Please use a PC Browser to access Register-Tadawul

Nutanix (NTNX): Evaluating Valuation After S&P MidCap 400 Index Inclusion Announcement

Nutanix, Inc. Class A NTNX | 40.26 | +4.87% |

If you are trying to figure out what to do with Nutanix (NTNX), you are not alone. The company just found out it will be joining the S&P MidCap 400 index after an official announcement from S&P Global. This kind of move is a big deal for Nutanix, since getting added to a widely tracked index often means more buying interest, especially from institutional investors who must adjust their portfolios to reflect the change. There is already talk about what this could mean for the stock in both the short and long term.

After the announcement, Nutanix shares started trending higher, and momentum has been positive for most of the year. The stock is up 28% over the past year and has gained roughly 26% since January. Even looking back three years, Nutanix has delivered strong triple-digit returns, showing it can ride both sector tailwinds and positive company news. The conference circuit has kept Nutanix in the headlines too, but it is really the index inclusion that has driven the latest jump and renewed investor focus on what comes next.

So with Nutanix now set to attract more attention, and potentially more capital, is this a genuine buying opportunity, or is the market already pricing in all the future growth?

Most Popular Narrative: 11% Undervalued

The leading narrative suggests Nutanix is trading at a notable discount to its calculated fair value, with analysts projecting strong tailwinds ahead.

Accelerating adoption of hybrid and multi-cloud architectures, highlighted by new integrations with Google Cloud as well as deepening partnerships with AWS, Azure, Dell, and Pure Storage, positions Nutanix to capture a broader share of enterprise infrastructure modernization budgets. This expands its addressable market and drives sustained revenue growth.

Ready to find out what is driving this bullish outlook? The core narrative hinges on ambitious forecasts for future profits and revenue, underpinned by expectations for premium margins and a powerful industry shift. Can Nutanix live up to these assumptions and justify the buzz? Only by digging deeper will you discover the pivotal numbers and growth targets behind this fair value call.

Result: Fair Value of $87.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if these risks materialize in coming quarters, such as slowing demand from enterprise cloud shifts or increased competition, they could limit upside for Nutanix.

Find out about the key risks to this Nutanix narrative.Another View: Valuation Through a Different Lens

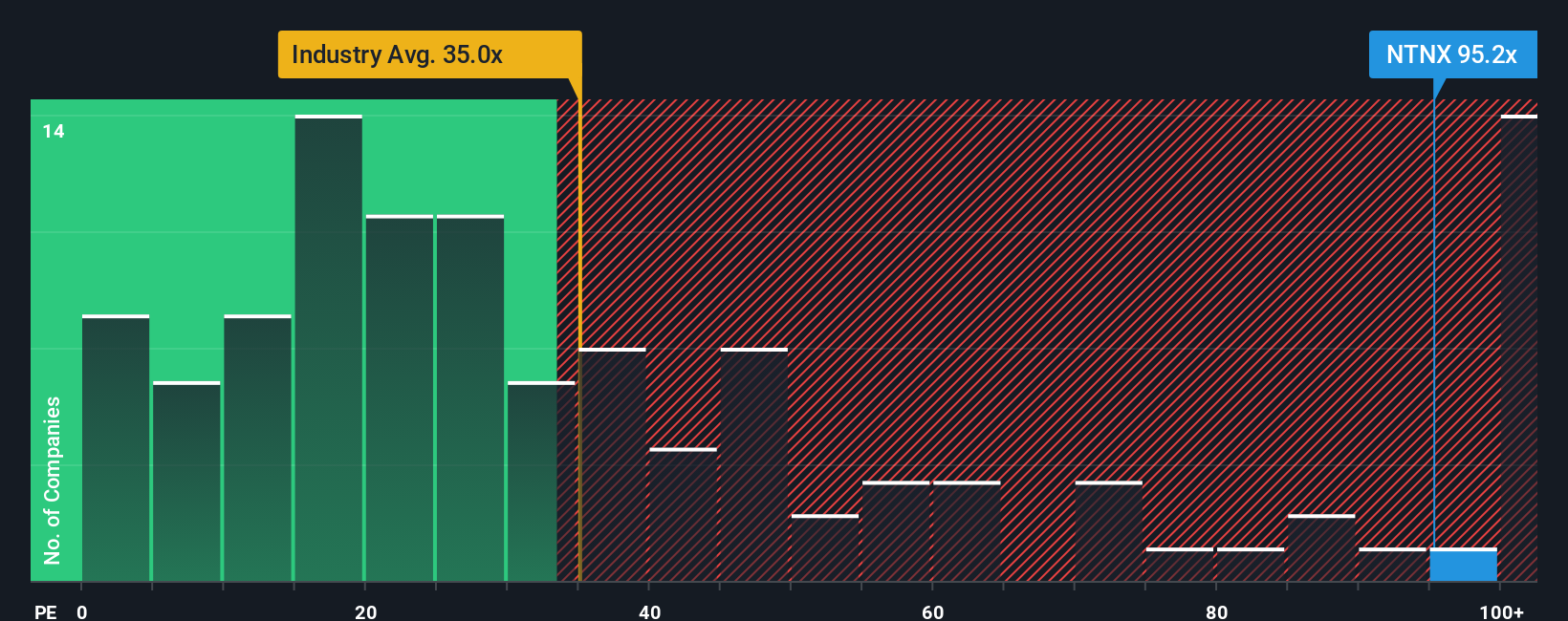

Looking at Nutanix from a different angle, the company’s share price appears expensive when compared to the industry average using earnings multiples. This method points to a less optimistic outcome than the analyst narrative. Which perspective will gain more influence as the market digests the latest news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nutanix Narrative

If you have your own perspective or want to dig into the numbers firsthand, you can build a complete analysis in just a few minutes from start to finish. Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors regularly scan for fresh opportunities that others miss. Don’t let your next big winner pass you by. Tap into powerful market trends right now using these tailored strategies:

- Spot companies pushing the boundaries of artificial intelligence and see which stocks are positioned to benefit most with AI penny stocks.

- Uncover potential bargains as you search for businesses the market may have underestimated with undervalued stocks based on cash flows.

- Catch promising healthcare innovators harnessing AI to tackle tomorrow’s medical challenges by using healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.