Nutanix (NASDAQ:NTNX) climbs 9.1% this week, taking one-year gains to 105%

Nutanix, Inc. Class A NTNX | 0.00 |

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Nutanix, Inc. (NASDAQ:NTNX) share price has soared 105% return in just a single year. On top of that, the share price is up 53% in about a quarter. Also impressive, the stock is up 64% over three years, making long term shareholders happy, too.

Since it's been a strong week for Nutanix shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Nutanix

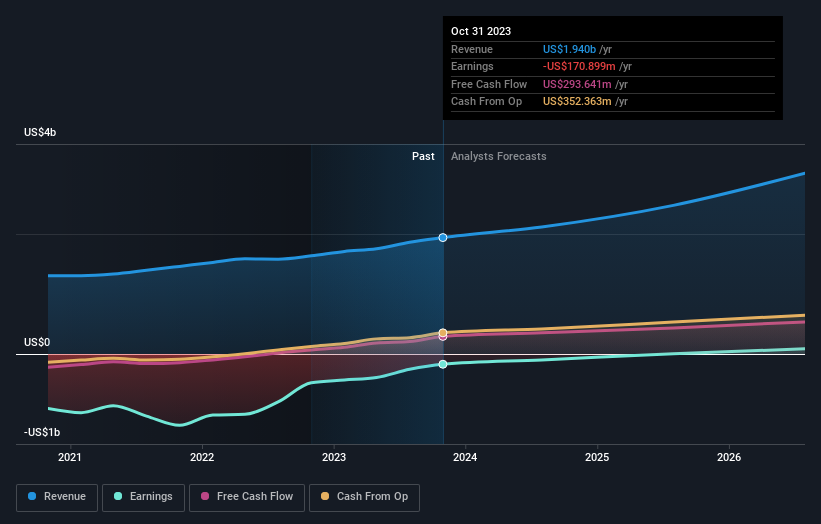

Nutanix isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Nutanix's revenue grew by 19%. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 105% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Nutanix is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Nutanix stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Nutanix shareholders have received a total shareholder return of 105% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.0% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Nutanix has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

But note: Nutanix may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Reuters 07/11 21:05

NI Holdings Q3 EPS $(0.08) Up From $(0.13) YoY, Sales $71.905M Down From $83.270M YoY

Benzinga News 07/11 21:16Azenta (AZTA) Valuation Insights Following Recent Share Price Decline

Simply Wall St 07/11 21:29Canaccord Genuity Maintains Buy on Artivion, Raises Price Target to $51

Benzinga News 07/11 21:35Canaccord Genuity Maintains Buy on Prestige Consumer, Lowers Price Target to $88

Benzinga News 07/11 21:56Will VNET Group’s (VNET) Green REIT Launch Reshape Its Approach to Capital Efficiency and Growth?

Simply Wall St 07/11 22:36Can Knife River’s (KNF) Tightened Guidance Reflect Durable Strength Amid Sector Hurdles?

Simply Wall St 07/11 22:39Did Medtronic’s (MDT) Positive Renal Denervation Results Just Shift Its Hypertension Device Narrative?

Simply Wall St 08/11 00:34