Nutanix (NasdaqGS:NTNX) Sees Q2 Revenue of US$655M And Net Income of US$56M Reports Strong Earnings Growth

Nutanix, Inc. Class A NTNX | 0.00 |

Nutanix (NasdaqGS:NTNX) saw a notable 10% increase in its share price over the past month, coinciding with the company's Q2 2025 earnings release. The earnings results revealed a revenue of $655 million, a substantial increase from the previous year's $565 million, and a net income rising to $56 million from $33 million. This impressive performance may have contributed to investor confidence, as reflected in the share price. Alongside the earnings announcement, the company provided optimistic guidance with expected full-year revenue between $2.495 billion and $2.515 billion. Additionally, Nutanix secured a $500 million revolving credit facility, which could bolster its financial flexibility. Meanwhile, broader market dynamics, including mixed stock performance and heightened economic uncertainty, seem to weigh less on NTNX's upward trajectory, as the tech-heavy Nasdaq had a mixed performance amidst news such as Nvidia's earnings and federal policy updates.

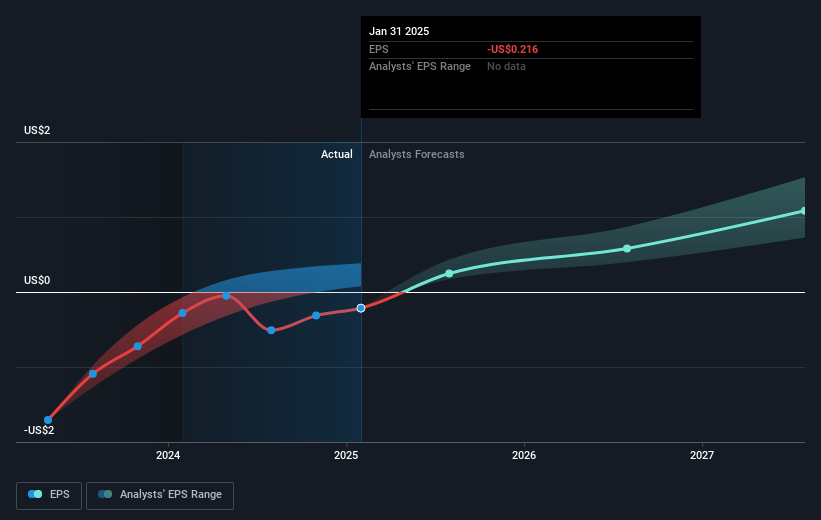

Over the past five years, Nutanix (NasdaqGS:NTNX) achieved a total shareholder return of 203.90%, highlighting significant growth and value creation for its investors. During this period, while still unprofitable, Nutanix reduced its losses at a rate of 32.5% per year. Additionally, the company outpaced the US Software industry's one-year return of 6.7%, emphasizing its competitive momentum.

Key developments during this time include the expansion of the Nutanix Cloud Clusters on AWS and the launch of Nutanix Enterprise AI, driving hybrid and multi-cloud advancements. Nutanix also completed share buybacks, including a tranche of 2.92 million shares for US$151.14 million in late 2024. Furthermore, Nutanix's shares, trading at US$69.35, remain undervalued against the estimated fair value of US$134.31, positioning it as a potentially attractive opportunity for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 01/12 14:29

Stock Ratings | Benchmark Bank maintained its "buy" recommendation for Grupo Televisa (TV) stock and raised its price target from $9 to $10, representing a potential upside of 269.0%.

Sahm Platform 01/12 09:00SentinelOne Partners with AWS to Boost AI Security and Cloud Protection

Reuters 02/12 16:01Reassessing Perfect (PERF): Is the Stock Undervalued After Recent Performance in the Beauty Tech Sector?

Simply Wall St 02/12 20:25Box Authorizes Expansion Of Repurchase Program By Additional $150M

Benzinga News 02/12 21:11GitLab Appoints Jessica Ross CFO, Effective Jan. 15, 2026, Succeeding Interim CFO James Shen

Benzinga News 02/12 21:15Dollar Tree, CrowdStrike And 3 Stocks To Watch Heading Into Wednesday

Benzinga News 03/12 06:23U.S. RESEARCH ROUNDUP-Crowdstrike, CSW Industrials, Targa Resources

Reuters 03/12 08:02