Power (SMR): Evaluating Valuation After Major Shareholder Sale and Strategic Asset Deal

NuScale Power SMR | 16.90 | -2.93% |

NuScale Power (NYSE:SMR) investors have plenty to digest this week. The stock is in the spotlight after Fluor, one of the company’s largest shareholders, unloaded nearly $100 million worth of its position as a lock-up period expired. This move not only raised eyebrows about possible overhang from future share sales, but also prompted a wave of speculation about NuScale’s capital needs and shareholder base. Around the same time, NuScale also announced a deal with the U.S. Department of Energy and CFPP LLC to acquire and repurpose reactor vessel parts from the canceled Carbon Free Power Project. This demonstrates resourcefulness but adds complexity to the company’s long-term growth story.

Zooming out, this flurry of activity comes on the heels of an incredibly strong showing for the stock over the past year. While NuScale has delivered a staggering 313% return in twelve months, recent weeks have seen momentum waver as long-term investors weigh the impact of additional share sales and shifting sentiment within the nuclear sector. Meanwhile, broader nuclear and uranium names have benefitted from structural shifts in the energy market, but NuScale’s own journey has involved both eye-catching growth and periodic volatility.

After such an extraordinary run, is the current dip nothing more than turbulence on the way to further gains, or are investors right to price in greater uncertainty and possible limits to future upside?

Most Popular Narrative: 8.9% Undervalued

The most widely followed narrative pegs NuScale Power as undervalued, suggesting its fair value still sits above current trading levels. Analysts see strong upside hinging on accelerated technology deployment and revenue growth prospects.

Major upside potential highlighted from the landmark TVA and ENTRA1 Energy partnership to deploy up to 6GW of NuScale SMR capacity, signaling commercial traction and technology validation. Bullish analysts cite the growing global and domestic demand for always-on, carbon-free baseload power, backed by policy tailwinds and an increasing need from sectors like data centers and AI.

This could be the story Wall Street is only starting to price in. Are you eager to see the bold drivers propelling NuScale’s future? One key assumption powering the bullish target is expectations for massive revenue ramp and historic profit margins if the commercialization push succeeds. Are you wondering how those forecasts stack up and what makes this narrative so compelling?

Result: Fair Value of $41.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing delays in securing customer contracts and the uncertainty of government grant funding continue to cloud NuScale's ambitious long-term projections.

Find out about the key risks to this NuScale Power narrative.Another View: What Do Other Valuations Say?

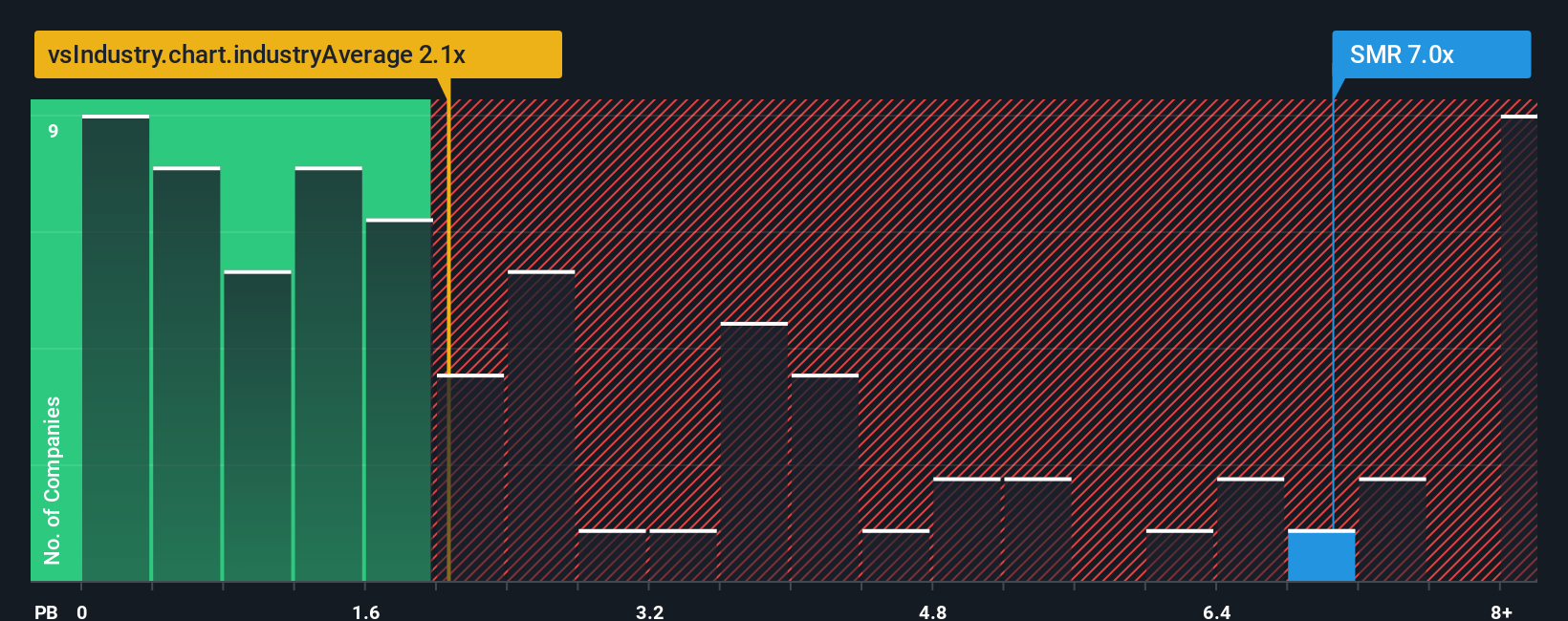

While optimism surrounds NuScale’s growth story, another approach casts doubt. When comparing book value to the industry, NuScale appears expensive. Could the market be pricing in too much future success too soon?

Build Your Own NuScale Power Narrative

If you want to take a different view or prefer working through the numbers on your own, the tools are here for you to shape your own perspective in just a few minutes, and Do it your way.

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Don’t limit your options. Power up your strategy by targeting stocks that align with breakthrough opportunities. The right screen can set you apart from the crowd.

- Target companies building tomorrow’s digital infrastructure as you unleash potential with AI penny stocks, directly impacting innovation in automation and smart technology.

- Generate income the smart way by using dividend stocks with yields > 3% to focus on stocks with impressive yields and stronger dividend consistency.

- Tap into emerging growth and market momentum through penny stocks with strong financials and spot the small-cap movers riding big financial shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.